Out of all the investment topics occupying investor’s minds at the start of 2022, there’s probably no topic garnering more attention right now than inflation. At the moment it feels that everywhere you look, prices are rising. Whether it be used cars, housing, utility bills or food, nowhere is safe from the pernicious effects of inflation. And whilst these price increases are hurting consumers right now, you can be sure that the longer that they persist, the more the markets will start to see them not as transitory, but as structural, which will lead to investment portfolios bearing the weight of revised inflationary outlooks and reduced real returns. The question facing investors therefore is how their current portfolio will perform in an inflationary environment and, if it’s not currently equipped to weather it, what changes or adjustments can be made to try to insulate the portfolio from the worst of the damage.

Whilst there are many articles espousing a variety of strategies and asset classes that offer the potential to benefit from an inflationary environment, many of them focus on the specific ownership of alternative investments such as gold and other precious metals, commodities, property and even cryptocurrency. For many, these assets are a little off the beaten track and perhaps unfamiliar, making the inclusion of them into investor portfolios a more challenging choice. As such, many will be looking at their familiar equity positions to do some of the heavy lifting, as they try to beat inflation’s effects.

This is an understandable rationale, because over the long term, when inflation occurs in a growing economic environment, companies recognise the inflationary impulses and act to mitigate them. One way they do this is by raising prices for their products when their input costs increase, or, in the case of banks, charging higher interest in anticipation of central banks reacting to the inflation and increasing base rates. Higher prices, therefore, can translate into higher earnings for some companies. This isn’t always the case however, as over shorter time periods, whilst companies are only just starting to adjust to the new price levels, stocks have often shown a negative correlation to inflation. Furthermore, they can be especially hurt by sudden unexpected inflation or the worst-case scenario, inflation in a weakening economic environment (stagflation). When inflation rises suddenly, or there is a stagflationary environment, it can heighten uncertainty about the economy amidst a time of rising input prices, leading to lower earnings forecasts for companies, and lower equity prices.

There are many competing theories as to the cause of the recent inflation, with some attributing it to overly easy central bank policy over the last few years, whilst others point to geopolitical tensions over energy etc. However, the recent experience of global lockdowns due to the pandemic, which brought economies to a halt and froze production in most industries, can’t be ruled out as a leading cause. As lockdowns end and the economy re-opens, consumers are once again spending. However, the supply chain backlog due to production shutdowns over the last two years has caused shortages of supply, and as such, we see increasing prices to clear a demand imbalance. In this environment, one where consumers are generating the inflation, in a period of what is likely to be stronger economic growth in the short term, with higher demand for raw materials and inputs, some equities have the potential to protect from the worst of the inflation. The best companies to own in this environment would be value stocks with pricing power, since they have the best potential to immediately benefit and re-rate on the back of improving earnings, whereas growth stocks, with earnings further into the future, suffer from the higher discount rate (assuming interest rates rise) for those cashflows. There are also specific industries that are generally accepted as being likely to benefit directly from inflationary environments (or from the policies used to temper them) such as energy, materials and natural resource/mining stocks, banks/financial companies and financial exchanges.

Whilst active investors will naturally react and pivot towards these types of stocks themselves, or they’ll move to owning managers and funds that invest in them, for more passive investors who own broad, diversified stock indexes, the decisions to take are more nuanced. Can a passive stock market investor, making use of broad index positions, count on the index to protect them in an inflationary environment and, even if it can, is there an argument for one index over another?

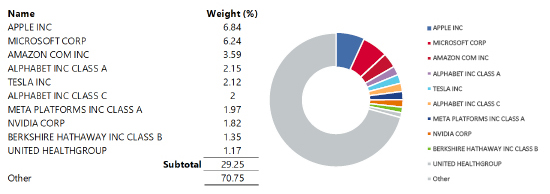

If we look at the makeup of the S&P 500 today, the most widely followed index of stocks in the world, we can see that its performance is now dominated by a handful of companies, seven of which are all in the same sector – technology – which is seen as a “growth” industry:

Source: iShares Core S&P 500 ETF Top 10 holdings & weightings (at 31/12/2021) – AJ Bell, iShares - January 2022

