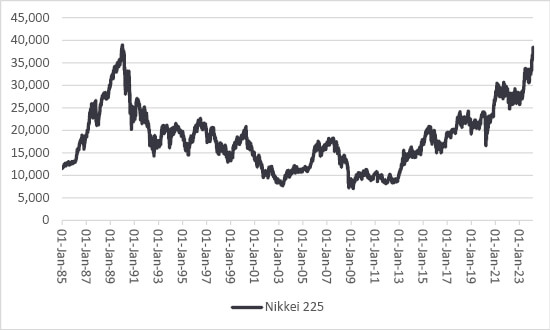

The world’s biggest stock market by market capitalisation, America, is making headlines as it sets new all-time highs and the second-largest arena, China, is making them for the wrong ones, as the Shanghai Composite index is no higher now than it was in 2007, thanks to a soggy economy and a spectacular property bust. But perhaps the biggest surprise to many advisers and clients will be the renaissance of the world’s third most valuable market, Japan, where the Nikkei 225 is on the verge of regaining the all-time high set all the way back in late 1989.

Japan’s Nikkei 225 is getting back to 1989’s all-time high

Source: LSEG Datastream data

Japan’s (almost unnoticed) return to favour offers several useful lessons.

“Japan’s debt-fuelled equity and property party in the 1980s was a whopper and it has taken the Nikkei just over 34 years to recover. By contrast it took the NASDAQ ‘only’ 15 years to get back to its 2000 peak once the technology, media and telecoms bubble burst (something fans of the Magnificent Seven may need to ponder, at some stage).”

But there are other factors at work, which may have implications for global markets and not just those in Tokyo, namely the Bank of Japan’s ongoing use of ultra-loose monetary policy and the continued decline in the yen.

“With its heavy weightings toward information technology (26%) and industrials (17%), the Nikkei 225 taps into the key themes of artificial intelligence and deglobalisation, and Japanese firms may be primed to benefit from sanctions against China as a valuable alternative source.”

With its heavy weightings toward information technology (26%) and industrials (17%), the Nikkei 225 taps into the key themes of artificial intelligence and deglobalisation, and Japanese firms may be primed to benefit from sanctions against China as a valuable alternative source. A low weighting toward financials (3%) is also noteworthy, as banking stocks in the USA and UK continue to flounder.

But Japan also has things in its favour, which may be lacking elsewhere, notably:

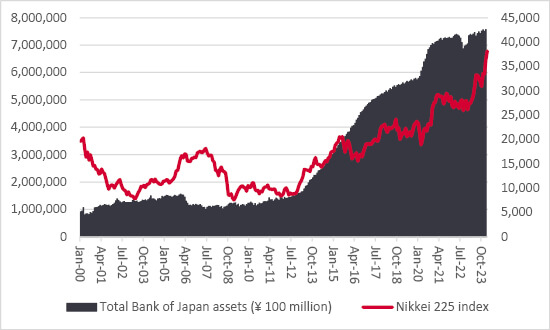

The Bank of Japan is still running QQE

Source: LSEG Datastream data, Bank of Japan, FRED – St. Louis Federal Reserve database

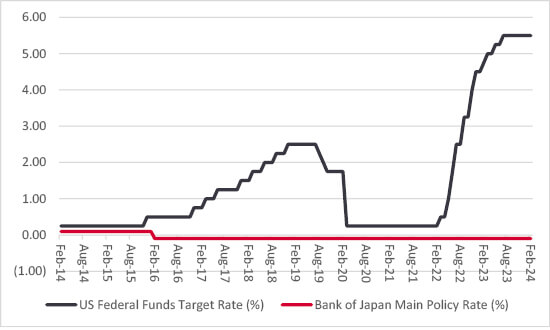

The Bank of Japan is sticking to a zero-interest rate policy (ZIRP)

Source: LSEG Datastream data, Bank of Japan, FRED – St. Louis Federal Reserve database

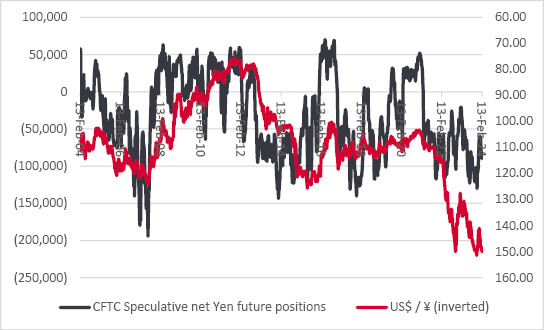

“The yen is back down to ¥150 to the dollar, pretty much an all-time low.”

One reason for the yen’s weakness is the interest rate differential between the greenback and the Japanese counter. But another is how international investors (and particularly hedge funds) use the yen as a funding currency for other positions. It costs nothing to short the yen, given the negative interest rate that prevails in Japan, and that cheap cash can be used to generate returns elsewhere (or so the theory goes). Data from America’s Commodity Futures Trading Commission (CFTC) shows that short positions are again piling up against the yen.

Shorts are piling up against the yen

Source: US Commodity Futures Trading Commission, LSEG Datastream data

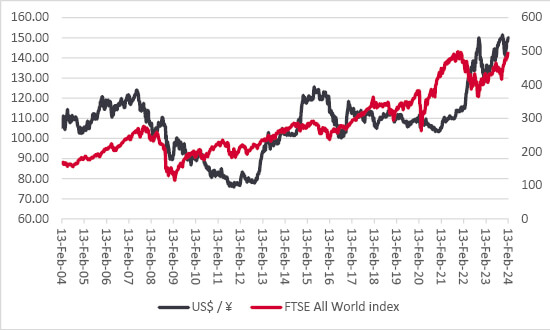

It may therefore not be entirely a coincidence that global equities are surging along, buoyed by the USA, which represents some 60% of the FTSE All-World index. Other factors are helping here, too, notably Bidenomics and free-spending fiscal policy, but a plentiful supply of cheap funding might be helping, too.

Is a cheap yen helping to fund the global equity run?

Source: LSEG Datastream data

“A reduced interest rate differential could spark buying of the yen, prompt a closure of short positions against it and turn off the tap on one important source of global liquidity. Watch this space.”

This matters because the Bank of Japan is, in theory, inching its way towards a first interest rate hike, just as the western central banks are laying the groundwork for their first cuts. A reduced interest rate differential could spark buying of the yen, prompt a closure of short positions against it and turn off the tap on one important source of global liquidity. Watch this space.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.