Interest rates remain one of the major driving forces behind markets at present. With a possible peak in rates in the rear-view mirror, expectations for the first cut and who will be the first mover amongst the Fed, the Bank of England and the ECB are being hotly debated.

Back in the fourth quarter of 2023 markets expected the Fed to cut as soon as March and to put through a series of six cuts sometime this year. Those expectations are being readily walked back following generally good economic news coming out the of the US and some inflation volatility. Though the Fed’s dual mandate (price stability and full employment) may at a point in time make for tricker management of monetary policy, for now they may be sitting in something of a sweet spot. Over in the UK and Europe, the Bank of England and ECB may soon wish they had that dual mandate. Their economies appear pretty weak, but they are tasked with focusing on inflation that is running well above target.

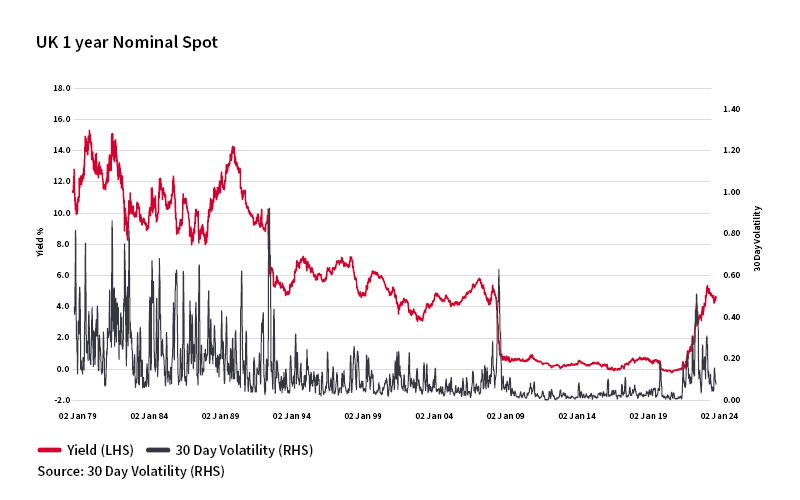

Each monthly inflation reading carries great weight for market expectations of interest rates and results in a lot of market noise. Bond markets remain volatile as a result however, historically speaking, this may be more like a return to normal rather than a new paradigm. As can be seen in the chart below of the spot 1 year UK gilt yield, its rolling 30-day volatility now appears similar to before the Global Financial Crisis.

UK 1 Year Nominal Spot

Source: Bank of England, 02/01/1979 – 14/02/2024

Longer-term inflation expectations have fallen since the start of 2022 and present challenges for those looking to buy index-linked gilts directly. We explore more of the questions around gilts in our latest white paper, Issues remain with index-linked gilts, including analysis of passive and active funds and ETFs, buying direct, inflation expectations and problems at short maturity.

Whilst interest rates remain where they are, money market funds will continue to yield the best rates we have seen in over a decade and crucially one that is now a real rate of interest. The money market sector has experienced significant inflow in the last year and prompted interest from clients and advisers. In response we have launched the AJ Bell Money Market MPS with an objective to achieve cash-like returns, without having to lock money in fixed-term accounts or invest in more volatile asset classes.

At this juncture we do not see merit in making predictions regarding interest rates – frankly anyone can have a guess and subsequently make an impact to short-term performance (positively and negatively). This is one of the reasons why we moved the duration of our portfolios to a more neutral stance in January; we prefer not to interfere unless a clear or identifiable risk presents itself.

The AJ Bell Funds and Managed Portfolio Service MPS range are managed to target specific ex-ante volatility levels. At the lowest end of the risk spectrum, and with the highest allocation to cash and fixed income, we have the AJ Bell Cautious Fund or equivalent MPS 1*. It currently holds 20% in cash / cash equivalents (money market funds) to benefit from the current rate environment whilst also investing further out on the yield curve to reduce the reinvestment risks of very short-dated instruments (which will produce negligible capital return in compensation for any falls yields / rates). A further 16% of the AJ Bell Cautious Fund and MPS 1 is invested in gilts, which currently yield over 4% and negate some of the reinvestment risks of cash. All told, cash / cash equivalent and fixed-income exposure within these portfolios sit at 73%, which is spread across the yield curve, credit spectrum and geographically.

*MPS 1 is available in passive, active, ‘pactive’ and responsible forms.

The AJ Bell Investments’ approach to not overly concentrate on any one theme or outlook is part of our rigorous and ongoing research, performance, and management styles. We craft our range of portfolios for the long haul to deliver outcome-orientated performance and returns to suit a variety of different needs as our investors expect, regardless of the current environment.

If you would like to learn more about how AJ Bell Investments can help you or your business navigate investment markets in 2024 and beyond, get in touch with our Business Development Team.

The value of investments can go down as well as up and your client may not get back their original investment.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.