In the ever-evolving landscape of investment products, passive products like Exchange-Traded Funds (ETFs) and index funds have gained immense popularity among investors, over the last twenty years. These funds offer exposure to a diverse range of assets, from equities to fixed income, commodities and more, all while aiming to keep costs low for investors. When evaluating the attractiveness of such investments, investors have traditionally relied on the Total Expense Ratio (TER), or its closely-related sibling, the Ongoing Charge Figure (OCF), with the cheapest headline cost often being the main guide to finding a good product. However, with the incessant drive amongst index product issuers to cut fees over the last few years, metrics other than the expense ratio can now represent an equal, or in some cases larger, piece of the fund selection story, such that those relying too heavily on the headline cost may experience poor investment outcomes.

In this article, we will discuss why investors should broaden their perspective beyond TER/OCF, and highlight some other areas investors should consider when choosing their passive funds. We will delve into the relevance of various factors such as replication methods, domicile, spreads, securities lending, tracking error and tracking difference. By including a broader range of criteria in their selection process, investors can build a more holistic understanding of the true costs, risks, and benefits associated with passive products, ultimately enabling better-informed investment decisions in their indexed portfolios.

The Total Expense Ratio, commonly referred to as “TER”, represents the annualised cost of investing in an ETF or index fund. It encompasses various expenses including management fees, administrative costs, and other operational charges, with TER typically expressed as a percentage of the fund's assets under management (AUM). Whilst TER is undoubtedly an essential metric, it has certain limitations that investors need to acknowledge. For starters, it focuses solely on the annual operating costs incurred by the fund, providing a useful snapshot of the recurring expenses associated with an investment. However, ultimately, the total holding cost of owning a passive product encompass more than just the management fees and administrative expenses. Furthermore, with TERs falling to single digit basis point levels in many core portfolio building blocks like developed market equity and investment grade bonds, other costs can now represent multiples of the annual charge of a fund. Let's explore some (but certainly not all) of these additional elements and their significance in the context of ETFs and index funds.

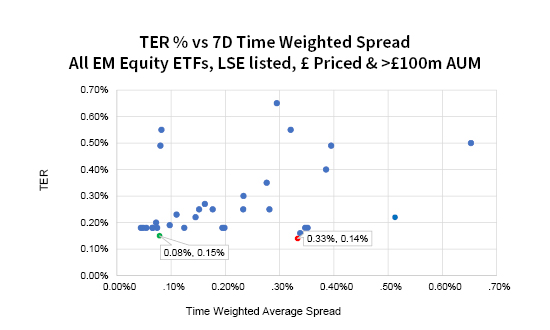

Spreads refers to the difference between the bid and ask prices of an ETF, representing the cost an investor incurs when buying or selling shares of the fund. A narrow spread implies a more liquid ETF, resulting in lower transaction costs. Conversely, a wider spread means higher trading expenses, potentially eroding returns. It is essential to factor in spreads, as they can have a significant impact on your investment, especially if you frequently trade or invest substantial sums. In some cases, two similar products may have similar TERs, but one may trade much tighter in the market, whilst the other would cost multiples of the TER to buy into and sell out of. The example below compares the weekly average spread of all UK LSE-listed global emerging market ETFs that are over £100 million AUM, to their TERs. As you can see, one of the lowest TER products is available at 0.15% and also has one of the lowest spreads at 0.08%. However, another product from a well-known issuer, whilst carrying a TER that is 1bps cheaper at 0.14%, had an average spread that week that was over three times larger. If this large spread differential was persistent, it would completely erase any benefit from the cheaper TER, all else being equal. So, whilst it's important to highlight that this is a very short time frame to assess spreads over and is only used as an example, it shows it is important to be aware that spreads can be multiples of TER in some products, so selecting on low TER alone is unwise.

Source: AJ Bell, Morningstar, LSE Weekly Statistics Report 04/09/23 to 08/09/23

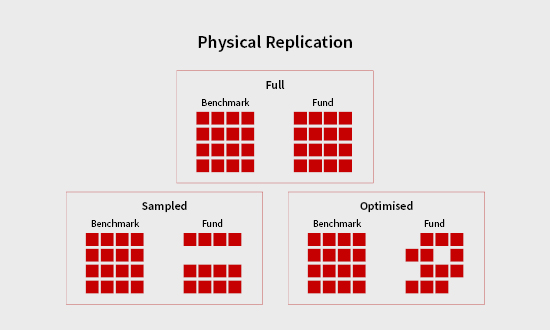

Passive funds aim to track the performance of a benchmark index and the method used for replication can significantly impact overall performance. There are two primary replication methods: physical replication i.e., holding the actual securities in the index (this can be full, sampled or optimised with different approaches suiting different asset classes) or synthetic replication (using derivatives like swaps to achieve index returns). Each method has its advantages and risks. Physically replicated funds often have lower TERs whilst incurring higher transaction costs due to trading and custody expenses. Synthetically replicated funds can have higher TERs, but whilst introducing counterparty risk, can be more efficient for performance, due to factors like withholding tax treatment. Evaluating the replication method used is crucial to aligning your investment choices with your risk tolerance and should be considered when comparing cost of ownership.

