The American author Cormac McCarthy died earlier this month at the age of 89.

One of his most famous novels, The Road, achieved mainstream success and was later adapted into a film with Viggo Mortensen. It details the journey of a father and son through the post-apocalyptic wasteland of North America as winter starts to set in. In McCarthy’s tale, the father and son encounter cannibals, marauders, and danger at every turn, set against a landscape of despair and hopelessness.

Their mission is simple: follow the road, get south, stay warm.

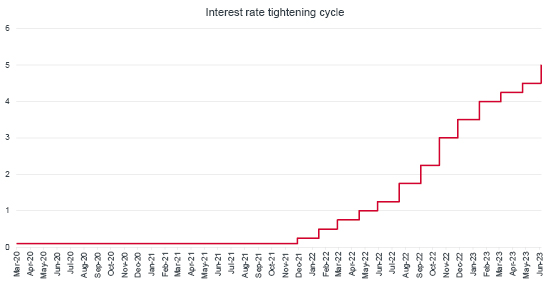

Over the past 18 months, the Bank of England has raised interest rates 13 times. From nearly 0% to 5%, this has gone from a record low to the highest levels seen since before the Great Financial Crisis of 2008. The Federal Reserve in the US has followed a similar road as they remain laser-focused on beating inflation.

Source: Bank of England

Their mission is also simple: follow the path of raising interest rates, get inflation down, stay growing the economy.

As in McCarthy’s novel, this road is also full of hidden dangers. Higher interest rates make it harder for businesses to borrow money and raise the cost of capital. They also affect mortgage rates. This can spread fear in the wider economy as people cut down on discretionary spending to maintain their housing standards, and it also affects the rate at which governments can finance public spending. As governments issue bonds (or “gilts” in the UK) to plug the budget deficit and higher rates causes economic growth to slow down, governments are now faced with a stark choice – cut public spending or increase the debt burden. Neither of these are palatable outcomes.

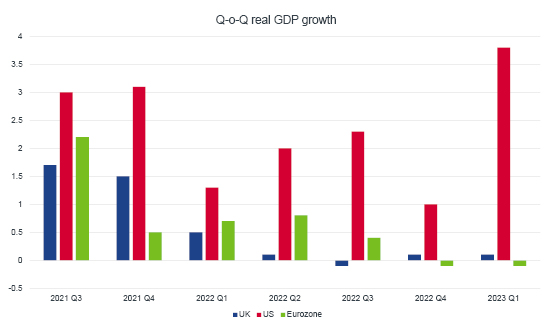

Source: Office of National Statistics

So far, a recession has not officially happened – although revised data from Europe shows that Germany entered a recession in Q1 2023. This lack of economic damage can cause problems as well. If the economy keeps growing too fast, inflation can become hard to contain. Businesses can start passing on higher price of materials to customers, while employees demand higher wages, causing the inflation spiral to keep turning.

The BoE has not covered itself in glory. The governor, Andrew Bailey, suggested in a speech last month to the British Chamber of Commerce that there was nothing they could do to stop inflation without taking drastic measures that would destroy the economy (despite the UK economy already growing slower than both the US and Eurozone). The chief economist, Huw Pill, had said in a podcast a few weeks earlier that "you don't need to be much of an economist to realise that if what you're buying has gone up a lot relative to what you're selling, you're going to be worse off.” In the UK’s case, Mr Pill suggested this was the service economy relative to the price of natural gas.

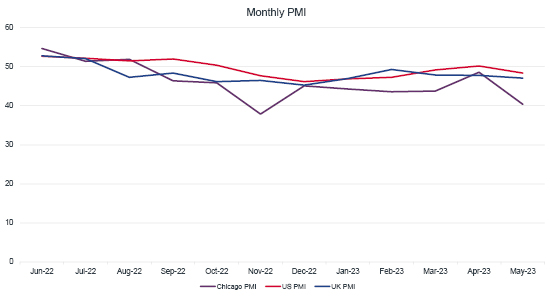

While these facts might be true from an academic point of view, they understandably hit a raw nerve with the public facing a cost-of-living crisis. However, unfortunately there are signs that things could get worse before they start to get better. Increases in unemployment are expected and Chicago PMI – the Purchasing Managers’ Index – came in a lot lower than expectations last month. This is worrying for a couple of reasons. The first is that PMI lower than 50 generally signals a recession. The second is that a figure well below 50 could signal a nasty recession.

Source: S&P

This is only one regional figure and other data suggests that the ‘soft landing’ is still on. This is the central bank’s ideal scenario – where inflation subsides and a long recession is avoided.

As we have said though, this road is full of danger.

A ‘hard landing’ – where inflation is only beaten through a sharp destruction of demand – could be the other outcome. This would be more painful for the economy but would beat down inflationary pressures and restore investor confidence in the ability of monetary policy to combat the threat of inflation. Central banks would reach their destination, but at a large economic cost.

Neither of these scenarios would be as devastating as stagflation. In this case, inflationary pressures would remain high while further interest rates hikes are considered necessary, leading to a prolonged recession and stifling economic growth. The central bank would also lose all credibility.

We believe it is unlikely that we see a hyperinflationary situation, and interest rates will eventually plateau. No road goes on forever. However, we understand this is an uncertain and dangerous path, and policymakers cannot afford to make a wrong turn. Importantly, we do not see interest rates coming down until inflation has been beaten. Until that time, we remain underweight duration in the portfolios.

If you would like more information about how AJ Bell Investments can help you or your business navigate these uncertain times, please contact your local Business Development Team representative.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.