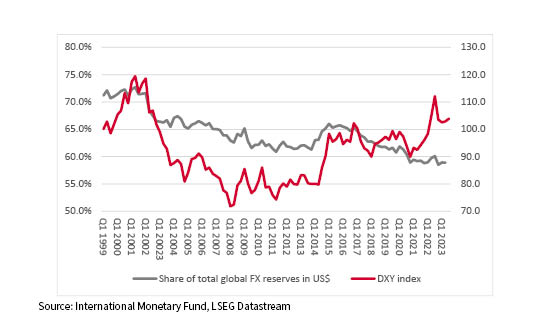

After shedding all of this year’s gains during an autumn retreat, the US dollar, as benchmarked by the trade-weighted DXY basket, or ‘Dixie’ index, stands no higher now than it did in spring 2022. Advisers and clients must now assess why the globe’s reserve currency is sliding, whether those trends will continue and what would be the potential implications for investment portfolios should the greenback continue to weaken.

DXY dollar index stands back at spring 2022 levels

LSEG Datastream data

“There are three potential explanations for the dollar’s weakness.”

There are three potential explanations for the dollar’s weakness.

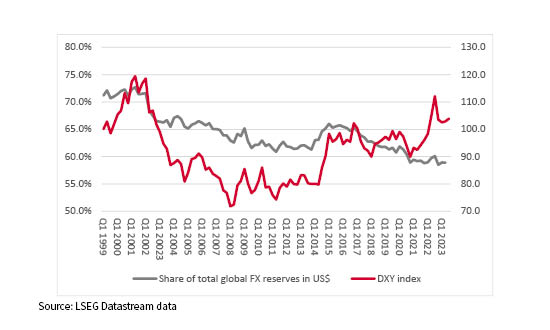

Over the past two decades, the euro has made its presence felt (nearly 20% of all forex reserves), as has the Chinese renminbi, but the latter is barely 3% of allocated forex reserves even now, and Beijing’s tight control of its currency is just one reason why it is not going to replace the dollar as the globe’s reserve currency any time soon.

US dollar continues to lose status as a reserve currency

International Monetary Fund, LSEG Datastream data

As such, it may not pay to overplay any ‘demise of the dollar’ narrative, not least given the lack of credible alternatives, but advisers and clients need to assess whether any of the three above trends will become entrenched, given the potential implications for portfolios.

Two asset classes in particular look sensitive to the dollar.

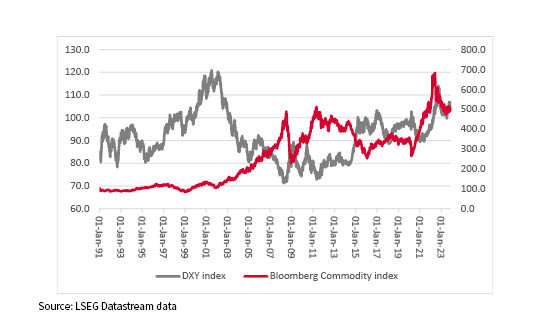

“While the past is by no means a guarantee for the future, it can be argued that there is an inverse relationship between the DXY and commodity prices.”

The first is commodities. All major raw materials, except cocoa (which trades in sterling) are priced in dollars. If the US currency rises then that makes them more expensive to buy for those nations whose currency is not the dollar, or is not pegged to it, and that can dampen demand, or so the theory goes. While the past is by no means a guarantee for the future, it can be argued that there is an inverse relationship between the DXY and commodity prices.

Dollar is traditionally seen as negative for commodity prices

LSEG Datastream data

“Dollar strength at the very least coincided with major swoons in EM, or at least periods of marked underperformance relative to developed markets, during 1995-2000 and 2012-15. Retreats in the greenback, by contrast, appeared to give impetus to emerging equity arenas in 2003-07, 2009-12 and 2017-18.”

The second is emerging equity markets. They do not appear to welcome a strong dollar either, judging by the inverse relationship which seems to exist between the DXY and MSCI Emerging Markets (EM) benchmarks. Dollar strength at the very least coincided with major swoons in EM, or at least periods of marked underperformance relative to developed markets, during 1995-2000 and 2012-15. Retreats in the greenback, by contrast, appeared to give impetus to emerging equity arenas in 2003-07, 2009-12 and 2017-18.

Emerging markets can also be sensitive to big moves in the dollar

LSEG Datastream data

This also makes sense, in that many emerging (and frontier) nations borrow in dollars and weakness in their currency relative to the American one makes it more expensive to pay the coupons and eventually repay the original loans.

Dollar weakness could therefore mean a resurgence in interest in two downtrodden asset classes, especially commodities. Should the American reliance on short-term T-bill funding lead to a second upward leg in inflation, then investors may look for stores of value where supply grows slowly in absolute terms, or at least relative to potentially rapid increases in the supply of fiat currency.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.