I was lucky enough to attend an investor event in Leeds last week and the subject everyone wanted to discuss was confidence – or at least the lack of it.

There are plenty of reasons investors are feeling shaky, not least concerns about the potential impact of the Israel-Gaza war and, closer to home, fears that inflation might prove stickier than had been hoped.

“Volatility and uncertainty are pushing many retail investors to stock up on government bonds or stash their cash in savings pots which have deceptively high interest rates.”

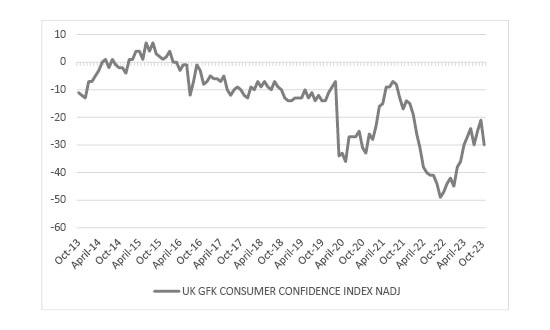

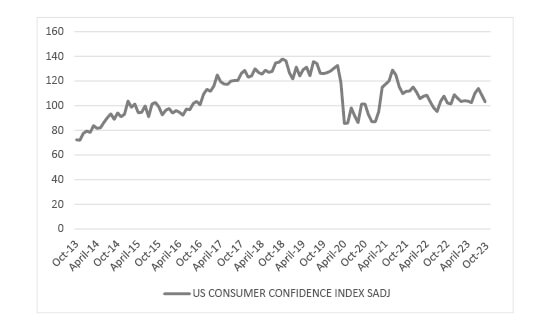

Consumer confidence, both in the UK and in the US has dropped away, not the kind of trajectory that warms hearts as we plough deeper into the “golden quarter”.

A lack of consumer confidence usually translates to a pull back in spending and there have been plenty of surveys suggesting Christmas 2023 is likely to be a lean one for many families.

Consumer confidence

Source: Refinitiv data

That lack of confidence, that uncertainty, is influencing investor behaviour and shaping global financial markets with both the FTSE 100 and 250 down since the start of the year – the latter almost 10% as UK shares struggle to find the front foot.

Volatility and uncertainty are pushing many retail investors to stock up on government bonds or stash their cash in savings pots which have deceptively high interest rates.

But advisers know it’s crucial not to make short-term decisions, to remember that current instability will be transient and that investing as a long game means downturns can actually present opportunities.

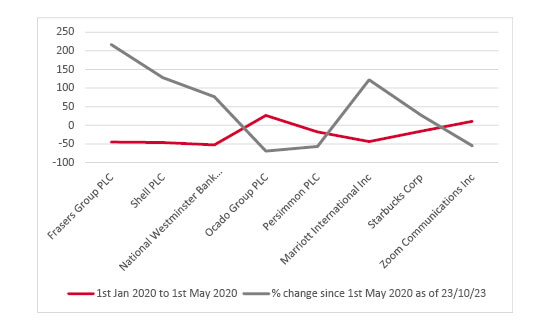

Looking back to 2020 as mutterings about Covid-19 turned into pandemic lockdowns, confidence took a similar dip.

Stock markets plunged and the share price of well-known companies like Shell, Nat West and Frasers Group all took double digit hits.

Notable pandemic movers

Source: Sharepad

The oil price plummeted as the global economy ground to a halt. It’s almost surreal to remember shuttered shops and discussions about negative interest rates.

Fast forward to where we are now, and those stocks have enjoyed impressive gains as the world continued spinning and what passes for normal service has been resumed, albeit with a few inflation-fuelled tweaks.

It’s been a similar picture in the US, with Marriott and Starbucks both enjoying a substantial return to form as people got reconnected with their lives and their friends and families.

Conversely many pandemic winners have become post-pandemic losers.

“Look at market fluctuations as your friend rather than your enemy.”

Homeworking has become entrenched, but we’ve adapted to a hybrid model which has lessened the ubiquity of video conferencing services and now we don’t have to queue around the supermarket car park, popping to the shop is a much more desirable option for people more interested in bargains than convenience.

There’s always an outlier, and UK house builders only enjoyed a brief moment of optimism before the weight of increased borrowing costs caused the sector to buckle.

But with a general election hurtling towards us expect a plethora of housebuilding pledges and schemes to help buyers get on or climb up the ladder.

Whilst we can all spot potential opportunities like hinted at changes to planning regulations, without a crystal ball or some kind of Warren Buffet-esque superpower it’s impossible to predict the timing of stock market fluctuations. However, the man himself advises us “to look at market fluctuations as your friend rather than your enemy.”

In the last couple of weeks there have been countless articles espousing the virtues of refreshing stock shopping lists, targeting companies you’d rather like to add to your portfolio if they reach a price that appeals.

And it’s here that the unsettling volatility, those fluctuations, can actually work in your favour.

Risk isn’t a bad thing, its just a measure of how you feel about your finances and your financial future.

Mitigating that risk doesn’t mean playing it safe. It doesn’t mean throwing everything into a cash cushion because the returns on cash savings look positively obscene compared to what we’ve been used to over the last decade.

We’ve all come up close and personal with inflation. We’ve experienced its impact on our living standards, on our wages and its crucial we understand that our savings aren’t exempt.

So many people I spoke to last week hadn’t really got to grips with that little conundrum and it’s understandable that headlines about war, about geopolitical uncertainty are taking a toll on people’s investing confidence.

But, like life, markets are cyclical and despite the dismal outlook the current crop of earnings has been remarkably robust.

Buying the dip isn’t new and whilst there are no guarantees that past performance will be repeated; finding good value, and good-quality opportunities from that dip is a favoured tactic of many institutional investor.

Advisers understand that time is the ultimate friend but helping clients see through the current uncertainty isn’t always easy.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.