In a world of thousands of stocks, certain people just want to focus on ones that are doing well. If these stocks are part of a group with a snappy acronym or label, they must surely matter, right? That is the widespread view among the investment community.

Investors love a narrative and what better way to hook people in than with a label that says, ‘look at me’. The Magnificent Seven is the latest grouping of stocks to grab all the headlines, a collection of names including Nvidia, Microsoft and Amazon that were responsible for a large chunk of US market gains in 2023.

History suggests these groupings rarely stay on top for a long time. Over the years, we have had FAANGs and the Nifty Fifty, among others. They have either evolved into different acronyms or labels or faded away.

Cracks are now appearing in the Magnificent Seven which suggests we could see new contenders for the ‘hot’ pack in the coming months.

Advisers and investors should sit up and pay attention to the potential candidates as the market latching onto a new acronym or label can provide a powerful tailwind for the members. However, catchy names do not necessarily make for good investments over the long term even if the hype can push share prices along in the near term.

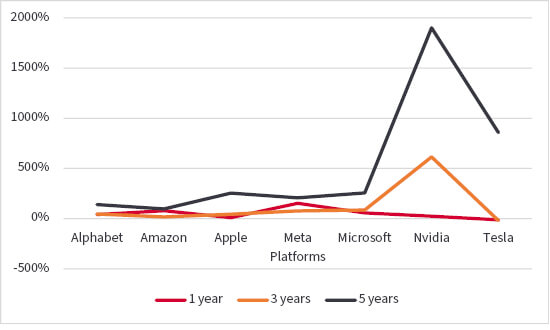

There is nothing magnificent about Apple’s and Tesla’s share prices this year. These two companies are lagging the pack because investors’ list of concerns is growing longer.

Apart from the expensive Vision Pro headset which is still in its commercial infancy, Apple has not launched a new product in a long time that has mass-market appeal.

Tesla faces growing competition in the electric vehicle space and chief executive Elon Musk is growing more unpredictable by the day.

MAGNIFICENT SEVEN: Share price performance

Source: AJ Bell, SharePad. Data to 21 March 2024

Over the past six months, Tesla’s share price is down by a third and Apple’s is flat versus a 20% gain from the Nasdaq index. Their lacklustre performance on the stock market suggests that the Magnificent Seven might need to lose these stocks and shrink to fewer members.

‘Famous Five’ looks the obvious choice for a replacement name, alternatively the ‘Sensational Six’ or ‘Dynamic Half-dozen’ would work if Apple or Tesla stage a comeback soon.

While the members of the Magnificent Seven are united by the common use of technology to drive their business, Tesla does stick out from the crowd given it is principally an automotive group.

Herein lies a key point. Commonality is important when looking at a specific group of stocks. You want to be able to compare apples for apples, not lump together a group of names because they are similar sized or have simply done well.

Goldman Sachs has been pushing the ‘GRANOLAS’ acronym as a marketing tool for the past four years. This acronym has returned to the forefront this year, partly because investors are proactively seeking an alternative to the Magnificent Seven but also because GRANOLAS are significant names across European equity markets.

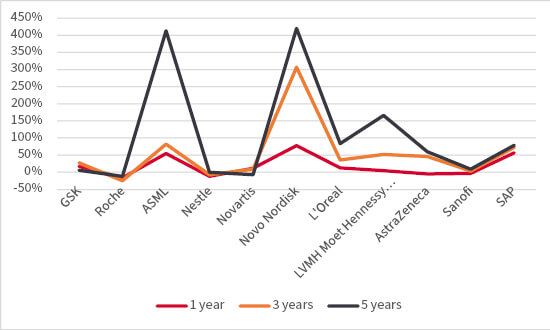

A key difference is that the Magnificent Seven all drove the US market in 2023 whereas only certain members of the GRANOLAS have been positive contributors to European markets of late.

GRANOLAS: Share price performance

Source: AJ Bell, SharePad. Data to 21 March 2024

The GRANOLAS consists of eleven names: GSK, Roche, ASML, Nestle, Novartis, Novo Nordisk, L’Oreal, Louis Vuitton, AstraZeneca, SAP and Sanofi. Of these, Novo Nordisk and ASML have enjoyed good share price gains of late and GSK and SAP are finally winning over the market. L’Oreal, LVMH and Novartis are slow burners but are moving in right direction. However, shares in Sanofi are not doing much and Roche and Nestle at are multi-year lows so the full pack is not delivering the gains in a way we saw with the Magnificent Seven last year.

What do the GRANOLAS represent? There is no common theme apart from they are all listed on a European stock exchange. Anyone who wants to use acronym groups as a way of identifying big growth companies might be disappointed by the GRANOLAS as certain members are more ‘defensive’ stocks. To sharpen the growth focus, one would have to reduce the number of pharma stocks and potentially add a different dynamic such as Ferrari, the car maker whose shares have been racing ahead.

Similar acronyms have existed to no great lasting effect, even if they created excitement when they first appeared. Investors soon wearied of the BRICs (Brazil, Russia, India, China) and the MINTs (Mexico, Indonesia, Nigeria and Turkey) were in their good books for a shorter time than the BRICs.

The FAANG quintet of Facebook, Apple, Amazon, Netflix and Google saw the acronym cast aside once Netflix disappointed with subscriber growth figures. It was subsequently adjusted for name changes and became MAANAM (Meta, Alphabet, Amazon, Netflix, Apple and Microsoft) and now we have the Magnificent Seven, with Nvidia muscling in and replacing Netflix.

Going further back, the Nifty Fifty proved to be a fad which helped US equity investors in 1971-72 and then over a cliff edge in 1973-74. A similarly bifurcated market in 1998-2000, led higher by tech, media and telecoms stocks to the apparent exclusion of all else, also ended in disaster.

Once the Nifty Fifty crashed it took the S&P 500 until the early 1980s to get back to its prior high and after tech’s collapse in 2000-2003 the Nasdaq needed more than a decade to return to its previous peak.

The acronyms and labels are a way of hooking in investors, but inaction by the exchange-traded fund industry to capitalise on their popularity is telling. These names get old quick, hence why it is rare to see the launch of ETFs that incorporate their identity.

You would have thought a Magnificent Seven ETF would hoover up assets in the current market, yet there are only two available (and none to UK investors) – one of which is a former tech ETF that has been rebadged by Roundhill Investments. One can only imagine that ETF providers do not want to take the risk of launching a product that could only have a short shelf-life before it needs to be recalibrated or wound up.

Recognising what is popular is important as an adviser or investor, but chasing the flavour of the month also has substantial risk and is not necessarily an effective way to construct or manage a portfolio.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.