I expect most people think market indices are relatively boring: just a measurement tool to tell us how markets have moved, or to give us something to measure our performance against. However, for those focused on passive investment and research, like myself, the evolution of indexing, and any changes to the sometimes arcane rulesets and classifications governing them, are actually topics of some interest!

Those who find indices more mundane should perhaps consider the enormous amount of assets now wielded by index-based investing. It could be argued that the somewhat faceless companies that publish the indices are actually among the largest active managers in the marketplace, due to the scale of assets their decisions now impact, and the forced rebalancing they inevitably precipitate.

With this in mind, I thought it would be worthwhile to highlight the latest changes to the GICS® (Global Industry Classification Standards), a business classification system created jointly by index providers MSCI and S&P Dow Jones Indices.

The GICS® sectors were launched in 1999 to determine the most appropriate industry categories for companies listed on global stock markets, based on where they derive their revenues from. There is also a qualitative overlay from a team of analysts, who determine if the classification suggested by the revenue analysis is indeed correct.

GICS® has evolved regularly over the years. It comprises 11 sectors, 24 industry groups, 69 industries and 158 sub-industries to this point, with several big edits having been made along the way. In 2016 and 2018, for example, new sectors were created which hugely impacted market segmentation for market participants.

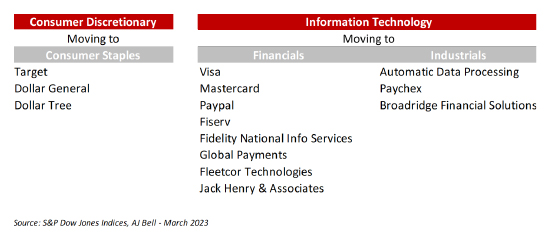

On Friday 17 March 2023, several more notable changes were made to the GICS® structure. Whilst perhaps not as material as those seen previously, these changes will still affect market participants – particularly those who use sector and factor strategies as part of their portfolio construction. The big changes this time revolve around two main areas: retailers and whether they’re classed as ‘Consumer Discretionary’ or ‘Consumer Staples’; and data and payment processors, and whether they’re defined as ‘Information Technology’ or ‘Financials’ stocks.

Retailers will now be classified based on the nature of goods sold, rather than according to the underlying technology used to deliver the product or service. This update reflects the fact that retailers have increasingly taken an omni-channel approach to sell their products, blurring the lines between existing segments.

The change here is around the ‘Data Processing & Outsourced Services’ sub-industry, which is being discontinued to reflect the close alignment with business support activities in other sectors. Companies in this sub-industry will migrate to ‘Industrials’ if they fall under Human Resources & Employment Services; ‘Financials’ if they fall under Transaction and Payment Processing; or ‘Consumer Discretionary’ if they process travel-related data.

There are some smaller additional changes within ‘REITs’, ‘Transportation’ and ‘Banks, Thrifts and Mortgage Finance’. These changes are likely to have more impact in broader indices that include smaller market cap stocks, rather than the S&P 500 and its related sector-based indices.

Some of the names that have been re-classified are among the largest stocks in the S&P 500 and will, therefore, directly impact the characteristics and size of some of the sectors that they leave and enter. Based on the full list of impacted companies’ new classifications, the changes will impact the composition of five S&P 500 GICS® sectors, with around 3% of the S&P 500 Index market cap being re-classified at the sector level, across 14 stocks.

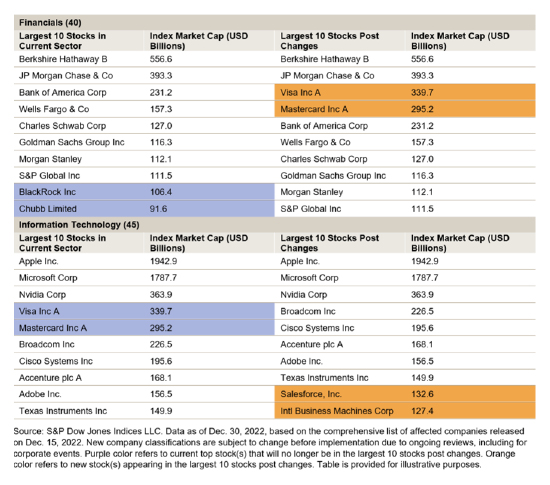

The graphic below shows the impact on the top 10 holdings in the two main sectors affected, namely IT and Financials:

Information Technology will see its fourth- and fifth-largest names switched out, to be placed into Financials, where they will become the third- and fourth-largest names in their new sector. As a result, Information Technology will become a smaller component of the S&P 500, falling to around 22% from 25%. It will also become a more concentrated sector in itself, with its top ten names representing a higher weighting of the overall sector.

From a factor basis, the sector’s drivers shouldn’t change materially, with growth still being the dominant factor in the sector. However, one place we will see change in underlying factor exposures is in Financials – a sector that’s a hot topic currently anyway, thanks to the banking crises in the US and Europe. The new names, Visa and Mastercard, will help nudge the sector a little away from it’s traditional ‘value’ factor exposure and towards the ‘growth’ factor. Financials will also now represent around 15% of the S&P 500 (from 11%).

Elsewhere, the ‘Consumer Staples’ and ‘Consumer Discretionary’ sectors will both see increases in their total representative market cap because of the changes, but without any material change in their overall profile within the wider S&P 500 index.

These changes may not, on the surface, be as impactful as other big reclassifications in years past. However, investors should nonetheless be aware of them and the potential for changes to the characteristics of some of the products they may own. This is because S&P 500 tracker funds, sector or factor ETFs/index funds and any active managers utilising sector rotation strategies or defined sector exposure tilts relative to benchmarks, will be forced to rebalance their portfolios to account for the new weights and classifications.

With the names impacted being telegraphed well ahead of time by MSCI and S&P, many funds should have been able to transition their portfolios, without too much one-day event risk or liquidity frictions.

S&P Dow Jones Indices and official GICS® classification datasets were updated on Friday. However, it’s important to note that MSCI-based benchmarks won’t formally recognise the updates until the May 2023 index review points.

At AJ Bell Investments, we continually monitor markets, and market indices, to ensure that we’re aware of upcoming changes and are comfortable with the impact they will have on our portfolios. These latest classification changes are no different.

Whilst not driven by the upcoming GICS® changes, the most recent update of our asset allocation in January saw us remove exposure to standalone sectors such as energy and financials. Instead, we moved towards broader-based, regional stock exposures, as the risk/reward dynamic of the sectors became less clear-cut.

That said, we do continue to monitor the attractiveness of equity sectors and review their potential to improve returns or diversify risk in the portfolios, as part of our tactical asset allocation toolkit. We will be sure to update our investors if our views on sectors change throughout 2023 and beyond.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.