Your needs evolve with your clients’. So we keep evolving too.

We are always looking for ways to improve our platform and make it even easier to use.

V2.0 website

- Intuitive and user friendly, the V2.0 website allows you to perform multiple actions from one screen

- Easily find the information you are looking for by using the search, filter and sort options on each page

- Data download options are available across the whole website, so you can export a range of client information into a CSV or PDF file

A series of user guide videos has been created to help you to use and navigate the website’s functionality: take a look.

Online change of bank details

- Update the nominated bank account your client uses for all withdrawals and payments.

- Instant bank account verification lets you know if we require any further information.

- Avoid payment delays by checking if your client’s bank account is verified before requesting income and withdrawals.

V2.0 Client onboarding journey

- New business applications, fund-specific illustrations and the pre-sale costs and charges disclosures are combined into one cohesive journey.

- Single point of entry means no need to input the same client data in different places, saving time and reducing the chance of errors.

- All key documents, such as KIIDs, illustrations, forms, KFDs, and T&Cs, are provided within the onboarding journey.

- The new ‘Onboarding dashboard’ makes it easy to find and resume paused applications; there’s no need to wait until you have all the client information before you start an application – just submit the data at your convenience.

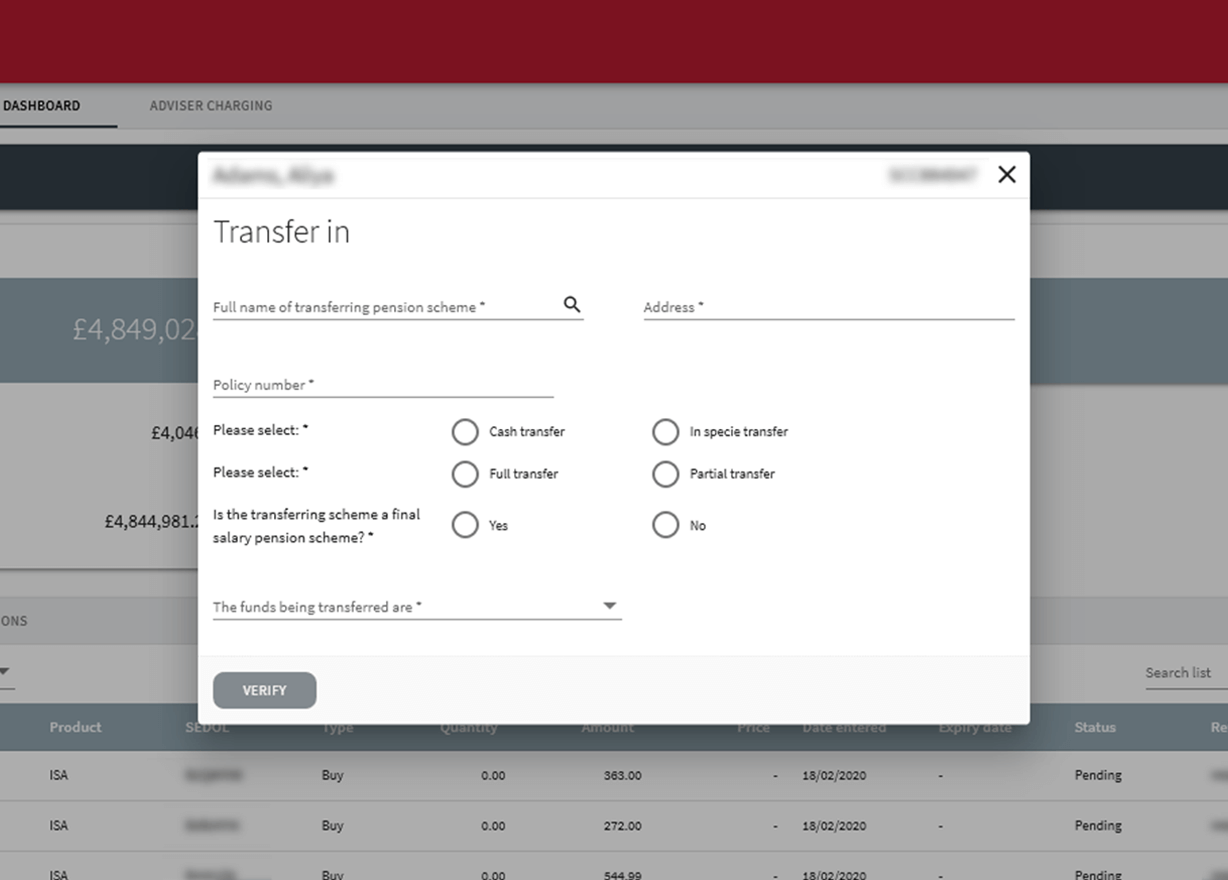

Transfers

- Initiate an automated message through Origo that will start the process, request money and complete the transfer with no need for user interaction

- Use the transfer tracker to view the status of ongoing transfers

Dealing

Buy and sell

- Easy-to-use, intuitive new layout

