Full-year results from food retailer Greggs on 5 March 2024 painted a picture of a company doing so well in its domestic territory that one has to ask when it might export the successful business model abroad. Investors typically welcome moves by UK companies to expand overseas as it creates new opportunities to grow earnings.

Greggs’ profits and market share are getting bigger, it is investing in manufacturing and distribution expansion, and shareholders are getting a special dividend. While the company is confident it can add at least another 500 stores in the UK, it will not take long to roll out these extra sites if you consider it is targeting 140 to 160 net openings in 2024 alone. So, what next?

The company’s operations are like a well-oiled machine, so it makes perfect sense to spread its wings further afield. There is talk that Greggs has a small team looking at overseas locations which might suit its proposition, but details have been thin.

While this sounds exciting, UK companies have a mixed history of succeeding overseas, including Greggs which has previously tried and failed to crack the Belgian market. It was a much smaller business at the time and renewed foreign expansion now would come with greater knowledge and a honed skillset.

Greggs previously spent five years seeing if its proposition would be successful enough in Belgium to be a springboard into other European locations such as a France and Germany. The acquisition of a small chain of five cafes in Brussels during 2007 took its store count to 11 sites, but a year later it decided to abandon the strategy and stick to the UK.

The company originally announced in 2003 that it was ‘taking buns to Belgium’ which is a bit like a foreign retailer setting up shop in Newcastle to sell sausage rolls. Locals will always prefer their homegrown offering and even the simple task of creating a sweet bun was going to be an uphill struggle for Greggs in a foreign land.

Will it be different this time? It depends on the location, competition and whether the local culture is a match for Greggs. The idea of quick service, affordable prices and convenience should have global appeal but success is not a given.

Here are four reasons why UK retailers have struggled with foreign expansion, together with examples of companies that have cracked it.

1. Failing to understand what the customer wants

UK retail companies dream of making it big overseas, particularly if they think their business model can work in a foreign country. One thing they often underestimate is whether the market needs another entrant as competition might already be plentiful.

Tesco found that out the hard way when it planted flags in the US via the Fresh & Easy brand in 2007. It was hard going to compete with the likes of Walmart and Trader Joe’s, and Tesco also misunderstood how US consumers liked to shop. At the time, they preferred to buy in bulk rather than the small pack size offered by the UK entrant. Self-service tills were a mistake by Tesco as US shoppers did not like them. It exited the business in 2013.

2. The economics do not stack up

In the UK, retailers often take a cautious approach to expansion and only sign leases on new buildings if they can get a good deal. This careful strategy sometimes goes out of the window if the management team is overly excited about overseas expansion. There is a danger they pay too much for a shop, for example, and cannot generate the returns needed to make it profitable.

For example, critics attribute HMV’s failure in the US to poor real estate decisions which meant stores were uneconomical to run.

3. Failure to differentiate

There is no point setting up in a different country if your product is identical to something already on the market. It is much better to spot a gap in the market than go head-to-head with an established player.

Pret a Manger is a good example of a British company that has embraced such an opportunity. While coffee shops are on every street corner in the US, there is a gap in the market for something that combines hot drinks with superior quality packaged sandwiches.

Traditionally, a US consumer would go to a deli and buy a decent sandwich which is made to order. Less common is the ‘food on the go’-type product from Pret, one that is already made and where the customer can be in and out of the shop in a matter of minutes. The bulk of Pret’s US stores are located in New York, but it has struck a deal with franchise partner Dallas International to go further afield in the country.

4. Being inefficient with logistics and warehousing

Retailers ASOS and Dr Martens have both experienced problems with their US warehouse and distribution operations in recent years, causing a knock-on effect that hurt their efforts to be bigger companies in the country.

ASOS underestimated demand as it expanded into the US, and its warehouse saw orders pile up and cause delays to shipping. That meant it had to freeze advertising and marketing campaigns while it sorted out the problem.

Dr Martens made ‘people and process’ errors by shipping too much stock too quickly in the US, causing bottlenecks at a distribution centre and in turn experiencing problems getting products to wholesale customers. It then saw wholesalers become reluctant to hold large volumes of its footwear amid signs of US consumer weakness.

JD Sports.

Founded in the early 1980s, JD has gone from a single shop in Bury to now running more than 3,000 stores across the UK, Europe, Asia Pacific and the US.

It has capitalised on demand for trainers and athleisure, while augmenting growth through various acquisitions including US retailer Finish Line in 2018 which gave it a position in North America.

JD is one of the few retailers to still have a vibrant bricks and mortar operation in addition to a successful online channel. Key to its success has been product and marketing relationships with big brands, meaning it has been able to get the right stock at the right time.

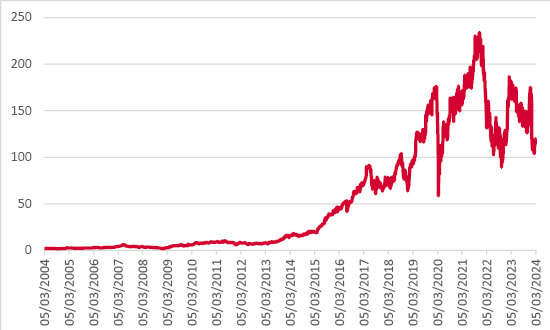

JD Sports Share Price

Source: FE Analytics, 6 March 2024

WH Smith.

It is a case of second-time lucky for WH Smith with overseas interests. Twenty-odd years ago, the company sold its 155 stores in 23 North American airports and retreated from Asia. Things were not going very well and the company had to rethink its approach.

Today, it has a presence in over 30 countries including stores in large airports as well as in hospitals and train stations in places such as Europe, Australia, UAE and India.

Its purchase of Marshall Retail Group in 2019 gave it another chance to go big in the US and now the travel-related operations are the key growth engine for the group. The travel stores benefit from having a captive audience – people have limited choice and little time to shop around, so they buy what is available and these items tend to have a higher-than-normal price.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.