The fifth anniversary of the UK’s referendum on its membership of the EU (23 June) appears to be passing with barely a murmur, which is surprising in many ways. The sound of fury which preceded and then followed the ballot would have suggested that such a milestone could attract a lot attention. Perhaps both ‘Remainers’ and ‘Leavers’ may be thinking there is no debate to be had, given the result and the UK’s withdrawal from the economic bloc on 31 January 2020, while it is equally possible that both have other things on their mind, as the pandemic continues to make its presence felt and uncertainty lingers over when lockdowns may end, in the UK and elsewhere.

The pandemic and its possible impact upon society, working habits and the economy continue to exercise advisers and clients, too, as they also ponder issues such as a possible shift toward greater state (and central bank) intervention in the economy, technological change, record levels of indebtedness and the new Cold War with China.

“One thing is undeniable – the UK stock market has been an appalling performer over the five years since the Brexit referendum. The question that portfolio-builders must address now is whether that period of marked underperformance means UK equities represent good value and are worth a fresh look.”

Given all of this, it is easy to see why Brexit is getting less attention, after several years of vitriolic debate. Yet one thing is undeniable – the UK stock market has been an appalling performer over the five years since that vote. The question that portfolio-builders must address now is whether that period of marked underperformance means UK equities represent good value and are worth a fresh look.

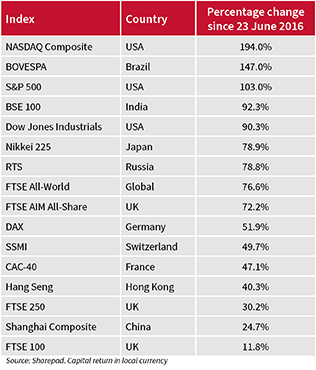

In local currency, capital return terms, the FTSE 100 is the single-worst performer among a list of major equity indices since the Brexit vote. If the numbers were to be presented in sterling terms, then the performance gap would be slightly bigger, as the pound is down by 6% against the dollar, 10% against the euro and 2% against the yen since the referendum. Those falls only serve to increase the value of overseas assets once their value is translated back into pounds.

FTSE 100 is the worst performing major index since the Brexit vote in June 2016.

Source: Sharepad

Even though the FTSE AIM All-Share can point to a far better showing than the headline FTSE 100, the junior London market represents a low single-digit percentage of London’s total market cap, so that provides cold comfort at best. There can be no denying that the UK has been a dog.

Brexit and the political and economic uncertainty which followed the vote to leave may be one reason why, as might be the tortuous journey of the necessary legislation through Westminster and Brussels. Perceptions that the UK dealt poorly with the earlier stages of the pandemic, and that its economy has been particularly hard hit, may be another.

“The FTSE 100 derives the majority of its earnings from overseas, so domestic considerations should be an inconvenience at best, not a deadweight on its back. Perhaps the real reason for its underperformance lies with the index’s constituents and its sector mix.”

But the FTSE 100 derives the majority of its earnings from overseas, so such domestic considerations should be an inconvenience at best, not a deadweight on its back.

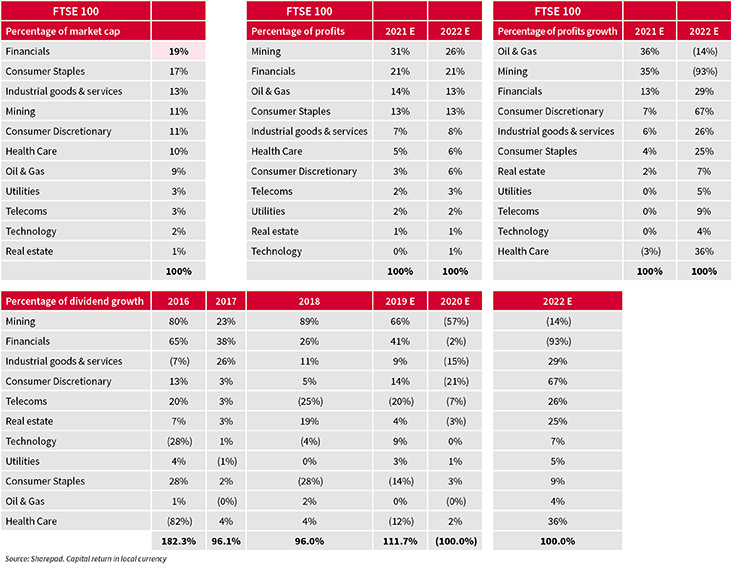

Perhaps the real reason then lies with the index’s constituents and its sector mix. The combination of unpredictable miners and oils, banks whose margins are being ground away by record low interest rates and quantitative easing, and plodders like pharmaceuticals and utilities does not necessarily fire the imagination. This is especially true during a period when economic growth is modest, inflation equally so, and market sentiment turning cooler by the minute on industries like mining and oil because of the perception that the holes they drill and products they sell do environmental harm.

FTSE 100 is dominated by miners, oils and financials.

Source: Company accounts, Refinitiv data, consensus analysts’ forecasts

A hefty weighting toward, and contribution from, consumer staples provides some ballast, but that includes two tobacco giants, whose business is not exactly flavour of the month with a lot of investors for ESG reasons either.

However, all may not be lost. That earnings and market cap mix may sound pretty unappealing when global growth is weak and inflation not an issue. But there still remains the possibility that this scenario is just about to change and, if so, it seems logical to expect strong growth, rising prices and (presumably) higher bond yields and steepening yield curves to favour a market such as the UK, which is tightly plugged into the global economic cycle.

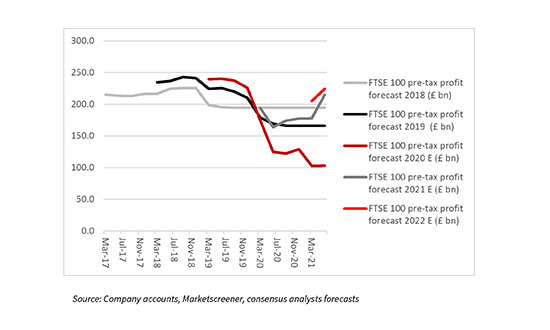

“Analysts have increased their FTSE 100 pre-tax profit forecasts by 21% for 2021 and 9% for 2022 in the last three months alone.”

Strong momentum in FTSE 100 earnings would suggest as much. Buoyed by the miners and oils, and to a lesser degree the banks, aggregate profit estimates for the UK’s leading index are marching higher. Analysts have increased their FTSE 100 pre-tax profit forecasts by 21% for 2021 and 9% for 2022 in the last three months alone.

Analysts continue to upgrade FTSE 100 earnings forecasts.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts

The FTSE 100’s failure to progress even as analysts are chalking up higher forecasts speaks of investor scepticism about oil’s recovery, talk of a mining supercycle and the inflation trade more generally – note how analysts expect oils’ and miners’ earnings to fall sharply in 2022. But perhaps there lies an opportunity if growth and inflation do surprise on the upside.

And while the FTSE 100 can point to just two bids for its members over the past year – RSA and now Morrisons (MRW) – there have been nearly 50 bids for companies further down the market cap ranks, either from trade or financial (private equity) buyers. The average bid premium offered so far is 36%, so someone, somewhere thinks that downtrodden, unloved UK equities offer value, five years after the Brexit referendum result, even if the final outcome of that will only become clear after a long period of time, and not one artificial date.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.