The Federal Reserve continues to insist that inflation is only transitory and will quickly fade as the base for comparison gets tougher from now onwards, especially when it comes to important inputs such as oil.

Yet not everyone is convinced. Central banks in Brazil and Russia are now hiking interest rates, the Norwegian one is promising higher borrowing costs in the second half, the Bank of England is gently slowing the rate at which it is buying gilts under its Quantitative Easing (QE) scheme and the Bank of Canada is actively reducing the scope of its equivalent programme.

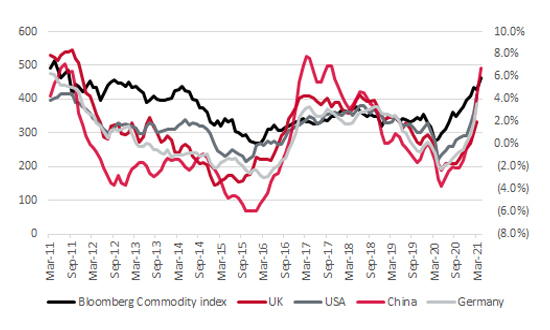

Economists are starting to fret. Usually, price rises start with commodity prices first, then they seep into factory gate (or producer) prices as companies see their input costs rise. You then get those very same firms jacking up their prices to preserve margins and that’s when consumers start to feel the pinch. It is not hard to make the case that the first two phases may already be underway, even if headline consumer price indices remain relatively subdued.

Raw material prices and factory gate prices are already rising sharply

Source: Refinitiv data

“The Industrial Metals and Mining sector is the top performer within the FTSE 350 this year and even Precious Metals and Mining ranks ninth out of forty, even if gold and silver seem to be out in the cold right now.”

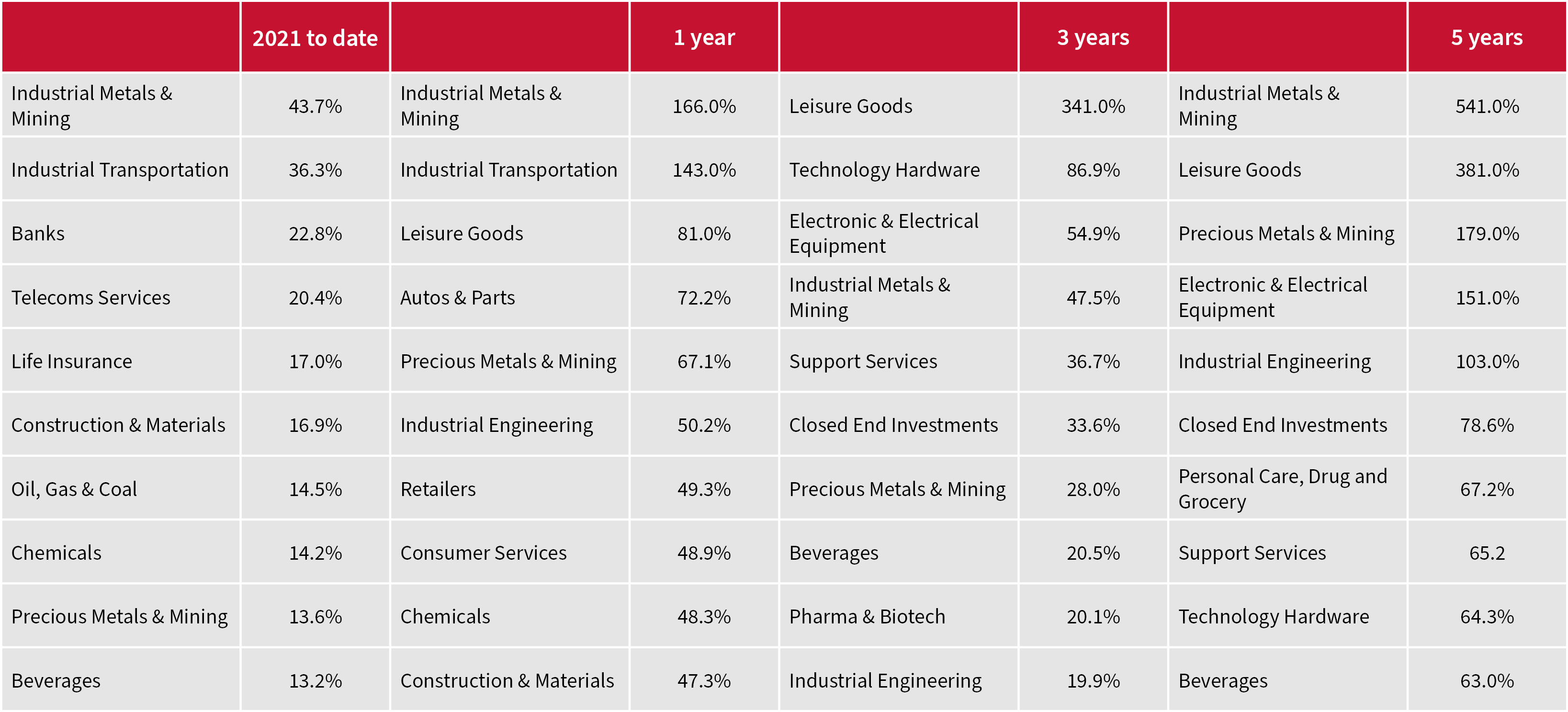

Stock markets are beginning to take note. The Industrial Metals and Mining sector is the top performer within the FTSE 350 this year and even Precious Metals and Mining ranks ninth out of forty, even if gold and silver seem to be out in the cold right now.