- Instruct straightforward one-off proportionate disinvestments

- Collate multiple trades into one transaction for a more streamlined approach

Dealing

Bulk dealing

- Save time by bulking together instructions for two or more clients

- No dealing charge

Dealing

Fund switch

- Mitigate risk with our straightforward switch method

- No dealing charge

Dealing

Regular dealing

- Reduce workloads with automated regular investments and disinvestments

- No dealing charge

Dealing

Dealing dashboard

- Quickly view the status of your clients’ purchases

One-off investments into models

- Invest your clients’ funds using their model portfolio allocation, all within a few clicks, using the V2.0 dealing tool.

- All deals are made free of charge.

- Perfect for when you are phasing clients into the market or investing new contributions and subscriptions.

This short video walks you through the procedure for placing deals within a client’s account, and explains how to instruct multiple buys.

Third-party MPS

- Access managed portfolios from a selected panel of Third-party MPS providers

- Link client accounts via the bulk dealing and model portfolio tools

- Can be used in conjunction with all other platform functionality

Multiple F&SS accounts for ISAs

- Open up to four advised Funds & Shares Service (F&SS) accounts, plus an XO account for the client, all under a single ISA

- Easily distinguish between accounts by adding a custom label that is only visible to the adviser

- Use each ISA F&SS account as part of your investment strategy, e.g. linking different model portfolios to each account

- Segment investment strategies within the ISA and allocate funds more directly between the accounts, e.g. income and growth

Flexible ISA – V2 ‘Money In’ tool

- See an overview of all your clients’ ISAs and how much subscription allowance they have remaining, after taking any withdrawals into account

- Easily sort and filter your client list, with the option to export it into a CSV file

