Virgin Orbit’s filing to the SEC on the day it announced it was entering Chapter 11 bankruptcy protection whilst it looked for a buyer laid bare the mountain the company had been trying to scale. The company expected revenues for 2022 to be in the region of $30 million, but overall Virgin Orbit expected to post a loss more than six times that figure.

Space is an expensive business; in the past the huge costs meant it was the provision of just governmental organisations, but the potential of huge profits has drawn in some of the world’s richest private investors.

But those private investors need to have very deep pockets and a seemingly endless supply of patience.

On paper Virgin Orbit’s business model makes sense. Space data analysts Euroconsult expect that by 2030 there will be around 1,700 satellites needing a piggyback to orbit every year, as more and more of our lives rely on technology. Virgin’s USP was flexibility, but by the time of it’s IPO in December 2021 risk appetite was already beginning to wane and the window of opportunity beginning to close.

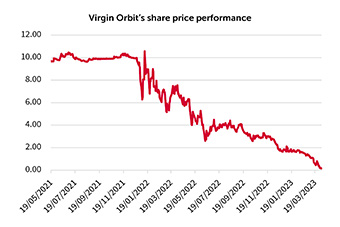

Virgin Orbit’s share price performance

Source: Refinitiv

January’s failed UK launch undoubtedly hammered another nail into Virgin Orbit’s prospects but, in reality, the company was already coming under increasing pressure from Elon Musk’s SpaceX. After smashing the record for the number of satellites launched on one rocket in 2021, the company hit new highs in 2022 with a record number of orbital launches.

There is a lot of risk involved in space stocks, so most should be treated as an investment moon-shot – small, speculative additions to a diverse portfolio

With scale comes an ability to cut costs, and the company’s ride-share option now starts at as little as $275,000. SpaceX is a dominant force and Musk has shown little inclination for taking it public, saying its long-term goals aren’t in line with the short-term demands of the public stock market.

Whether it’s profitable or not is impossible to pinpoint, but Tesla has proved that Musk is magnet for retail investors and institutional investors alike. SpaceX is undoubtedly the best-known name in the space game, but in the absence of a pending IPO there is no direct way for retail investors to buy in at the moment.

There is a lot of risk involved in space stocks so most should be treated as an investment moon-shot – small, speculative additions to a diverse portfolio – but being part of that one small step will be alluring to some, especially with NASA working on plans to take man back to the moon.

The previously mentioned Euroconsult’s 9th edition of its annual space market overview estimated the global space economy was worth a whopping $424 billion in 2022 – growth of 8% – which is significant by any standards.

For those put off by the big money being lost by players like Virgin Orbit, an investment trust like Seraphim Space provides the option to invest in a whole galaxy of smaller companies, though the path to profitability is equally challenging here.

The portfolio reads a bit like a Star Trek script with fantastic names like ICEYE, Constellr and D-Orbit. All promise a riff on the same theme – ground-breaking, next generation technology for tomorrow’s world.

This is tomorrow’s world, but we know how quickly tomorrow’s technology becomes ingrained in today’s society.

For more cautious investors, some existing defence stocks like BAE Systems could provide exposure to the space race in a more traditional way. The company announced it will launch its first multi-sensor satellite cluster into low earth orbit in 2024, which will provide military customers with “information and intelligence”.

BAE Systems snapped up In-Space Missions in 2021 and is working on integrating that into its extensive operations, and by doing so it could become a key building block of those UK space ambitions that were so rudely crushed by Virgin Orbit’s failed Cornwall launch in January.

By chance one of the biggest companies in Seraphim’s portfolio, ICEYE is working with BAE on their Azalea project.

This is tomorrow’s world, but we know how quickly tomorrow’s technology becomes ingrained in today’s society. As evidenced by SpaceX’s ride share price list, the costs are coming down and as costs come down, more goes up.

Some analysts have pointed out that the space sector is looking an awful lot like the commercial air travel sector after World War II – poised for massive growth.

There must be additional regulation, and there will be plenty of companies that burn up before re-entry, but our data needs mean there will also be incredible successes and that’s something worth considering.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.