The fantasy world of Westeros is back on our screens as of last week, with a new show, House of the Dragon. The biggest HBO debut in history, pulling in massive audiences in the US, Europe and UK, it eclipsed the record previously set by its parent series, Game of Thrones. Set around 200 years before the events in the original series, it follows the fortunes and politics of the ruling dynasty of the period, House Targaryen, amid an inter-family war amongst the various factions for control of the realm. Having watched the show, the first episode of which was a little dull I have to say, the context of the plot did get me thinking about the brewing crises engulfing Europe since the end of Q1 and continuing into the summer: irresistible fire breathing dragons (inflation, which has the potential to lay waste to the ECB’s best laid plans), ambitious and ruthless upstarts on one hand (peripheral country leaders going against the European Council and taking advantage of situation to wrest more power), and tired and weakened rulers on the other (Germany, which has grossly miscalculated on their energy strategy due to the war on Ukraine, and them being dragged kicking and screaming into the sanctions regime applied on Putin’s Russia). Then, underneath it all, there’s a plebeian that are none the wiser about the great game being played (badly I must add) by their ruling elites. In this environment, the fragile unity and political accords that hold the Eurozone and, by extension, the European Union, together are stretching at the seams, adding a further dimension of risk to an already volatile and challenging market environment. How then should investors then approach the region, in the context of portfolio construction and is Europe still investible in its current situation?

Germany announced record inflation levels yesterday, with a figure of 8.8% year on year to August. This was driven by energy and food price increases, which rose by 35.6% and 16.6% respectively. Core inflation, excluding food and energy, rose to 3.1%, up from 2.8% in July. Recently, Bundesbank head, Joachim Nagel, said inflation in Germany could reach double digits for the first time since 1951, so Germany is clearly feeling the breath of the dragon in its domestic economy – a frightening prospect for a country that still bears the memory of the hyperinflation of the Weimar Republic in the 1920s and, as a result, has always cherished a harder currency and financial discipline.

The fallout from such a figure is likely to cause consternation amongst the ECB, who may feel, to paraphrase the famous Stark family motto from Game of Thrones, that winter is indeed coming. Even allowing for the more Gallic insouciance that has been its hallmark with Christine Lagarde at the helm, rampant inflation and the spectre of stagflation in Europe’s largest economy has to sharpen minds. However, it could be said that the ECB generally have less room to manoeuvre when compared with their peer central banks, since they are battling not only inflation fears, but also fragmentation risk in a union of 19 Eurozone countries, with yields on the government bonds of Northern Eurozone members again diverging from yields on bonds issued from their supposed riskier, Southern neighbours.

MSCI released a paper at the end of June, which discussed the prospects for the Eurozone, and specified four distinct scenarios that they see ahead:

Source: MSCI

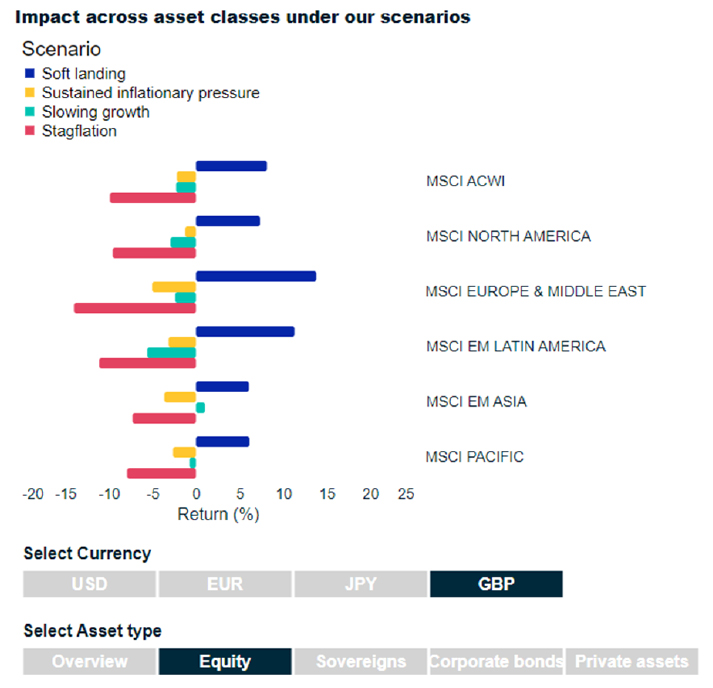

These scenarios lead to a broad range of outcomes, which in MSCI’s opinion show European equity markets have the most to gain, relative to other regions, should the ECB get it right and manage to coordinate a softer landing, but also the most to lose, should stagflation take hold in the Eurozone area:

Source: MSCI

As such, European equity positioning has the potential to be a key component for investor portfolios in H2 2022 and, with this background, investors should ensure that they are appropriately positioned to weather a range of possible outcomes in Euro area financial markets.

We feel the ECB do have a difficult task ahead of them, with inflation spiking in the core member states more than the periphery, as we head into a winter that may be colder than usual, with record gas prices as a result of the Russian stranglehold over supplies. As a result, many commentators are expecting the ECB to step up the aggressiveness of their rate hike cycle, in order to get ahead of the market. Whilst this would ordinarily be a very negative development for the periphery, who would be expected to see their yields rise faster and further than their Northern neighbours, the launch of the ECB’s new Transmission Protection Instrument (TPI) has improved their flexibility, as it allows them to react in a more finely tuned manner, maintaining spreads between core and periphery, as they increase base rates to combat inflation. This has the potential to change the calculation a little towards Europe’s prospects, since it provides a way for the ECB to regain some control of inflation via rate rises, without losing control of yields.

Our European positioning was recently reviewed as part of our regular asset allocation process and, although we recognise the challenges faced by European financial markets and the ECB, in the current environment we feel that the potential increase in risks for European equities are adequately compensated by the higher returns on offer, so we decided to retain our current positioning in the portfolios. The range of outcomes are, however, very broad, and as a result we remain vigilant to developments in the European markets and the very fluid dynamic that is in place there, and stand ready to act should we feel action is needed to insulate the portfolios from market turbulence.

If you would like to hear more about how AJ Bell Investments can help you or your business navigate investment markets in 2022 and beyond, please get in touch with your Business Development Team contact.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.