The International Monetary Fund’s quarterly Composition of Official Foreign Exchange Reserves (COFER) reports may not be everyone’s idea of bedtime reading but one trend immediately emerges from the latest data. The dollar is still – slowly – falling from favour as the globe’s reserve currency with non-US central banks.

As of June 2021, the dollar represented 59% of global exchange reserves, only a fraction above December’s 25-year low and way down from this century’s 73% peak, reached in 2002.

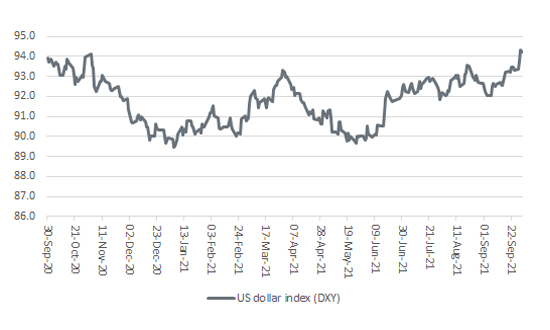

The creation of the euro may have something to do with this, as may the rise of the Chinese renminbi, while the US may not have helped its cause with rampant deficit creation and money printing since 2009 (even if it is not on its own in either respect). This has perhaps tempted some central banks to sell dollars in exchange for something else (gold or other currencies), because the greenback trades well below its early-century highs, as measured by the trade-weighted DXY index. The so-called ‘Dixie’ benchmark currently stands at 94 compared to its 2002 peak (for this century) of 120.2.

US dollar trades at a new high for 2021

Source: Refinitiv data

“The DXY index trades at its highest mark for 2021 and all market participants, not just currency traders, will know that attention must be paid when the US currency starts to make a move, up or down.”

This may feed into the ‘demise of the dollar’ narrative that is popular with some economists and investors (even if that neglects the lack of credible alternatives, especially as the Chinese renminbi still represents just 2.6% of global foreign reserves). Yet for all of that, the DXY index trades at its highest mark for 2021 and all market participants, not just currency traders, will know that attention must be paid when the US currency starts to make a move, up or down.

Two asset classes are particularly sensitive to the dollar, at least if history is any guide.

“Two asset classes are particularly sensitive to the dollar, at least if history is any guide: commodities and emerging equity markets.”

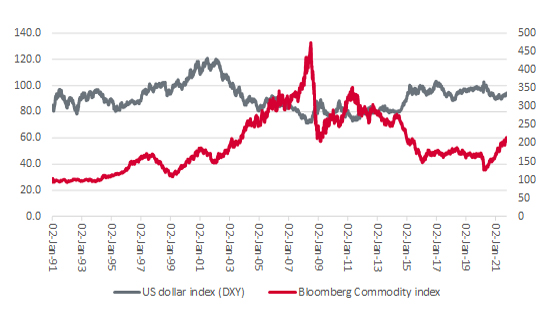

The first is commodities. All major raw materials, except cocoa (which is traded in sterling) are priced in dollars. If the US currency rises, then that makes them more expensive to buy for those nations whose currency is not the dollar or is not pegged to it and that can dampen demand, or so the theory goes. While the past is by no means a guarantee for the future, it can be argued that there is an inverse relationship between ‘Dixie’ and the Bloomberg Commodity Price index.

Dollar is traditionally seen as negative for commodity prices

Source: Refinitiv data

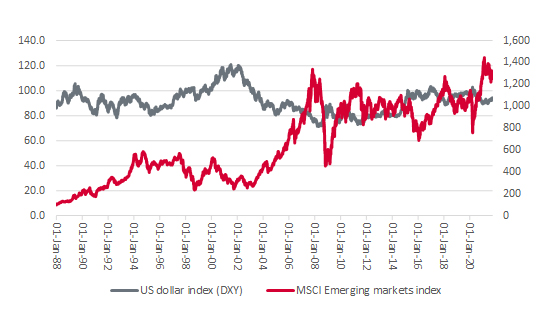

The second is emerging equity markets. They do not appear to welcome a strong dollar either, judging by the inverse relationship which seems to exist between the DXY and MSCI Emerging Markets (EM) benchmarks. Dollar strength at the very least coincided with major swoons in EM, or at least periods of marked underperformance relative to developed markets, during 1995–2000 and 2012–15. Retreats in the greenback, by contrast, appeared to give impetus to emerging equity arenas in 2003–07, 2009–12 and 2017–18.

Emerging markets can also be sensitive to big moves in the dollar

Source: Refinitiv data

This also makes sense, in that many emerging (and frontier) nations borrow in dollars and weakness in their currency relative to the American one makes it more expensive to pay the coupons and eventually repay the original loans. Sovereign defaults are thankfully few and far between in 2021 – Suriname and Belize are the only ones that spring to mind – but a rising dollar could put more pressure on potential strugglers whose credit ratings continue to slip, notably Tunisia.

“But before advisers and clients jump on the dollar bandwagon – and to conclusions – it must be worth asking why the US currency is back on a roll, and there are a couple of possibilities here: risk aversion and US monetary policy”.

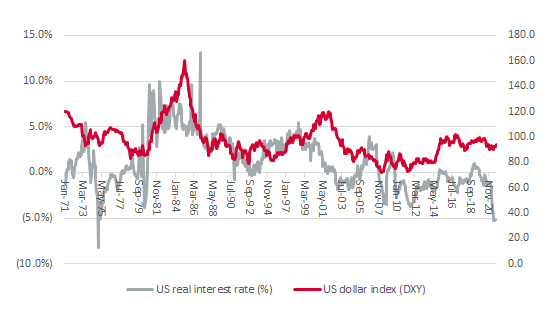

But before advisers and clients jump on the dollar bandwagon – and to conclusions – it must be worth asking why the US currency is back on a roll, and there are a couple of possibilities here.

Real US interest rates are near record lows

Source: Refinitiv data

Yet the sensitivity of the emerging markets and commodity prices to sharp moves in the dollar suggests the Fed will have to move carefully, as the US central bank will not wish to cause – or be blamed for – the sort of upset which is now known as 2013’s taper tantrum. If monetary policy does become less loose, it seems sensible to expect higher volatility at the very least.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.