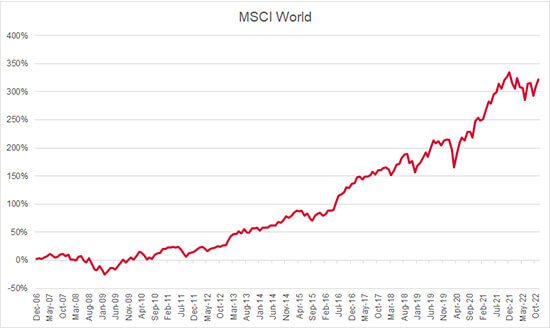

‘There Is No Alternative’, or TINA for those in the know, is a stock market mantra repeated by investors to promote the virtues of equity markets. First used in the 1980s by Margaret Thatcher, its meaning has now adapted to justify poor returns in equities on the grounds that no other asset classes are worth investing in. Since the Great Financial Crash (GFC) in 2008, this has mostly held true. The era of low interest rates, quantitative easing, and relative stability in global politics saw equities enter a decade-long bull run. Meanwhile bond yields remained on the floor, providing poor returns for fixed-income investors.

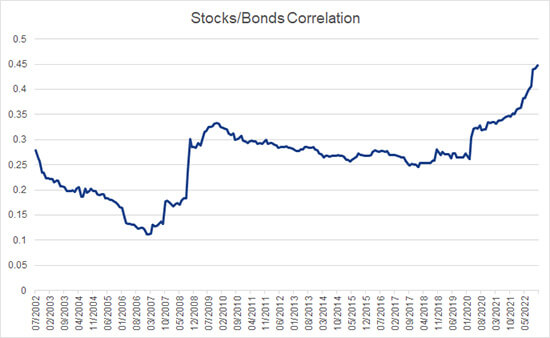

This called into question the usefulness of bonds and in particular the efficacy of traditional 60:40 portfolios.

Given that bonds were providing investors with poor income returns, there was a clear risk of capital losses, and diversification benefits were not as good as they once were, what other choice did investors have? In other words – TINA.

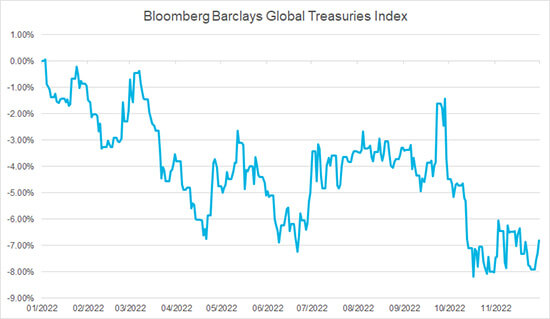

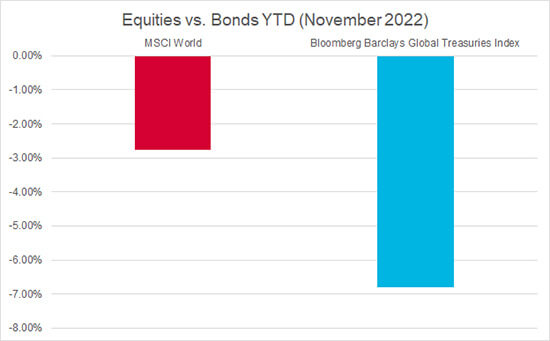

This has been particularly in focus during 2022. Bonds have historically offered protection during periods of market stress, but during the past year they have failed. Central banks across the world raised interest rates, which caused bond prices to plummet.

This has influenced equity markets too, which are also down during the year. The dual threats of inflation and recession weigh heavily on the global economy. However, while central banks remain laser-focused on constraining inflation, bond yields have been on an upward trajectory.

The AJ Bell portfolios successfully mitigated some of the effects of this price change by taking a short duration stance. This meant that interest rate rises had less of an impact on our underlying investments than average fixed-income duration.

But there has really been no place to hide during the bear market of 2022. The sharp repricing in bond markets has raised yields to levels not seen since the GFC. High yield debt, which faces heightened credit risk during recessions, is now yielding around 7-8% – a return expectation not dissimilar to what might be expected by equities. Far from being no alternatives to equities, now There Are Reasonable Alternatives (TARA).

The reasons for this include:

On the first point, if investors suffered losses when cash deposit rates were close to zero, they had little choice but to continue investing. There was no alternative. But now they can disinvest and put their money in a high interest cash deposit account, earning around 4%, to recoup their losses. Another way of putting this – TARA!

Equities are also not offering the same relative excess return for their riskiness compared to bonds as they have done. The ‘risk premium’ has been squeezed, partly since bonds have repriced much more sharply than equities over the past year.

On the final point, alternative investments have been popular during 2022 as they have offered some inflation protection for investors. This is true for the allocation to infrastructure we hold in the AJ Bell portfolios, which is a sector that has contractual agreements which provide pricing power.

We are currently in the process of setting our annual asset allocation, which will decide where we position the AJ Bell portfolios during 2023. As we head into the New Year, these are uncertain times, but our short duration stance has protected investors from the worst movements in fixed-income markets so far. This means that attractive yields are now available without the need to crystalise losses. Additionally, our tactical sector positioning has provided a boost for returns despite a tough year in equity markets. With different types of investments starting to look attractive again for the first time in over a decade, we remain focused on utilising all the tools in portfolio management to continue providing an optimal service for investors.

*All figures are in GBP and correct at time of writing, data from Morningstar and Bloomberg.

The value of investments can go down as well as up and your client may not get back their original investment.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.