It’s a well-worn line that “you shouldn’t try to time markets you just have to have time in markets”. There’s no getting away from that salient bit of advice, but for investors staring at the prospect of recession it’s hard not to wonder if there’s not more you can do to cushion your portfolio from the worst of what’s coming down the line. Diversification is always smart but is there anything we can learn from past UK recessions to help you choose what to keep in your basket of investments, what to add, and what to cut loose?

Recessions come in different shapes and sizes. The Bank of England is anticipating that the recession currently stalking the country will be long and shallow, more like that experienced in the 1990s or early 2000s than the short sharp shock that was the post-Covid recession.

“…market performance often flashes warning signs months before the official data catches up.”

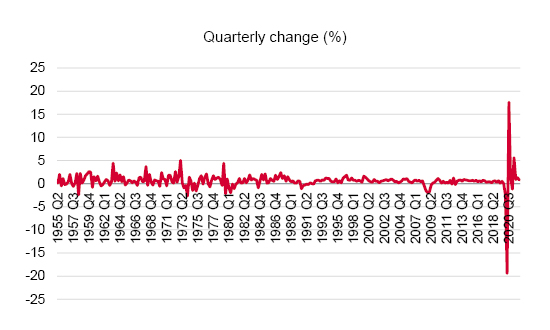

UK GDP since 1955

Source: Office for National Statistics

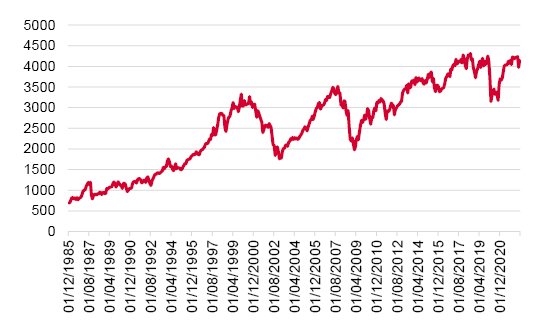

GDP numbers give a snapshot of how the economy is faring, but there’s a lag, it’s backward-looking and by the time the data is published so much can have changed. By contrast markets tend to have one eye focused on the now and one very much looking towards the future. Whilst it takes two quarters of negative growth before a recession is technically signed off, market performance often flashes warning signs months before the official data catches up.

FTSE 350 Performance since 1986

Source: Refinitiv

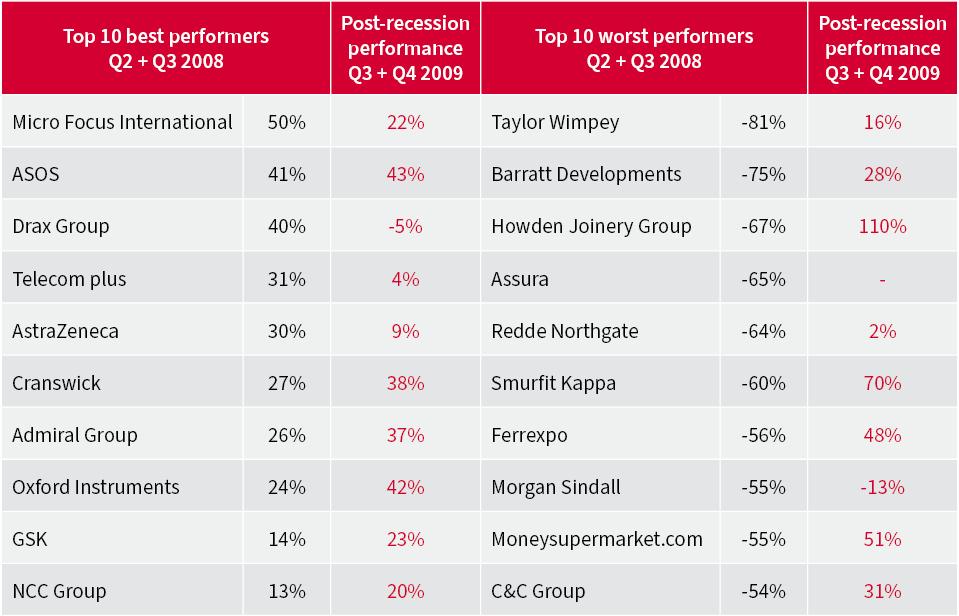

Which stocks suffered the most as the UK economy began to shrink over the last two recessions, and which held up against the slowdown? Is there anything we can glean from the data that might inform our choices as the UK faces its next downturn?

