The FTSE 100 is up by around 10% over the past 12 months, and it is now trading within a couple of percentage points of the all-time closing high of 7,878 reached back in May 2018. Vaccinations, an end to lockdowns (in England, at least), ultra-loose monetary policy from the Bank of England, fiscal support from the Government, and a global economic recovery are all possible reasons for the headline index’s steady advance from the pandemic-induced panic low of 4,994 in March 2020.

“The question now is if catalysts are required for the FTSE 100 and UK equities to make further gains, and the sort of advances which justify exposure within the realms of a balanced asset allocation.”

But advisers and clients must look forward when they plan portfolios, not backwards, so the question now is if catalysts are required for the FTSE 100 and UK equities to make further gains, and the sort of advances which justify exposure within the realms of a balanced asset allocation.

Dividend payments are one possibility. A prospective yield of 3.9%* for 2022 from ordinary dividends, with the prospect of further special payments on top, may appeal to some, although with UK headline inflation running at 5.1%, according to the consumer price index, that part of the investment case for the FTSE 100 and UK equities looks less enticing than it once did.

Merger and acquisition activity is another. Over 70 UK quoted firms received bids in 2021 and two FTSE 100 firms were acquired: insurer RSA (in a deal that was announced in 2020) and grocer Morrisons. Overseas buyers snapped up both and a pound that has failed to regain its pre-Brexit poll levels from 2016 may have had a role to play here, as it made these assets look cheaper to euro- and dollar-denominated buyers.

Bid activity suggests there is value to be had, but value still needs something to happen to crystallise it. And perhaps that takes us on to earnings momentum.

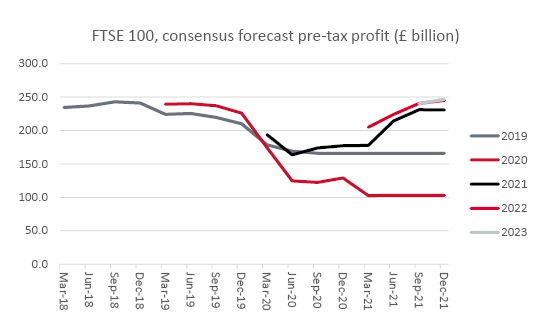

The good news is that earnings momentum remains positive for the FTSE 100 as analysts continue to increase their profit estimates.

“The good news is that earnings momentum remains positive for the FTSE 100 as analysts continue to increase their profit estimates. The less good news is that aggregate profits growth for the index is expected to slow to a virtual crawl following 2021’s rebound.”

Aggregate earnings forecasts for the FTSE 100 in 2022 and 2023 continue to rise

Source: Company accounts, Marketscreener, analysts’ consensus forecasts

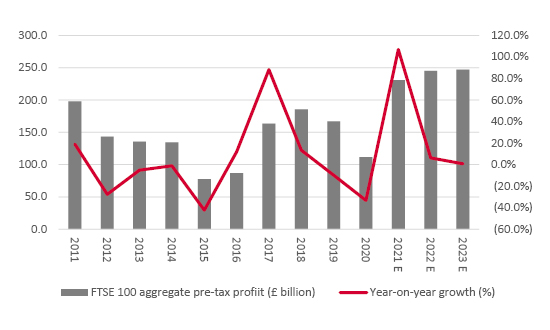

The less good news is that aggregate profits growth for the index is expected to slow to a virtual crawl following 2021’s rebound. Not all of the numbers are in yet, but total pre-tax profits for the FTSE 100 are expected to have doubled in 2021. While it is unrealistic to expect such a torrid pace to continue, advisers and clients could be forgiven for looking askance at estimates which look for 6% profits growth in 2022 and just 1% in 2023.

