There have been a couple of bits of retail news over the last few weeks that bear real consideration.

The first was that Swedish “flat pack” maestro IKEA was taking over a massive shopping centre in the heart of Brighton and the second that after 137 years of calling, Avon is setting up shop in the UK.

By themselves they might not raise much of an eyebrow amongst investors but when you consider the wider context, the moves they are making say something about the state of the UK high street and about the future of retailing in general.

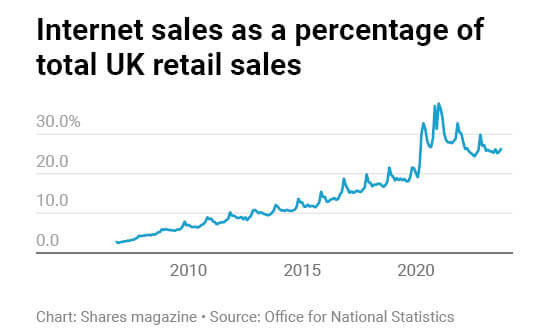

Pre-pandemic bricks and mortar stores were coming under increasing pressure from the growth of online shopping which had peaked at just over 20% of all retail in the months before the first UK lockdown.

Percentage of retail sales made online

Source: ONS

Pre-pandemic bricks-and-mortar stores were coming under increasing pressure from the growth of online shopping which had peaked at just over 20% of all retail in the months before the first UK lockdown.

With stores shuttered for months, people were forced to turn to the internet, and by the winter of 2020 almost 40% of sales were being made online.

Traditional retailers which had already been feeling the squeeze buckled.

Huge names like Debenhams and TopShop disappeared from our high streets as they struggled to balance huge costs like rents and rates with falling footfall.

Shoppers are mixing it up; some want the opportunity to touch and try before they buy, others want help and advice whilst still more want the chance to engage directly with brands.

Company Voluntary Arrangements were all the rage as physical retailers fought to play the game on a new playing field that favoured online competitors with cheaper out-of-town warehouse space.

Whether our post-pandemic need for social interaction played a part or whether online sales growth was always going to plateau we can only hazard a guess but plateau it has.

Shoppers are mixing it up; some want the opportunity to touch and try before they buy, others want help and advice whilst still more want the chance to engage directly with brands.

Avon’s customer used to get that physical interaction through door-to-door sales or make up parties, but even before Covid that method was being seen as increasingly old fashioned and the brand had struggled to retain its relevance.

Whilst clothing can be bought in multiple sizes, tried on and then returned if it’s not the right fit, not every retailer will allow you to return beauty products once they’ve been opened unless they are faulty.

And getting the right product can sometimes take quite a bit of trial and error, which is undoubtedly the reason 80% of beauty sales still happen in stores, something Avon’s global CEO Angela Cretu highlighted when the new plans were announced.

But unlike the Body Shop, which Avon’s owner Natura recently sold, this new solo venture will be focused away from prime locations. Avon’s beauty boutiques will most likely be integrated into neighbourhoods and run by representatives who take on the franchise.

For those more expensive city-centre locations it’s relying on its tie up with Superdrug: all the bang without the big bucks.

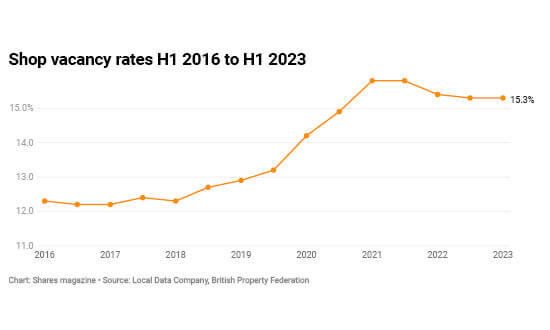

Shop vacancy rates H1 2013 to H1 2023

Source: Local Data Company

Cost pressures are still foremost in many retailers’ minds. It’s why those huge “prime” locations vacated by the likes of Debenhams, have, for the most part, remained empty.

IKEA’s decision to buy up an entire shopping centre in the heart of Brighton seems to fly in the face of everything that’s worked for the furniture behemoth.

Omni-channel retailing is strangely not one size fits all.

Beloved staple of out-of-town retail parks, IKEA has thrived partly because its ‘drive up and load up’ model has become an essential part of early adulthood.

An earlier foray onto the high street crashed and burned, but this is a sort of halfway house, a mix of its two offers, where people can actually walk out of the store with small and mid-sized items and arrange delivery for the rest, and it’s already been working at another site in Hammersmith the company opened last year.

Omni-channel retailing is strangely not one size fits all. It’s even more complex than the bricks and mortar vs online dilemma.

If it were easy, online’s biggest success story, Amazon, wouldn’t have backtracked half a dozen times from bricks and mortar ventures.

Just this month the retailer shuttered its only two Amazon clothing stores in the US and here in the UK it has closed four Amazon Fresh locations this year, though it insists it is still committed to the formula.

Physical retail is expensive.

Do it correctly and it fosters brand loyalty, allows customers to immerse themselves in the full store story and creates a permanent physical shop window that enhances those online.

But the location has to be perfect, the store perfect and the engagement… perfect.

Vacancy rates have fallen slightly from their post-Covid highs but it’s still a renter’s market, which has a knock-on effect on the kinds of rents that can be asked by property giants like British Land and Land Securities.

And falling rents have made the case for bricks and mortar more persuasive even to those pure play online businesses like Gymshark.

Retailing seems straightforward: give the people want they want, how they want it, at a price they want to pay for it. In reality it is constantly evolving.

But thriving high streets mean thriving property companies, thriving hospitality businesses and thriving transport networks, which is why brands keep on trying to find the right mix of ingredients to make magic.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.