- Initiate new ISA subscriptions straight from the tool

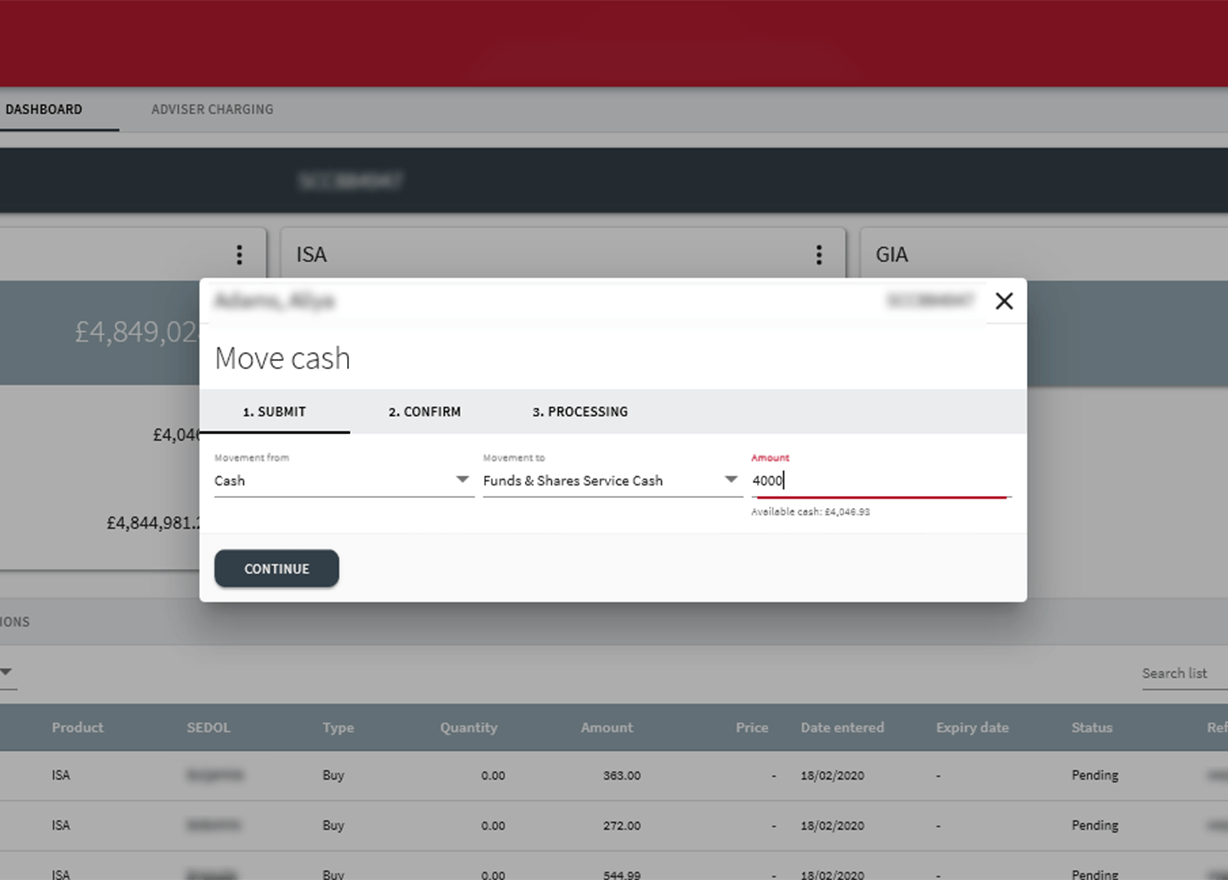

Cash management

- Set up and manage regular disinvestments, either for an individual stock, or proportionately across the whole portfolio of eligible assets

- Create one-off and regular cash movements to transfer any available money between the SIPP cash account and the Funds & Shares Service cash account, or vice versa

- View a summary of transactions in and out of your clients’ accounts, including overdue transactions which have not been processed due to insufficient funds

- Regularly invest on your clients’ behalf via our RIA, SIPP, ISA, JISA or GIA on a monthly basis, without incurring any dealing charges

Adviser branding

- Add your firm’s branding to our platform, reports and client mobile app.

- Simply upload your firm’s logo, choose your border and colour scheme, then press save.

- The preview screen lets you see what your branding will look like across our website, reports and the client mobile app.

