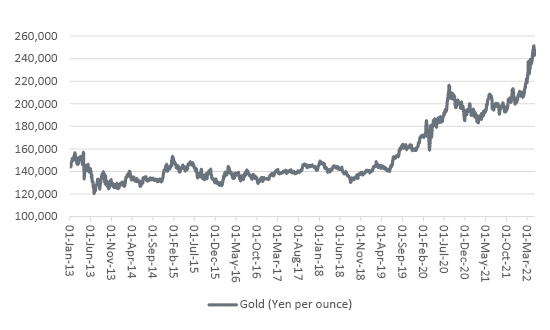

Back in 2013, the Texas-based founder and manager of the Hayman Capital hedge fund, Kyle Bass, gave an interview in which he tersely stated: “I would buy gold in yen and go to sleep for ten years.” The case for short yen/long gold was based upon tattered state of Japan’s public finances, the country’s weak demographics and how the Bank of Japan had got itself into trap whereby any attempt to tighten monetary policy would only lead to an economic slowdown and – in turn – lower interest rates and more money creation via Quantitative Easing.

“Back in 2013, the Texas-based founder and manager of the Hayman Capital hedge fund, Kyle Bass, gave an interview in which he tersely stated, ‘I would buy gold in yen and go to sleep for ten years.’”

Mr Bass also asserted that it was too early to invest in Japan. That may not have worked out so well, since the Nikkei 225 is up by around 150% since the start of January 2013, although such returns still pale compared to what the headline US indices have done, in local currency terms.

More intriguingly still, the hedge fund manager’s thesis on the yen and gold has started to play out quite spectacularly. Gold did nothing in yen for six years, but it has since advanced by 70% in the next three (or, in other words, the yen has lost 70% of its value relative to gold over that time frame).

The gold price is surging (in yen)

Source: Refinitiv data

The questions to ask now are:

It is possible that the time it took the gold/yen trade to play out tested the patience of even the most committed portfolio builder. But Tokyo’s main index has started to lose momentum as the Bank of Japan (BoJ) has debated tighter monetary policy and Prime Minister Fumio Kishida has moved away from the ‘Abenomics’ policy of his predecessor, Shinzo Abe.

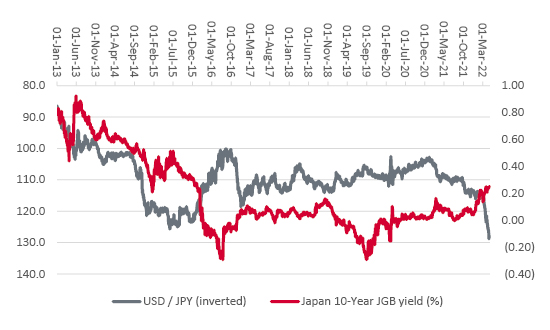

“Japan’s currency has started to tank, even as Japanese Government Bond (JGB) yields have started to rise. The yen has fallen to ¥128 to the dollar, a mark last seen in 2002.”

Moreover, Japan’s currency has started to tank, even as Japanese Government Bond (JGB) yields have started to rise. The yen has fallen to ¥128 to the dollar, a mark last seen in 2002.

The yen is tanking against the dollar

Source: Refinitiv data

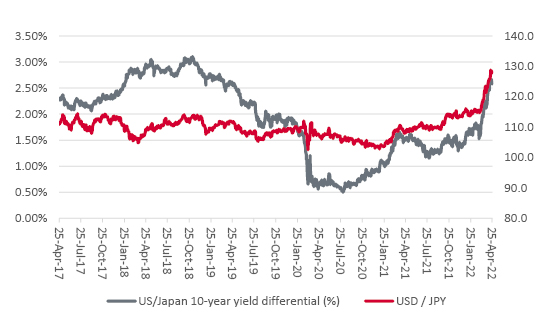

That seems slightly counter-intuitive as normally higher yields would attract more capital. But JGB yields are rising much more slowly than they are in the USA, where the US Federal Reserve is talking a much tougher game. As a result, the dollar is attracting capital and the yen is plunging.

US Treasury yields are rising (much) faster than Japanese JGB yields

Source: Refinitiv data

In Washington, Fed chair Jay Powell is talking about inflation more than anything else right now. Markets are listening and pricing in an 80% chance of a 3% Fed Funds rate by the end of 2022. The prospect of a second American attempt at Quantitative Tightening (QT) and a withdrawal of Quantitative Easing is also upon us.

In Tokyo, inflation may stand at a 42-month high, but the headline rate is still only 1.2%, below both the BoJ’s 2% target and miles below the prevailing 8.5% headline rate in the USA. As a result, BoJ Governor Haruhiko Kuroda is in no rush to raise the headline base rate from minus 0.1% and remains committed to a policy of Qualitative and Quantitative Easing (QQE) with Yield Curve Control (YCC), whereby it will permit 10-year JGB yields to move up or down by 25 basis points (0.25%) from its 0% target.

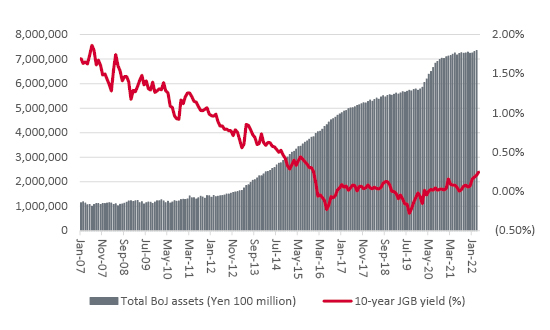

“Despite all of that effort, inflation is stubbornly below target and, worse, the 10-year JGB yield is approaching 0.25%, to perhaps set the BoJ and bond market vigilantes on a collision course.”

The result is that the Bank of Japan, after multiple rounds of QE and QQE, as well as decades of zero interest rates, and a few years of YCC, has a balance sheet that exceeds 100% of GDP. But despite all of that effort, inflation is stubbornly below target and, worse, the 10-year JGB yield is approaching 0.25%, to perhaps set the BoJ and bond market vigilantes on a collision course.

Source: Bank of Japan, FRED – St. Louis Federal Reserve database

This potential contest is one that all Western central banks will be watching. The BoJ is yet to pull the trigger on rate rises or Quantitative Tightening and already the bond market is moving ahead of it, amid fears of inflation.

The currency market is perhaps taking the view any tightening of policy will not last long, in keeping with prior attempts in Japan and the US between 2017-19, as the Japanese economy slows and financial markets wobble, to force rapid backtracking on QT and interest rates.

Meanwhile gold bugs lurk, awaiting their moment. The Bank of Japan, and the yen, may be test cases for the view that central banks are in a corner of their own making after over a decade of experimental policy: either tighten to tackle inflation, making indebted economies and leveraged financial markets turn turtle, or do nothing and see inflation do the damage instead.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.