Industrial Metals and Mining is also the leading sector on a three- and five-year view. That may lead some investors to wonder if they have missed the boat. If the Fed is right, then the answer may be ‘yes’. But if inflation grabs hold, or we simply get a rip-roaring economic recovery, or commodities are in the early stages of a new ‘super-cycle,’ as some are suggesting, then miners could yet offer some of the treasure that portfolio builders are seeking.

“If inflation grabs hold, or we simply get a rip-roaring economic recovery, or commodities are in the early stages of a new ‘super-cycle,’ as some are suggesting, then miners could yet offer some of the treasure that portfolio builders are seeking.”

Mining shares are performing strongly

Source: Sharepad

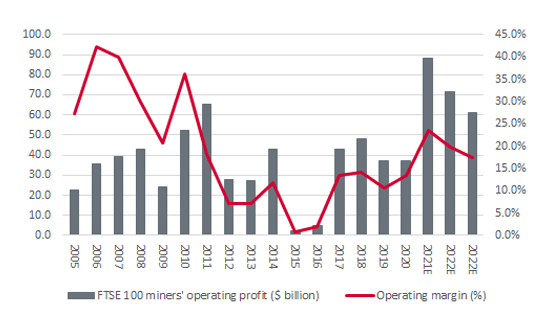

For all that miners’ share prices are motoring, analysts’ earnings estimates look pretty conservative compared to the sector’s cyclical peaks of 2006–07 and 2011–12, at least if you use the aggregate consensus forecast for the seven miners which currently reside within the FTSE 100: Anglo American, Antofagasta, BHP, Fresnillo, Glencore, Polymetal and Rio Tinto.

Their aggregate operating profit peaked at $65 billion in 2011, although return on sales peaked at 36% in 2010.

Yet analysts seem to think that the mining sector’s operating margin will peak this year at just 23%, despite years of cost control and the current boom in prices. Granted, that equates to $88 billion of operating profit, a new all-time high, but analysts expect that to ebb to $71 billion in 2022 and $61 billion in 2023, in the view that the initial post-pandemic surge of activity runs out of steam.

Analysts believe miners’ profits will peak in 2021

Source: Company accounts, Marketscreener, consensus analysts’ forecasts

“Commodity bull markets often result from supply-side constraints that are the result of the bust (and hangover) that followed the preceding boom, as miners cancel projects and rein in capital investment to shake off the excesses of the last upcycle.”

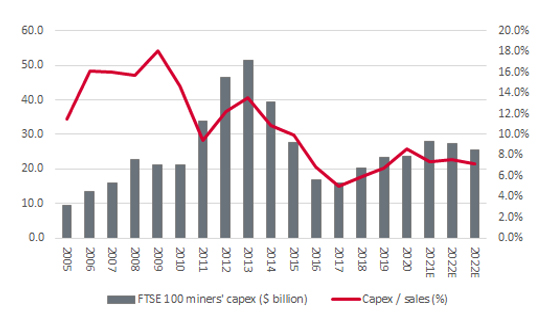

In the event of an inflationary recovery, or maybe even stagflation, that could yet look conservative, especially as sustained increases in raw materials do not always require rampant demand growth. In fact, quite the opposite. Commodity bull markets often result from supply-side constraints that are the result of the bust (and hangover) that followed the preceding boom, as miners cancel projects and rein in capital investment to shake off the excesses of the last upcycle.

This building block is in place.

The FTSE 100 miners’ capital investment peaked at 18% of sales in 2009, two years before the profit peak, and at $51 billion in 2013, no less than two years after it, as a dash to increase output undid the very boom it was looking to support. Investment subsequently slumped to just 5% of sales, or $16 billion, in 2017. Spending is ticking up but to nothing like the highs seen in 2009–11 and nor are miners splashing the cash on big acquisitions. Largesse is out and fiscal probity is (still) in. Mines cannot just be switched on in a flash.

Miners continue to show capex restraint

Source: Company accounts, Marketscreener, Refinitiv data

“A ‘green’ future based on renewable energy may also lean heavily on copper, cobalt, rare earths, platinum, palladium and other metals and resources.”

If demand really does pick up and prices start to run, it could take some time for supply to catch up, especially as Government spending plans for infrastructure around the globe suggest that demand for commodities could be strong. A ‘green’ future based on renewable energy may also lean heavily on copper, cobalt, rare earths, platinum, palladium and other metals and resources (wind turbines are made of steel and the manufacturing process needs iron ore). A debt-laden slump may snuff out the bull case, but heavy metal could continue to strike a chord with investors if we get a strong recovery, inflation, or both.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.