Investors and advisers are increasingly turning to passive investment products such as tracker funds and exchange-traded funds as they seek a low-cost, easy way to get exposure to the markets.

There are numerous reasons why trackers and ETFs are filling more portfolios. Underperformance by active managers is one of them – just 36% of active managers beat the average passive alternative in 2023 across seven key equity sectors, according to analysis of Investment Association data by AJ Bell.

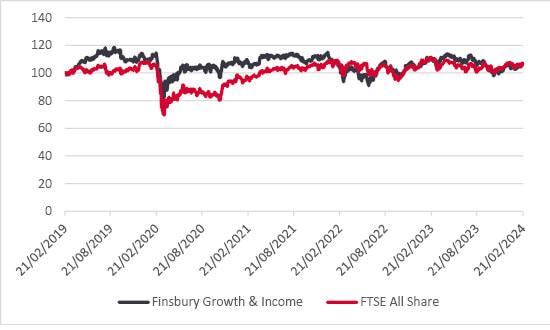

Another potential reason behind the migration to passive is a mixed performance in recent years from big name fund managers previously known for doing well. For example, Terry Smith’s Fundsmith Equity Fund and Nick Train’s Finsbury Growth & Income both underperformed their respective market benchmarks for three years in a row, and the demise of Neil Woodford’s funds is also firmly engrained into investors’ minds.

Rebased to 100

Source: LSEG

No-one should expect fund managers to outperform every single year, but lagging for three consecutive years will naturally make investors and advisers think twice about their commitment to these funds.

Investors typically pay a higher fee to use an active fund or investment trust versus a tracker or ETF as that additional money covers the cost of the fund manager managing the portfolio. Charges eat into returns over a long period and investors are right to think about switching to a cheaper passive alternative if they aren’t getting the outperformance they are paying for.

In Terry Smith’s defence, Fundsmith Equity Fund still delivered a 12.4% return in 2023 which is a decent performance relative to historical gains from equities. It just wasn’t as much as the broader market (16.8%, as measured by the MSCI World Index in pounds). Smith even acknowledges the appeal of passive funds, saying in an interview: ‘Passive is a really good choice for most people. Outperforming over the long term is not easy.’

Alliance Trust is a popular investment trust, offering exposure to global equities via a multi-manager approach. While it has outperformed the MSCI All Country World benchmark over the past three and five years, there have been plenty of times when it has lagged the market. Co-portfolio manager Stuart Gray argues that investors need to be more patient with underperforming active funds in general but admits that is ‘not a realistic expectation’. He adds: ‘We are all human and performance affects what we think of things’.

Investors should judge active managers over a longer period than three years as there will be times when their style is out of favour or they simply go through a bad patch. The key unknown is whether a fund manager can sustain their success over the long term. It’s up to the investor to decide if they are comfortable taking that risk or whether that factor is removed from their decision-making process by going passive.

Like everything in investing, it’s important to consider both sides of the argument. ‘Passive is simple and cheap, but the problem is that you are giving up a huge opportunity in active investing,’ argues Gray. ‘If you can harness active returns, it can be really powerful for your portfolio. If we suggest that over the long term equities deliver 4% a year ahead of inflation, if you can add 1% or 2% of active returns on top you’ve just increased your return by a quarter or half. Through the power of compounding, if you add that up over decades it can have a huge (positive) impact on your retirement fund.’

Looking at the market from a broader perspective, investors are voting with their feet in terms of their commitment to active management. IA data shows that £9 billion has been withdrawn from active open-ended funds by retail investors over the last five years, while at the same time a net £75 billion has flowed into passive strategies.

Admittedly, the past few years have also seen outflows from equities into cash as investors take advantage of more generous interest rates on savings accounts. Cash rates are now trending downwards in anticipation of the Bank of England cutting rates this year. That suggests more investors might return to equities again, and it is this process which could stimulate some debate about whether to go passive or active with any fund decisions.

It is reasonable to suggest investors who have spent the past few years earning a decent rate on cash without taking any risk might approach a shift back to investing with a bit more consideration to costs and charges.

There will still be active managers who demonstrate the skill for stock picking and I must stress that active still has a role to play in many investors’ portfolios. It just feels like we’re at a turning point in the industry where passive is getting more attention, and rightfully so.

Just look at social media – type the term ‘ETF’ into YouTube and you will find endless videos featuring people discussing how these investment products work and why they might appeal. A lot of these videos have hundreds of thousands of views, implying that the public is eager for information.

ETF providers are capitalising on this growing interest in passives by becoming more competitive on charges and launching new products. The industry is highly competitive, and charges are only going one way – down. That’s great for the investor.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.