Aggregate earnings growth for the FTSE 100 is expected to slow dramatically in 2022 and 2023

Source: Company accounts, Marketscreener, analysts’ consensus forecasts

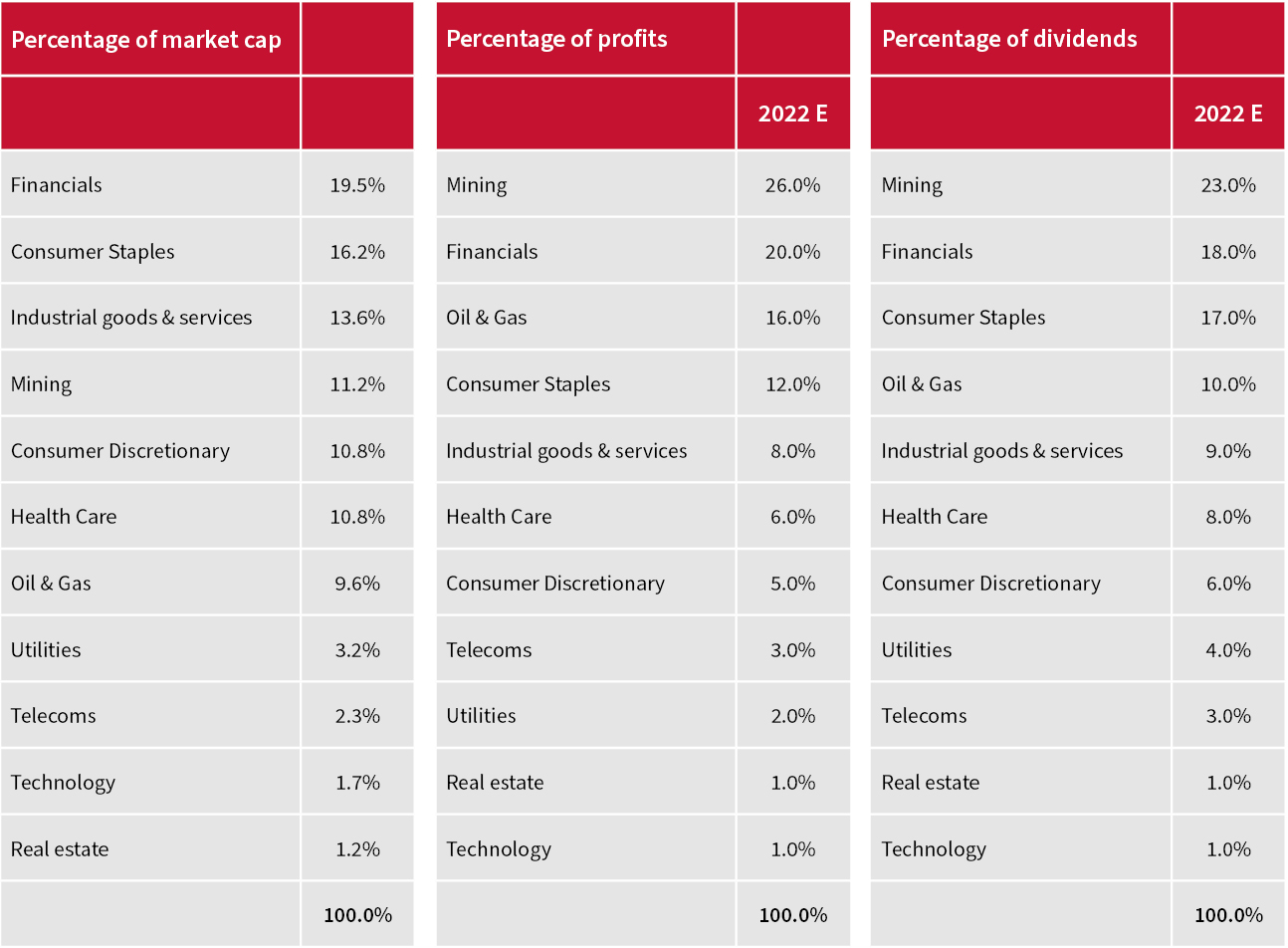

The reason for this sudden go-slow lies largely with the FTSE 100’s mix of constituents. Without wishing to be too pejorative about it, the index is largely made up of the unpredictable (oils and miners), the indigestible (banks and insurers) and the downright stodgy (utilities, telecoms and to a lesser degree pharmaceuticals). A racy mix it is not, at least in the low-growth, low-inflation, low-interest-rate environment that has dominated for the past decade or more.

