American musician and bandleader Frank Zappa once asserted that, “The mind is like a parachute. It doesn’t work if it isn’t open.” Investing is surely just the same. No-one has a crystal ball and financial markets are at their most volatile – and therefore ripe with opportunity – when consensus opinions are coming under duress. Mood follows price and both the bull and bear cases always seem most compelling at, or at least near, the peak and trough respectively.

“Share prices are assuming that inflation will gently decelerate, interest rate hikes will stop and then become rate cuts and as a result the world’s economic powerhouse will suffer nothing worse than a soft landing, or even start to soar once more after avoiding an encounter with the ground altogether.”

This is why the debate over whether the USA is going to go into recession in 2023 matters. Right now, share prices are assuming that inflation will gently decelerate, interest rate hikes will stop and then become rate cuts and as a result the world’s economic powerhouse will suffer nothing worse than a soft landing, or even start to soar once more after avoiding an encounter with the ground altogether.

If so, then all may be well and good. But what if the consensus is wrong and such a glorious hat-trick does not fall into investors’ laps? Applying Zappa’s maxim, it must be at least worth looking out for possible danger signs and considering what could go wrong if the core scenario does not develop as anticipated. Where the US goes, the world tends to follow, after all.

One useful exercise may be to try and block out 2020 to 2022 altogether, given the extraordinary challenge posed by COVID-19 and the massive amount of monetary and fiscal stimulus (let alone scientific research) that was deployed to beat it off.

Think back to 2019. The US economy was losing momentum and then President Trump was trying to goose it into life before 2020’s election, not least by leaning on the Federal Reserve to keep policy loose. It can be argued that the US is now returning to that trajectory as the Fed steps away from ultra-loose policy, Capitol Hill stops authorising stimulus cheques and the debt taken on during 2020-22 starts to weigh.

Is the US economy returning to its pre-pandemic trajectory?

Source: FRED – St. Louis Federal Reserve database

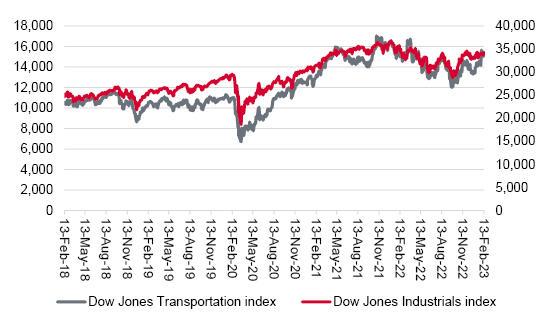

“One of this column’s preferred indicators, the Dow Jones Transportation index, was going nowhere fast in 2019 and it has lost momentum again over the past year.”

One of this column’s preferred indicators, the Dow Jones Transportation index, was going nowhere fast in 2019 and it has lost momentum again over the past year. The benchmark has thus far failed to recapture its November 2021 high, even after a furious rally from the autumn low. This is worth bearing in mind if Dow Theory holds good, and the Industrials follow where the Transports go.

Is the rally in the Dow Jones Transportation index running out of track?

Source: FRED – St. Louis Federal Reserve database

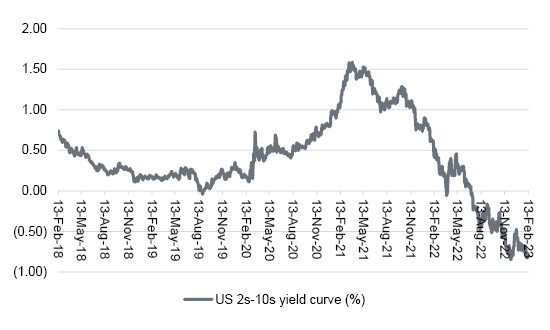

Another tried and tested market indicator was looking pretty lacklustre in 2019, too, namely the yield curve. US two-year Treasuries were yielding more than US ten-year government paper, to suggest fixed-income markets were expecting a slowdown in the US economy and looser monetary policy in response. If anything, now, the inversion is even more dramatic, as the last time two-year Treasuries yielded this much more than ten-year Treasuries was January 1980, just as the USA was about to lurch into a recession.

Is the yield curve correct to warn of a downturn?

Source: FRED – St. Louis Federal Reserve database

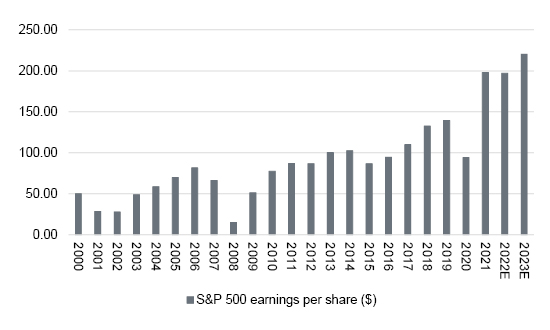

“Most tangibly of all, US corporate profits are starting to feel the strain.”

Most tangibly of all, US corporate profits are starting to feel the strain.

A year ago, analysts were looking for aggregate earnings per share (EPS) from the S&P 500 index of $225, up from $198 in 2021, with further progress to $247 in 2023. Consensus forecasts now think earnings fell in 2021, to $197, while 2023 estimates are down to $220. If the US economy does hit a bump, then even 12% earnings growth this year could be hard to achieve, even allowing for some of the fierce cost-cutting already in evidence at some of America’s largest corporations.

Will US corporate earnings forecasts stay under pressure?

Source: S&P Global Research

Those earnings forecast downgrades help to explain why the S&P 500 is still lower than it was at this time last year. A soft landing or unexpected growth could quickly cure the ills that trouble corporate earnings and boost the index, but a sharp downturn could put earnings forecasts, and the benchmark, under more pressure.

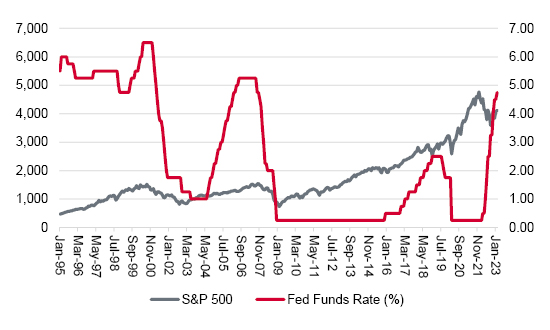

“Markets still think the US Federal Reserve can save the day with interest rate cuts, and they may well be right. But history shows the Fed starts to cut only once something has snapped – the economy, the markets or both.”

Markets still think the US Federal Reserve can save the day with interest rate cuts, and they may well be right. But history shows the Fed starts to cut only once something has snapped – the economy, the markets or both. Frantic rate cutting did not provide immediate succour in either of the 2000-03 or 2007-09 bear markets.

Will Fed rate cuts come too late, as they did in 2000 and 2007?

Source: S&P Global Research

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.