Retirement Investment Account

Find a pension that fits

Some things just belong together

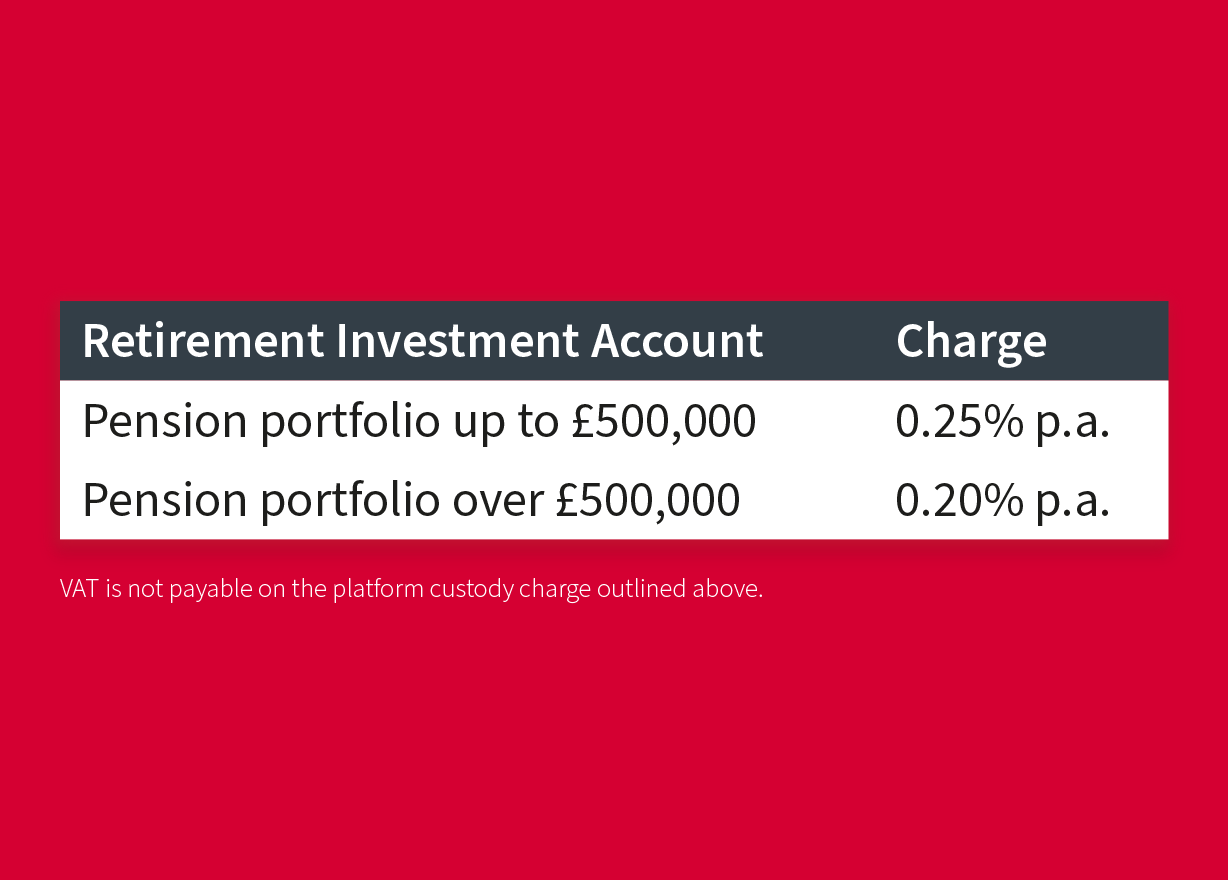

Certain combinations just work. Thanks to the addition of our Retirement Investment Account – with an all-in platform charge from as little as 0.25% p.a. – our range of pensions now includes the perfect match for clients at any stage of their savings journey. Our Retirement Investment Account provides your clients with:

- a low-cost charging structure that will appeal to a wider group of clients;

- access to our Funds & Shares Service, giving you and your clients comprehensive investment choice;

- the range of benefit options that you expect from us;

- access to the usual functionality and cash management tools that are available with our full SIPP; and

- a new pension option in addition to the existing SIPP.

The value of investments and the income from them can go down as well as up and your client may not get back their original investment.

‘All-in’ pricing

There are no charges for:

- account setup

- wrapper administration

- transfers-in

- online dealing*

- flexi-access drawdown

- capped drawdown

- UFPLS payments

*Dealing in instruments that settle in any currency other than GBP incurs a foreign exchange charge of 1.00% and this includes the acquisition or disposal of any assets as part of a corporate action and the payment of dividends in non-GBP.

SIPP vs RIA cost comparison

Not sure which is right for your client? Try our cost comparison.

The lang cat’s review

Read the lang cat’s verdict on how our Retirement Investment Account is positioned relative to our peers.