On both sides of the Atlantic investors have found themselves asking the same two questions: exactly how resilient is the consumer and how will spending patterns impact central bankers rate hike decision-making over the coming months?

The answers to both are complicated, which makes it incredibly hard for anyone to map out a path through these turbulent times.

Even as interest rates have shot up, pushing up borrowing costs on top of other cost-of-living pressures, both the US and UK economies have eked out surprising levels of growth with consumer spend playing a big part in fending off recession.

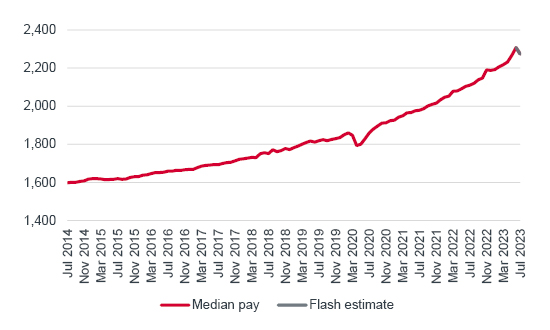

But the real game changer for the UK economy is likely to be found in the latest wage growth data, which also surprised on the upside at 8.2% in the second quarter, comfortably outstripping the Bank of England’s own forecast of 7.6%.

UK pay growth closes in on inflation

Source: Pay as you earn real time information from HM Revenue and Customs

Despite signs that the incredibly tight labour market is finally relaxing, with the unemployment rate creeping up to 4.2%, vacancy numbers falling and payroll data for July showing wage growth slacking off a bit, markets have been seriously shaken.

But on the day those wage growth figures sent share prices tumbling one sector seemed completely out of step, thanks in part to an unscheduled trading update from Marks & Spencer which saw its shares surge to a 12-month high, dragging a whole host of retailers along with it.

A decade of mixed fortunes for Marks & Spencer

Source: Refinitiv

The high street doyen might seem like an unlikely beneficiary of a cost-of-living crisis, but it’s cleverly given shoppers that little bit of luxury alongside price-conscious basics which has tempted more customers through the doors.

After fighting their way through two years of Covid disruption people want to live, and given a chance to splurge at the right price, the consumer is finding a way, either because they still have a bit of a savings cushion or because they’re prepared to deal with the consequences on another day.

And it’s finally found the magic ingredient to make its clothing sparkle as brightly as its food offer with smart tie-ups with England’s Lionesses to help it appeal to new generations.

In the US, retail sales have also come in hotter than expected with shoppers snapping up Amazon’s ‘Prime Day’ bargains in a bid to beat the inflation blues, and sales at Home Depot and Walmart have also been far more resilient than had been forecast.

After fighting their way through two years of Covid disruption people want to live, and given a chance to splurge at the right price, the consumer is finding a way, either because they still have a bit of a savings cushion or because they’re prepared to deal with the consequences on another day.

Just to add to the confused picture investors are trying to bring into focus, some retailers are feeling the squeeze.

The tune won’t please central bankers who can’t enjoy their roles as the economic bad guys.

Raising rates is a deliberate act to squeeze economies, to make things just that bit harder, so people won’t be prepared to pay those simmering prices.

But just to add to the confused picture investors are trying to bring into focus, some retailers are feeling the squeeze. In the UK Wilko has hit the skids, though its travails have primarily been self-inflicted, and in the US Target’s last trading update was a stinker.

Tricky trading for Target Corp

Source Refinitiv

For the first time in six years sales at Target dropped, with a shopper backlash in some stores over its LGBTQ Pride merchandise partly responsible for the dismal second quarter.

Target said its customers were spending less on things like clothing because they had to set aside more of their monthly budgets for the food shop.

The results also suggested that the health of the American consumer might not be quite as rosy as other economic data might have suggested.

Investors can be forgiven for feeling a little whiplashed. Bad news is often seen as good news and vice versa.

What is abundantly clear is consumer resilience will be vital for economies to bounce back from recent shocks, but timing is everything and right now that resilience might look more like a curse than a charm.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.