Source: AJ Bell – September 2023

Tracking difference measures the difference between the fund’s return and the benchmark return. All else equal, a fund’s tracking difference should be equal to the benchmark return minus TER. However, fund frictions and transaction costs mean that this is usually not the case, and with TERs now being so low on many funds, other factors can now have larger impacts on tracking difference. Tracking error measures how closely an ETF or index fund replicates its benchmark index, in terms of volatility. A lower tracking error indicates a more precise tracking of the index, while a higher tracking error suggests a larger deviation, and consistently high tracking error may signal poor index replication, potentially affecting long-term returns. It’s important to use both tracking error and tracking difference in assessing your selections, since a fund may have low tracking error, but still deliver sub-par tracking difference versus peers. Alternatively, a fund may have a low tracking difference, but track its benchmark poorly, with a large tracking error. Tracking difference is often the more important metric for long-term investors, whilst tracking error can often be the more important factor for shorter time frame investors.

![]()

Source: FT, Vanguard (HK) – April 2021

Some ETFs and index funds engage in securities lending to generate additional income for their investors. By lending out the securities held in the fund's portfolio, these funds can earn fees that offset a portion of the TER or, in some cases, even recover the full amount, improving tracking difference. However, investors must be aware of the associated risks, such as counterparty risk and collateral management, on these lending programmes, and consider the impact of securities lending when assessing the costs of ownership of a fund. A higher TER fund may be made cheaper and achieve a better tracking difference due to a securities lending programme; however, it will also have become riskier than an equivalent fund without securities lending.

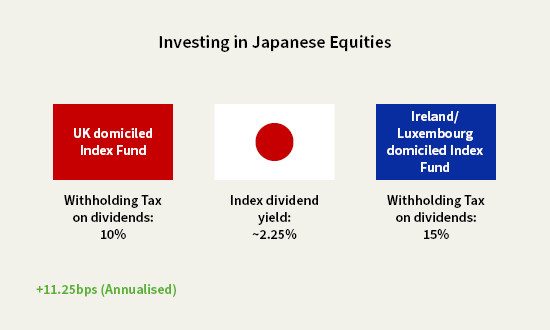

A fund’s domicile, i.e. the country where it's officially registered, will impact the financial rules that the fund has to follow and can significantly impact the operations of the fund. This can have a larger-than-expected impact on returns, often due to how the fund is taxed and the presence of tax treaties between nations. For a passive fund investor, focusing only on TER and not considering domicile can often mean missing out on improved returns from preferring one domicile over another, which in some cases can mean performance impacts larger than the TER saving. A stylised example for a Japanese equity index fund is given below, where a UK-domiciled fund would achieve a 11.25bps annualised performance improvement, simply due to a more favourable withholding tax treaty, versus an index fund domiciled in Ireland or Luxembourg, all else being equal.

Source: AJ Bell – September 2023

As shown above using just a few highlighted areas, passive investing, often regarded as a very straightforward, low-cost and simple way approach to building a diversified portfolio, has evolved into a more complex ecosystem of fund types with varying strategies, operational structures and costs. Whilst the Total Expense Ratio (TER) remains a valuable metric for quickly assessing the annual costs associated with passive ETFs and index funds, it is essential to recognise that TER represents only one face of a multi-faceted problem in passive fund selection. By incorporating the above, and other additional elements, such as anti-dilution practices, benchmark selection and timing, unit pricing, AUM etc. into their fund selection process, passive investors can make better-informed choices, help optimise their passive investment portfolios and achieve their financial objectives.

At AJ Bell Investments we do the hard work of keeping on top of fund research and selection, so you don’t have to. Our Fund Research Team has a wealth of experience, and takes a holistic approach in initial selection and ongoing oversight of the passive and active fund marketplace, always with the aim of ensuring that our portfolios are implemented with the most cost-effective and efficient funds available. We are whole of market investors, running unfettered portfolios, which ensures that we are not limited in the choice available for our investors, and our flat 0.15% annual management fee, on all our AJ Bell product ranges, includes our ongoing fund research, oversight and management.

If you would like to hear more about how AJ Bell Investments can help you or your business navigate fund research and investment markets in 2023 and beyond, please get in touch with our Business Development Team.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.