The UK’s interim results reporting season is drawing to a close, and advisers and clients may be feeling they can breathe a sigh of relief. As in the USA (Shares, 28 Jul’ 22), more firms are saying they are beating or meeting expectations and disappointments look relatively few and far between.

This is despite concerns over input cost inflation, ongoing supply chain stresses, the war in Ukraine, rising interest rates and the real risk of the UK tipping into recession. It also offers support to analysts’ forecasts, which, in aggregate for the FTSE 100, are looking for 20% growth in net profit in 2022 and another 14% in 2023, despite this long list of possible challenges.

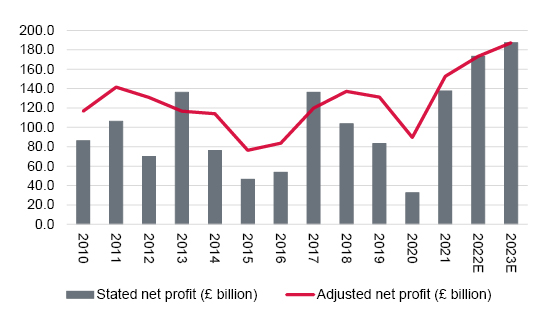

Analysts see higher profits from the FTSE 100 in 2022 and 2023

Source: Company accounts, Marketscreener, analysts’ consensus estimates

Those estimates put FTSE 100, with its £2 trillion market capitalisation, on 12.4 times earnings for 2022 and 10.9 times for 2023. Both multiples look tempting, and suggest the UK is cheap relative to both its own history and international peers, especially once the FTSE 100’s dividend yield of just over 4% is added to the equation.

This lowly valuation may be one reason why the much-maligned UK equity market is, for once, outperforming on the global stage and is, at the time of writing, top of the global rankings for 2022 to date, in terms of local currency capital returns. Only the UK’s FTSE 100 and India’s S&P BSE 100 offer a gain so far (and both are up by barely 1%).

The question now how reliable are those earnings forecasts? If they prove too optimistic, then the FTSE 100’s resilient showing so far this year could prove to be a nasty bear trap.

“Profits already stand at a record high, given 2021’s outcome, and there do look to be multiple challenges ahead, so at first glance, it seems a stretch to expect double-digit percentage profit increases for this year and next.”

Profits already stand at a record high, given 2021’s outcome, and there do look to be multiple challenges ahead, so at first glance, it seems a stretch to expect double-digit percentage profit increases for this year and next.

Aggregate earnings dipped in 2019 before the pandemic as the global economy started to lose momentum. Then came the virus, but the economic impact was more than counter-acted by vast amounts of monetary and fiscal stimulus. But rising interest rates and Quantitative Tightening now dominates central bank policy while penniless Governments are no longer handing out cash with such abandon.

Under such circumstances, an economic slowdown, or downturn, now would seem logical.

However, the FTSE 100’s profit mix means forecasts of profit growth in 2022 and 2023 may not be such a dubious proposition as it may first appear.

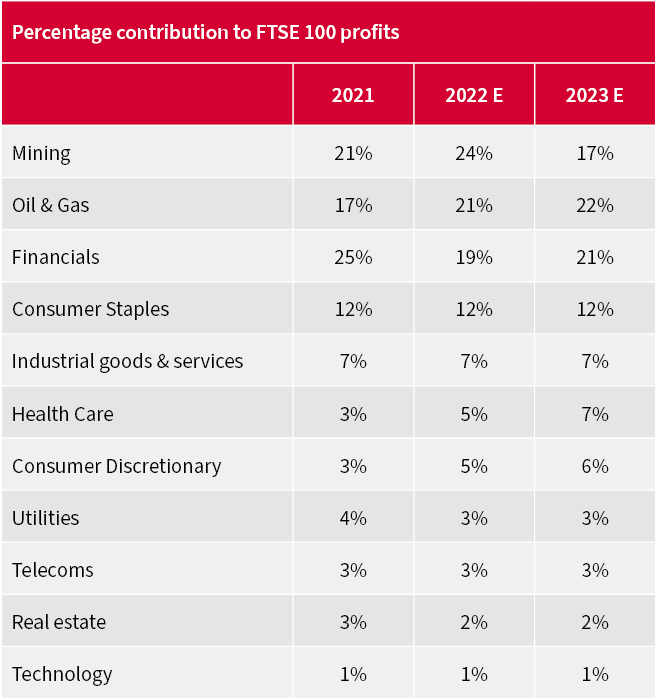

“Mining, oil and financials (banks and insurers) are forecast to generate two-thirds of aggregate FTSE 100 pre-tax profits in 2022 and not much less in 2023. An environment where inflation stays sticky and rising interest rates keep the yield curve steep could help all three of these key sectors.”

