Warren Buffett’s antipathy toward gold as an investment is well known, thanks in part to a speech the Sage of Omaha gave at Harvard in 1998. Buffett acidly asserted that, ‘Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.’

It may therefore seem perverse to return to the precious metal in the immediate aftermath of the publication of Berkshire Hathaway’s (BRKA:NYSE) annual report, sadly adorned in black this year to mark the passing of Buffett’s long-term business partner Charlie Munger. But the timing makes sense in some ways. Even as the S&P 500 equity index barrels towards new highs, gold is holding firm above $2,000 an ounce, near its all-time peak and, intriguingly, the maths suggests that the answer to the question, ‘which is the better investment, gold or US equities,’ is either ‘neither’ or ‘both,’ as they have matched each other over the past 42 or so years. However, there have been periods where one of US stocks or the precious metal has done much better than the other, so perhaps the real question is what lay behind those periods and what would be needed for them to be repeated.

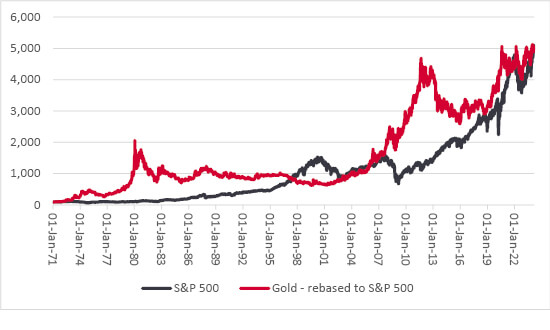

Gold and the S&P 500 have performed equally well in capital terms since 1971

Source: LSEG Datastream data

“If we start on 1 January 1971 – the year when US President Richard M. Nixon smashed up the Bretton Woods monetary system, withdrew the dollar from the gold standard and effectively launched the modern era of ‘fiat’ currency – then gold has performed just as well as the S&P 500 in capital terms.”

If we start on 1 January 1971 – the year when US President Richard M. Nixon smashed up the Bretton Woods monetary system, withdrew the dollar from the gold standard and effectively launched the modern era of ‘fiat’ currency – then gold has performed just as well as the S&P 500 in capital terms.

In all truth, Buffett then edges the argument, thanks to the dividends and buybacks on offer from equities, whereas gold offers no yield. But there are three clear eras when even those cash returns would not permit US equities to catch up with returns from the physical metal – the mid-1970s, the early 2000s and then 2019 onwards.

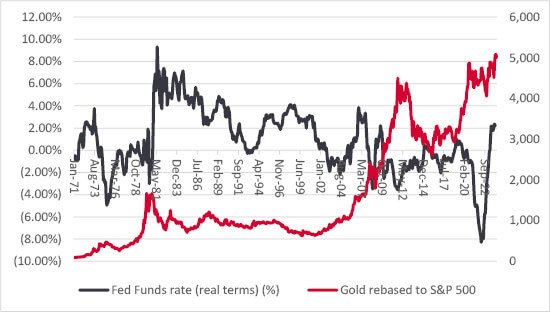

Gold has enjoyed three marked eras of outperformance relative to US equities

Source: LSEG Datastream data

In each case, inflation higher than the Fed Funds rate meant that US interest rates were negative in real terms. As such, there was no opportunity cost in holding gold.

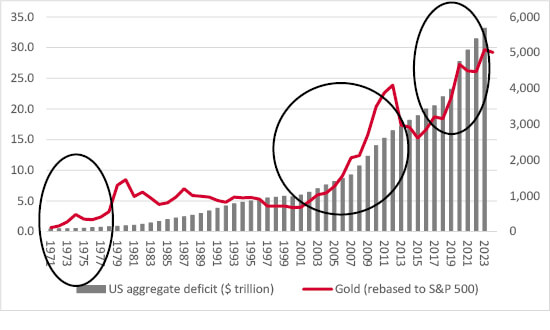

“Increased debt and inflation may well be linked anyway, but each of mid-1970s, the early 2000s and then 2019 onwards saw gold do well as US Government borrowing rocketed.”

But these periods had another defining characteristic, namely galloping growth in the US deficit. Increased debt and inflation may well be linked anyway, but each of mid-1970s, the early 2000s and then 2019 onwards saw gold do well as US Government borrowing rocketed.

Periods of rapid US Government borrowing have been good for gold

Source: LSEG Datastream data

Perhaps here, investors were looking for a store of value where supply grew relatively slowly, if at all, in contrast to paper Government promises which, for much of this century, have then been met with the help of suppressed interest rates and money printing, courtesy of zero interest rate policies (ZIRP) and Quantitative Easing (QE).

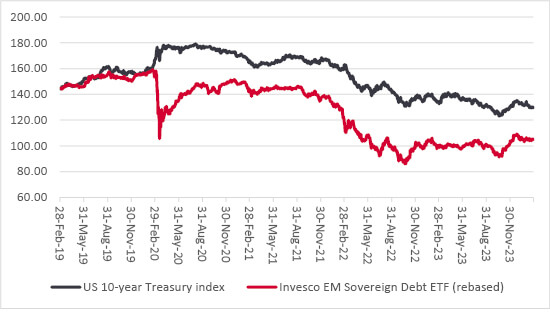

“Not surprisingly, US Treasuries are paying close attention to America’s fiscal incontinence.”

This argument is often given as a reason for the rise of Bitcoin, and the cryptocurrency is making a fresh run towards its previous all-time high of almost $67,000. Not surprisingly, US Treasuries are paying close attention to America’s fiscal incontinence. The bond price falls (and yield increases) seen from the highs (and lows) of early 2020 may reflect an easing of pandemic-induced panic, inflation, an end to QE and higher interest rates from the Fed. But the ever-growing Federal debt pile is increasing the supply of Treasuries at a time when the interest burden, at one fifth of the US tax take, means the pressure is on the Fed to cut rates when it can, sticky inflation or not.

“Emerging markets faced their own debt crisis in 1997-98 and have stuck to the lessons learned, as evidenced by how their central banks were far quicker to respond to inflation’s return in 2021-22 and how sovereign debt / GDP ratios are often much lower than they are in the West.”

It may therefore be no coincidence that emerging market government bonds, as benchmarked by the Invesco Emerging Market Sovereign Bond ETF (PCY:NYSE) and the DBIQ Emerging Market USD Liquid Balanced Index that it tracks, have outperformed US Treasuries since autumn 2022. Emerging markets faced their own debt crisis in 1997-98 and have stuck to the lessons learned, as evidenced by how their central banks were far quicker to respond to inflation’s return in 2021-22 and how sovereign debt / GDP ratios are often much lower than they are in the West.

Emerging market sovereign bonds are starting to outperform US Treasuries

Source: LSEG Datastream data

This is still a nascent trend, but it may be one worth watching, especially given how sentiment towards US assets is still favourable, while emerging markets still feel largely ignored by comparison.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.