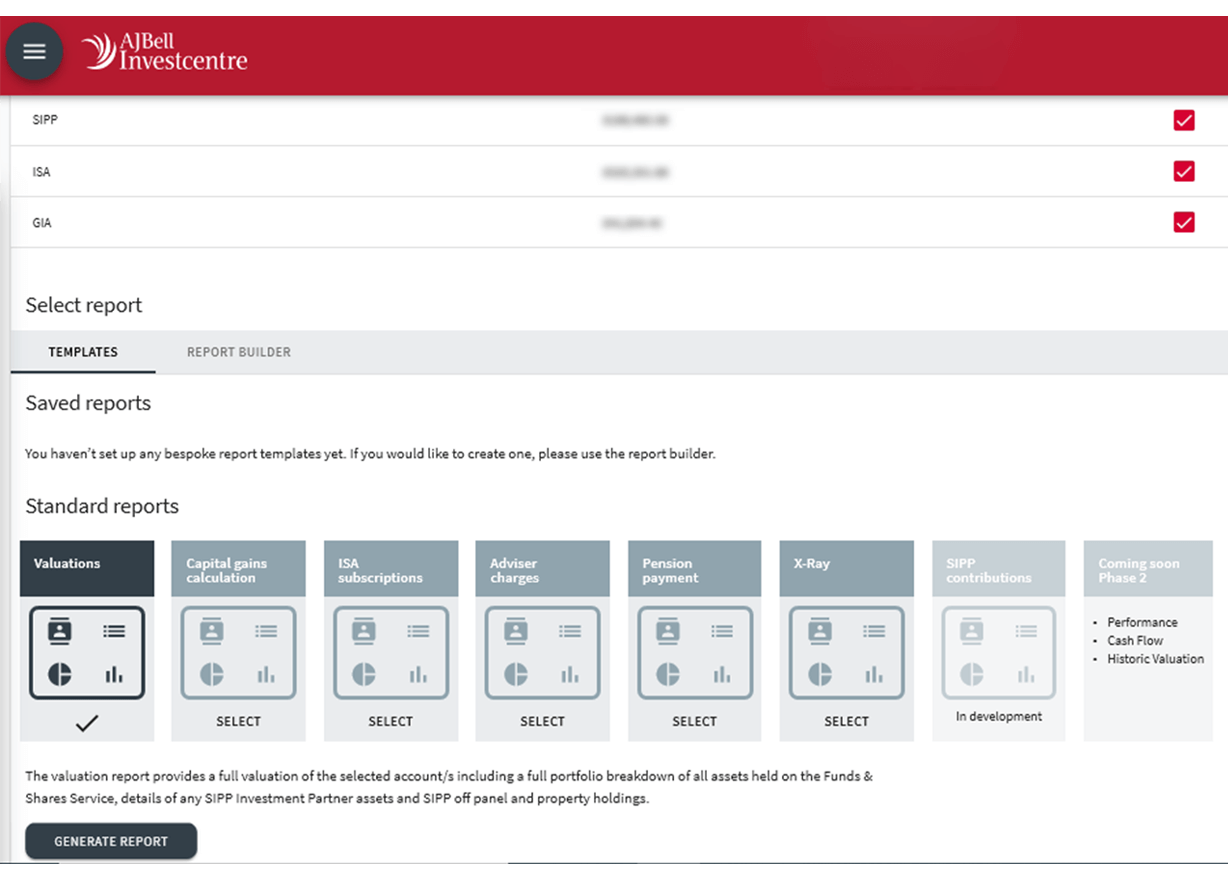

Reporting

- Create branded standard or bespoke reports for individual clients or groups of clients

- Create point-in-time valuation reports for individual and multiple accounts at client level. SIPP valuations include Funds & Shares Service assets, as well as investment partner and off-panel holdings

- Capital Gains Tax reporting includes accrued losses and gains in the current tax year, and allows you to input gains and losses made elsewhere or carried over from previous years

- Portfolio x-ray enables you to quickly analyse the asset allocation, stock sectors and underlying holdings that make up a portfolio

- Pension income report lets you view PCLS and income payment information within a set date range

- Adviser charges reporting allows you to view charges for a particular date, or within a range of dates of your choosing

- Generate reports on the investment performance of your clients’ accounts or portfolio over a selected period, against a selected benchmark(s)