Mining, oil and financials (banks and insurers) are forecast to generate two-thirds of aggregate FTSE 100 pre-tax profits in 2022 and not much less in 2023. An environment where inflation stays sticky and rising interest rates keep the yield curve steep could help all three of these key sectors. The counter-argument is that a recession would hurt demand for commodities and crush raw material prices (as happened in 2007-09) and also lead to an increase in provisions for sour loans from the banks (as also happened in 2007-09). But commodity prices stayed firm throughout much of the stagflationary 1970s, and shrugged off economic downturns quite readily, so a negative outcome may not be quite so certain, even under a bearish macro scenario.

Oils, miners and financials still hold the key to FTSE 100 earnings

Source: Company accounts, Marketscreener, analysts’ consensus estimates

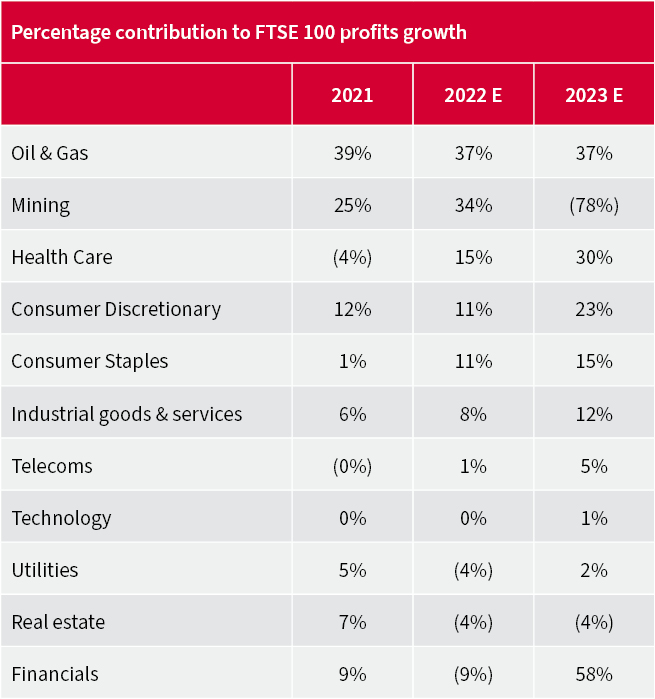

The importance of these three sectors becomes even more clear when their percentage contribution to earnings growth is quantified. Oils and miners are expected to provide 71% of FTSE 100 earnings growth in 2022 but financials are not expected to contribute anything, thanks to a return to taking loan loss provisions this year, compared to 2021’s writebacks.

“The picture changes for 2023 when insurers and banks and oils are expected to generate a very substantial portion of FTSE 100 profits growth, but miners are forecast to detract from the overall pot, thanks to an anticipated retreat in the earnings.”

The picture changes for 2023 when insurers and banks and oils are expected to generate a very substantial portion of FTSE 100 profits growth, but miners are forecast to detract from the overall pot, thanks to an anticipated retreat in their earnings.

Oils, miners and financials still hold the key to FTSE 100 earnings

Source: Company accounts, Marketscreener, analysts’ consensus estimates

Again, any advisers and clients who think commodity prices can confound the consensus may find UK equities of greater interest. Those who do not may well take a more cautious view.

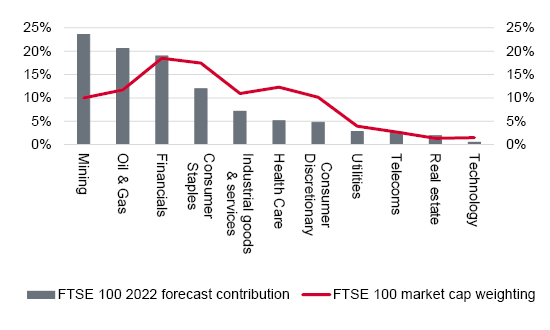

“One final point to bear in mind on industrial sectors’ profit contributions is how their percentage of FTSE 100 earnings compares to their weighting within the index by market capitalisation.”

One final point to bear in mind on industrial sectors’ profit contributions is how their percentage of FTSE 100 earnings compares to their weighting within the index by market capitalisation.

Markets are implicitly distrustful of 2021-22’s oil and mining profits boom

Source: Company accounts, Marketscreener, analysts’ consensus estimates, Refinitiv data

Miners and oils market cap weightings within the benchmark lie well below their forecast profit contribution for 2022 and 2023. This suggests that they could yet surprise on the upside if commodity prices prove more resilient than analysts and economists currently expect, but advisers and clients will have to decide for themselves how likely they think that is.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.