Last quarter we mentioned markets may be looking to turn a corner after being on ‘recession watch’ for much of the last two years. Data now confirms, subject to revision of course, that the UK experienced a technical recession in the second half of 2023. Notably the US and many other economies appear to have avoided such a fate and the mention of a recession now appears less frequently from forecasters and the media; the focus has shifted instead to a possible ‘reacceleration’. Global economic data during the first quarter aided this narrative, which provided fuel for a further rally in risk assets and gave pause for thought regarding how quickly major Central Banks would cut interest rates this year.

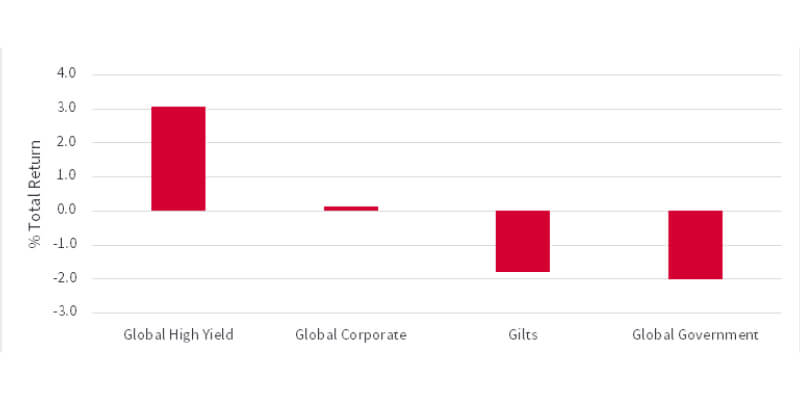

The market went into 2024 expecting up to six interest rate cuts from the US Federal Reserve this year, however by the end of the quarter the consensus had shifted be more aligned with policy makers’ expectations of just three cuts. This, and two higher-than-expected US inflation prints, conspired to shift yields higher across the US curve. Most global government bond yields followed, however shorter-dated yields in the UK were kept in check by inflation readings that came in a touch below expectations. In corporate bonds, credit spreads tightened to provide insulation from the move higher in rates.

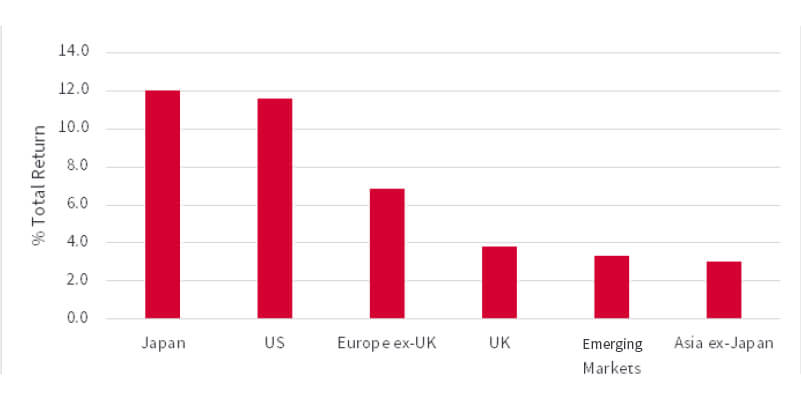

Source: AJ Bell, 01/01/24 to 31/03/24. Total returns represent those in GBP terms.

Developed equity markets had a strong start to the year. Japanese equities maintained momentum as the sense of change to inflation dynamics in the country, coupled with long-running corporate reform, continued to attract international investor attention. In the US, some of the ‘Magnificent Seven’ fell by the wayside and a broader rally ensued, encompassing sectors such as energy and financials, albeit with Nvidia continuing to lead the way and dominating the headlines. UK equities participated in the rally, however lagged behind the peer group. Larger companies generally fared better than mid- and small-cap components, particularly in the UK.

Emerging market equities had another quarter of varied returns, with India and Taiwan performing well, whilst markets in Brazil and South Africa struggled. Chinese equities fell sharply in the first couple of weeks of the year, then staged a strong rebound into the quarter end on the back of improving economic data and interventionist rhetoric from policymakers. Indian equities did well but were outshone by their developed market peers.

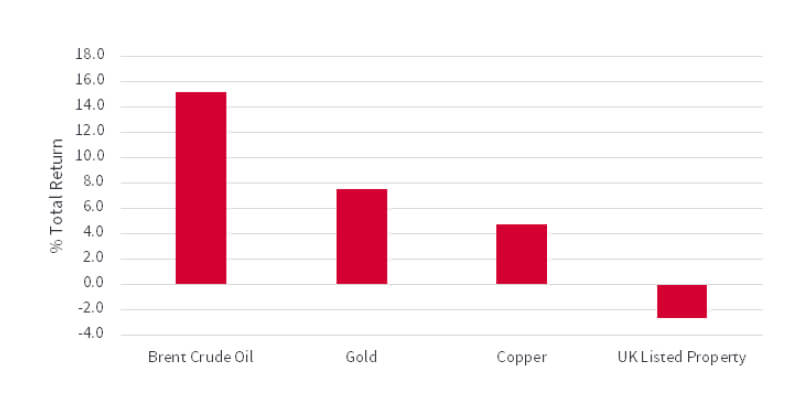

Source: AJ Bell, 01/01/24 to 31/03/24. Total returns represent those in GBP terms.

Within alternatives, listed UK Property came under pressure from rising bond yields. In commodity markets, the oil price responded positively to better-than-expected global activity data, even although supply remains marred by security incidents in the Middle East and the ongoing conflict between Russia and Ukraine. The gold price reached a record high as some countries increasingly view it as a alternative ‘safe haven’ to parking cash in the US dollar banking system.

Source: AJ Bell, 01/01/24 to 31/03/24. Total returns, where applicable, represent those in GBP terms.

A spritely start to the year for equities puts investors at ease at a time when there is plenty on the agenda. In the US, aside from the smaller regional banks coming under strain from higher rates and declining real estate values, the broader economy has weathered higher interest rates impressively. The outlook appears predicated on that remaining the case whilst simultaneously providing the Fed the opportunity to lower interest rates. As summer approaches, elections and their policy machinations should come into sharper focus, bringing with them the usual background noise.

The Investment Asset brings together regular insights and literature updates from the Investments Team. As an asset in staying up to date with the latest news and analysis, the Investments Asset covers changing macro-economic trends, market updates and events from around the globe.

The value of investments can go down as well as up and your client may not get back their original investment.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.