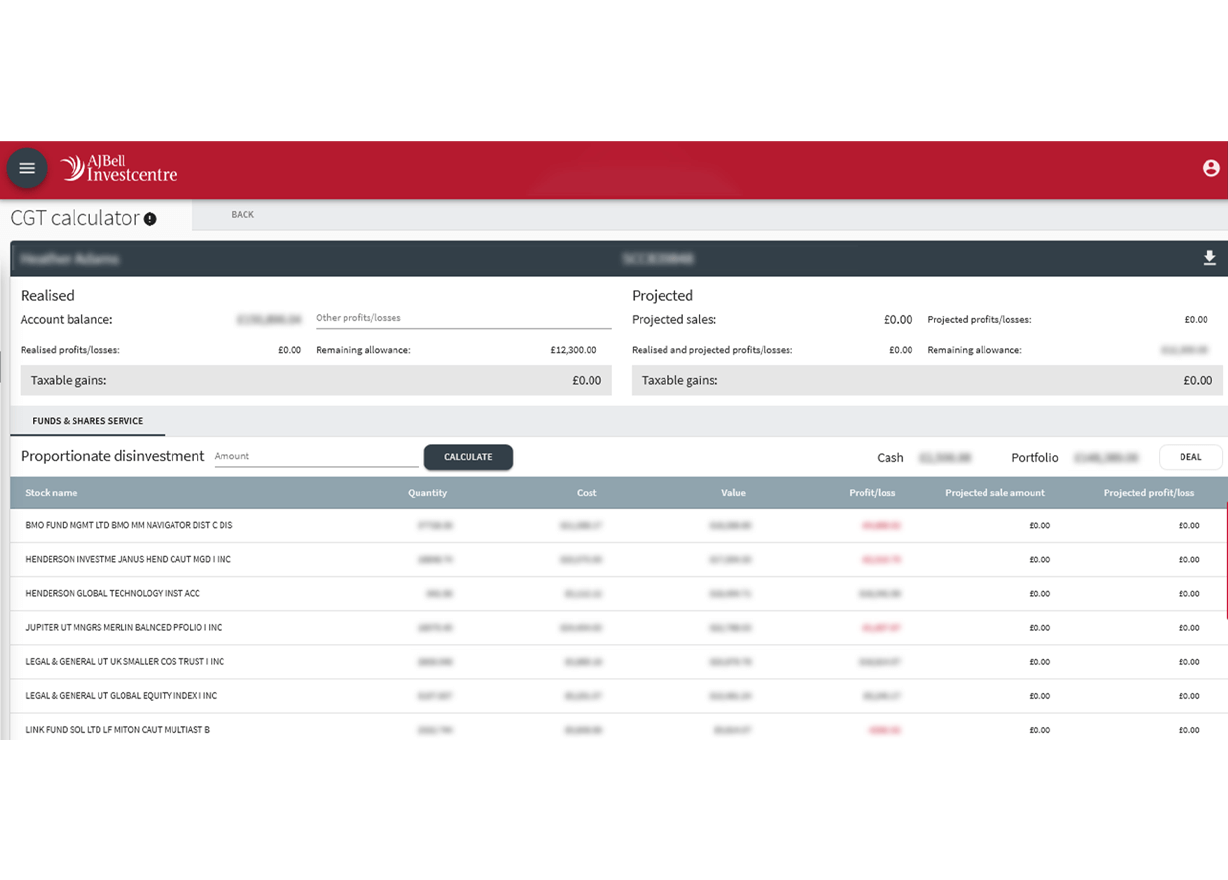

CGT calculator

- Summarise each client’s capital gains, and any tax due on them

- View all GIA clients’ transactions that may be subject to CGT. Calculate the liability based on ‘actual’ and ‘what if’ scenarios, and execute trades based on those ‘what if’ scenarios

Withdrawals and closures

- Request online withdrawals any time, even before cash becomes available, and we’ll make the payment once your clients’ cash has settled.

- All online withdrawals are made via straight through processing.

- Set up regular and consolidated natural income payments and also amend or delete them online.

- View your clients’ nominated bank account details, and identify which ones need updating or verifying.

- Request closures online, and let us send your client’s closing balance to their nominated bank account.