Whatever your opinion of Donald Trump, you always know what the President of the United States is thinking and he could not be clearer on the dollar: he does not like a strong greenback. This is odd, because a strong currency is usually a sign of economic strength in absolute terms or at least relative to international peers and rivals, but the President does not want a bouncy buck and his administration has done its best to talk down the greenback.

“You always know what the President of the United States is thinking and he could not be clearer on the dollar: he does not like a strong greenback.”

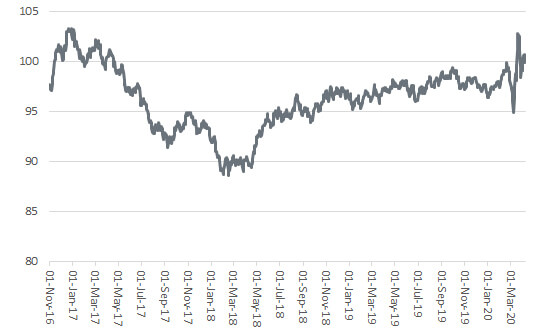

It even worked for a while, although a sequence of interest rate hikes from the US Federal Reserve in 2018 and America’s superior economic growth record meant that economics trumped talk, if you will pardon the expression. Then along comes the COVID-19 crisis and that gives the dollar another boost. All of a sudden, advisers and clients are looking for haven assets and that generally tends to mean the world’s reserve currency. As a result, the trade-weighted DXY dollar index (known fondly as ‘Dixie’ by traders around the globe) stands back over 100 for the first time since spring 2017, just after Trump’s November 2016 election win.

“Advisers and clients are looking for haven assets and that generally tends to mean the world’s reserve currency.”

Dollar is on the rise once more

Source: Refinitiv data

Dollar strength can therefore be a sign of concern for advisers and clients, not just presidents who fear it harms exports, as it is suggestive of fear, if not distress. In this respect, the good news at least is that the DXY index is nowhere near the peak of around 120 that it reached at the start of this century, or its all-time high of about 160 in the mid-1980s (a situation that was only resolved by 1985’s Plaza Accord, when the G5 unilaterally revalued the deutschmark, as they were then, against the US currency).

“The good news at least is that the DXY index is nowhere near the peak of around 120 that it reached at the start of this century, or its all-time high of about 160 in the mid-1980s.”

However, there are two more tangible reasons for looking at a strong dollar with some concern.

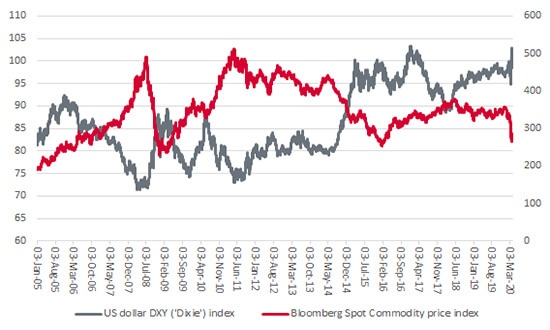

First, a rising greenback is not good for commodity demand. All major raw materials, except cocoa (which is traded in sterling) are priced in dollars, so if the US currency rises, then that makes them more expensive to buy for those nations whose currency is not the dollar or is not pegged to it. Note how there seems to an inverse relationship between ‘Dixie’ and the Bloomberg Commodity Price index.

Dollar strength is traditionally seen as negative for commodity prices

Source: Refinitiv data

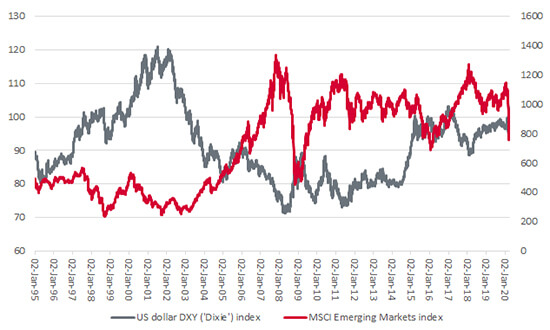

Second, emerging equity markets do not appear to like a strong dollar either, judging by the inverse relationship which seems to exist between the DXY and MSCI Emerging Markets (EM) benchmarks. Dollar strength at the very least coincided with major swoons in EM, or at least periods of marked underperformance relative to developed markets, during 1995–2000 and 2012–15. Retreats in the greenback, by contrast, appeared to give impetus to emerging equity arenas in 2003–07, 2009–12 and 2017–18.

Emerging markets are also traditionally wary of a bouncy buck

Source: Refinitiv data

This also makes sense, in that many emerging (and frontier) nations borrow in dollars and weakness in their currency relative to the American one makes it more expensive to pay the coupons and eventually repay the original loans. Zambia and Ecuador are already looking to restructure dollar debts, while Argentina is still grappling with its $83 billion in foreign liabilities. The higher the buck bounces, the more uncomfortable those debts become as interest payments suck away cash that could otherwise be used for investment.

“One trend within emerging markets worth noting is how Asia is doing markedly better than Latin America, Eastern Europe and the Africa/Middle East region.”

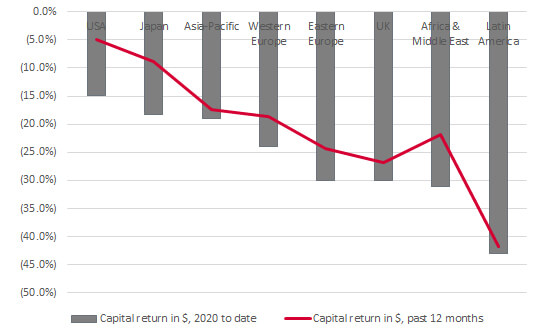

However, there is one trend within emerging markets that is worth noting, which is how Asia is doing markedly better than Latin America, Eastern Europe and the Africa/Middle East region. Over the past year, in dollar terms, Asian stock markets have beaten all other emerging arenas and trailed only the US and Japan.

Asia has done relatively well over the past year

Source: Refinitiv data

Admittedly, all Asia has done is go down less than everywhere else and many advisers and clients will take cold comfort at best from relative outperformance – they cannot pay bills with smaller losses, only income and actual profits.

It will be interesting to see if Asia can keep it up as and when global economic activity and risk appetite pick up again. Perhaps its outperformance reflects nothing more than a view that the region was first in and first out when it comes to the viral outbreak. Perhaps it is due to the region’s much lower reliance on commodity prices, relative to Eastern Europe (where Russia dominates) and Latin America. But, given the experience of SARS in 2002–03, Asia may have been better prepared and equipped to deal with such a situation and it may be that such readiness will serve the region – and investors in it – well over the longer term, too.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.