By focusing on share price performance, we get an indicator of how investors viewed different companies, and different sectors, as they considered all the factors that teed up the last two recessions.

Officially labelled on 23 January 2009, revisions show the economy actually began to falter from April 2008. With the benefit of hindsight, no-one will be surprised to see house builders and construction companies like Taylor Wimpey and Howden Joinery among those losing the most ground, as lenders cut credit lines and Britain’s property boom turned to bust. Big pharma like AstraZeneca, and tech companies like Micro Focus International and online retailer ASOS thrived, an interesting mix of growth and value stocks that mostly held onto their share price performance.

Source: Sharepad

Once through to the other side it’s clear there were opportunities for investors to make gains as the economy powered back up.

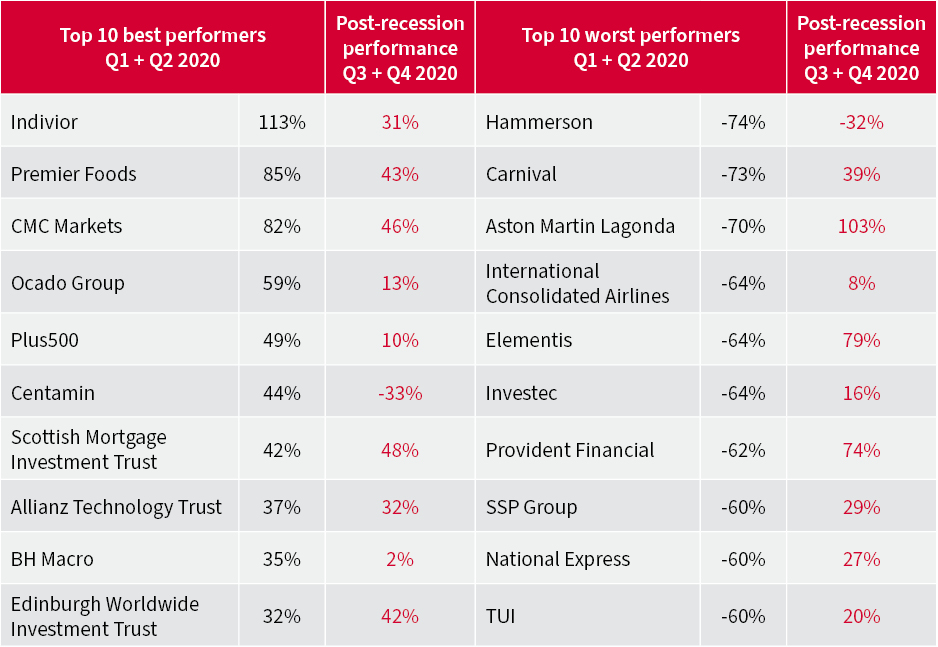

It was a similar picture in the run up to the ‘Covid crash’, though the 2020 recession was far, far deeper and far shorter than that seen in the wake of the financial crisis. Investors were sussing out the situation and making moves into sectors they expected to thrive: grocery tech business Ocado and food manufacturer Premier Foods along with global pharma in the shape of Indivior. They also sought to make a quick exit from those they expected a pandemic to weigh heavily on like travel and hospitality stocks Carnival and SSP.

“Every recession is different, as are the factors that create economic slowdowns unique to each slice of time.”

Source: Sharepad

And once again most enjoyed a post-recession surge whether they’d tumbled or not.

Every recession is different, as are the factors that create economic slowdowns unique to each slice of time. Looking back can only give you an idea of how investors were interpreting the economic climate of the time.

As for the here and now, it’s clear the slowdown that’s already underway is nibbling away at consumer confidence, and investors have been looking for clues about company resilience in the last set of earnings that have mostly just been delivered. Valuations have been adjusted, and a lot of the bad news has already been priced in.

And this is set to be a somewhat unusual recession, one born of high inflation but offset by high employment. That’s not to say some stocks won’t fall as the above tables clearly demonstrate. But what can be relied on is every recession is followed by recovery, and when sentiment flips markets can hit the ground running, leaving the uninvested in the dust.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.