The FTSE 100 is heavily slanted towards miners, financials and oils

Source: Refinitiv data, Marketscreener, analysts’ consensus forecasts

But even here may be where opportunity lies because there is just the chance that the environment is changing. Markets are no longer preoccupied with where inflation has gone and how low interest rates could go, but where inflation could peak and how high interest rates may have to go to rein it in.

“Markets are no longer preoccupied with where inflation has gone and how low interest rates could go, but where inflation could peak and how high interest rates may have to go to rein it in. In this environment, the FTSE 100 could come into its own.”

In this environment, the FTSE 100 could come into its own. It has underperformed in the world stage since the Brexit vote (if not before). Underperformance can mean unloved and unloved can mean undervalued, at least from a contrarian’s perspective. And undervalued is always a potentially interesting starting point, with the FTSE 100 looking decent value relative to its own history on around 13 times earnings for 2022.

Granted, its unusual, or at least distinctly twentieth-century, earnings mix (lacking in technology, abundant in commodities) may mean the FTSE 100 deserves a low rating relative to international peers such as the USA, which is packed with tech, biotech, social media and online winners, and an equally large range of potential future disruptors.

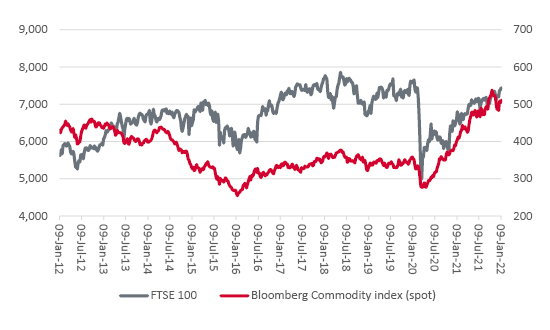

FTSE 100 may take its lead from commodities in 2022

Source: Refinitiv data

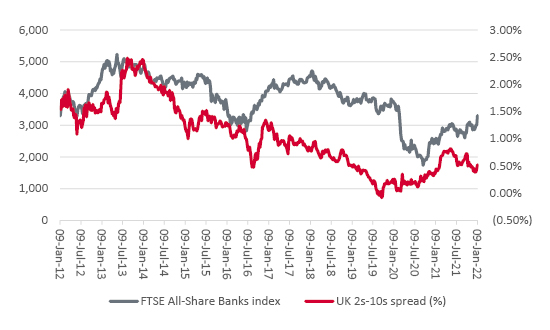

But if inflation runs hot and stays hot, then ‘real’ assets such as commodities, or paper claims on them via shares in mining and oil producing, may not be such a bad place to be. Nor may banks, which would welcome, at least to some degree, higher interest rates and a steeper yield curve, as they will help to fatten up net interest margins and thus profits (so long as higher borrowing costs do not weigh too heavily on customers’ ability to meet interest payments and return principal). The FTSE All-Share Banks index is up by 10% this year already and can point to an advance of more than 25% over the past 12 months, so the market is starting to look upon the banks more favourably than it has for a while.

Banking stocks are warming to steeper yield curves

Source: Refinitiv data

An index that gets 62% of its forecast profits and 51% of its forecast dividends from miners, financials and oils may therefore sound a bit unpredictable, indigestible or downright stodgy. But if inflation takes a hold, then the FTSE 100 might start to look more tempting.

Equally, if even modest interest rates slow the global recovery right down, or even tip it over into a recession, or a new viral variant does that job, then the UK’s heavyweight index could yet struggle to move past that May 2018 peak and continue to lag its global peers, many of whom already trade at or near new all-time highs, including America, France, Germany and India.

* Marketscreener, aggregate consensus analysts’ forecasts

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.