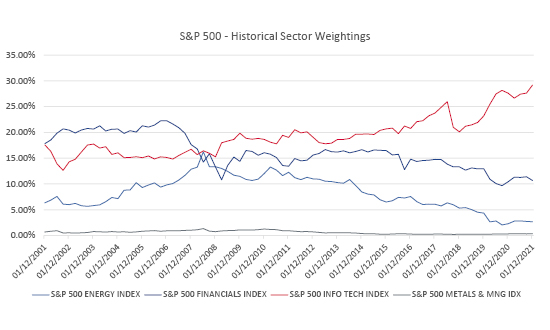

This was not the case ten years ago, where the top ten stocks represented only about 18% of the index (versus 29% as at 31 December 2021) and only included three technology stocks, alongside two oil companies, an industrial company, a consumer product company, a pharmaceutical company, a telecommunications company, and a bank. This indicates that the index then wasn’t as exposed to the fortunes of a very small number of growth stocks in one sector but more broadly to several sectors. Similarly, the sector weighting for some direct inflation beneficiaries has been higher in the past than it is now and also, the general level of industrial commodities has been marginal for a long time:

Source: S&P 500 Index Historical Sector Weightings - Bloomberg LP, AJ Bell – January 2022

What this demonstrates is that the S&P 500 index as currently constituted may not be best-placed to absorb the impact of inflation, should it persist and we see increases in interest rates, with the dominant companies responsible for much of the index performance being predominantly quality/growth stocks in one sector: technology.

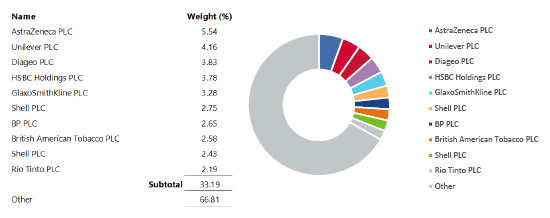

If we contrast this with something like the FTSE 350, which in sterling terms has underperformed the S&P 500 significantly over the last 10 years:

Source: FTSE 350 Index & S&P 500 Index Returns - Bloomberg LP – January 2022

We can see that whilst it is similarly concentrated in the top 10 (accepting that there is a lower total number of constituents) there is more sectoral diversity in the top ten stocks, and there are more businesses that could be said to be explicit beneficiaries of inflationary impulses:

Source: FTSE 350 Index – Top 10 Constituents & weightings (at 31/12/2021) - AJ Bell, Bloomberg LP - January 2022

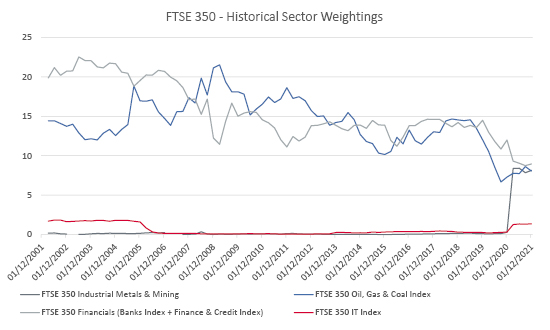

In addition to the top ten makeup, the sector makeup overall is more heavily skewed towards businesses that would be expected to be inflation beneficiaries, as well as perhaps generally giving more of a value bias to the index, due to the underperformance relatively versus the likes of the S&P 500 and, also by sector, due to the relative weakness of many of its dominant industries over several years:

Source: FTSE 350 Index Historical Sector Weightings - Bloomberg LP, AJ Bell – January 2022

In summary, if we are indeed entering a sticky inflationary environment and investors want to hold stocks as a bulwark against its effects, it’s important to consider what the index concentration and sector breakdown looks like for the chosen benchmark index. If the index is perhaps not sufficiently exposed to likely inflation beneficiaries, or is overly concentrated into a handful of names and a single dominant sector, it may be prudent to add additional sector or factor bets (e.g. value stocks over growth stocks), to help portfolio resilience. Alternatively, an investor could re-weight regionally to markets that are structurally more favourable toward inflation beneficiaries, due to larger sector weightings in those types of industries.

At AJ Bell Investments we do the hard work of keeping on top of asset allocation and implementation so you don’t have to, and that being the case, we have recently recast the strategic asset allocation for 2022 for our growth portfolios, with inflation protection being one element we factored in. This has seen us bolstering our general equity positioning further, combining additional sector bets in financials with the energy sector position we added last year. However, whilst inflation is certainly topical at the moment, there is potentially a large range of outcomes for markets in 2022 and, as such, we try not to overly concentrate in any one theme or outlook, aiming to craft portfolios that do what our investors expect, regardless of the market environment. We charge a flat 0.15% annual management fee on all our product ranges, which all benefit from our ongoing research, oversight and management.

If you would like to hear more about how we can help you or your business navigate investment markets in 2022 and beyond, please get in touch with our Business Development Team.

The value of investments can go down as well as up and your client may not get back their original investment.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.