It was Warren Buffett’s mentor, Benjamin Graham, who once wrote: “The intelligent investor is a realist who sells to optimists and buys from pessimists.” Such plain-speaking, common sense has yet again proved its worth over the past 12 months to offer a timely lesson to us all.

“It is almost a year to the day (23 March 2020) since the FTSE 100 bottomed at 4,994 amid widespread fear over what the pandemic could do to global growth and corporate profits (amongst other things).”

It is almost a year to the day (23 March 2020) since the FTSE 100 bottomed at 4,994 amid widespread fear over what the pandemic could do to global growth and corporate profits (amongst other things). Dividend cuts were picking up speed, oil prices were on their way into negative territory (if only briefly) and perceived ‘haven’ assets such as the dollar, gold and bonds were performing strongly. Pessimism prevailed.

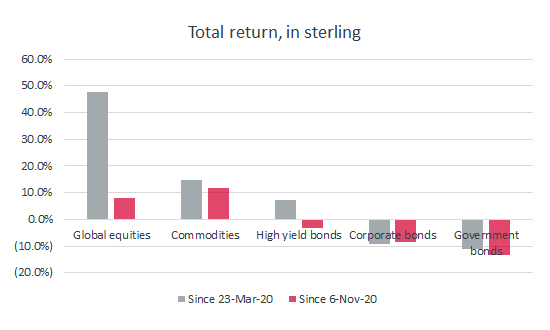

Lo and behold, 12 months later and the picture is very different. Any advisers or clients shrewd enough to have stored up some cash and brave enough to have started to take on more risk a year ago would have done remarkably well, as four datasets show. Advisers and clients now must decide whether these trends will continue, further changes in performance trends since ‘Pfizer Monday’ on 9 November will dictate, or whether a further shift in gear is imminent.

“Hard to believe as it may be, given the fear that dominated a year ago, equities have been the best place to be over the past 12 months. As benchmarked by the MSCI All World index, global stocks have beaten commodities and bonds.”

Hard to believe as it may be, given the fear that dominated a year ago, equities have been the best place to be over the past 12 months. As benchmarked by the MSCI All World index, global stocks have beaten commodities and bonds. Government bonds, in theory a port in a storm, have provided no shelter with capital losses more than offsetting any yield that they offered. Equities beat corporate bonds, Government bonds and high-yield (or junk) bonds, with commodities dead last.

There have been subtle changes since November. Commodities have taken the lead from equities and high-yield bonds have started to flag. Meanwhile, the rout still seems to be on when it comes to investment-grade corporate and Government bonds.

Equities and commodities have dominated over the past year

Source: Refinitiv data.

Unlike bonds, where most major categories have fallen on a one-year view, all geographic equities options have gained. Asia and Japan have performed consistently well, perhaps thanks to the relatively low number of pandemic cases they have suffered and their rapid, robust approach of test, track and trace as well as containment.

“America’s domination of early 2020 has faded and it is prior laggards who have come to the fore – emerging markets and even the unloved UK equity market have put on a spurt.”

America’s domination of early 2020 has faded and it is prior laggards who have come to the fore – emerging markets and even the unloved UK equity market have put on a spurt, finding itself outpaced by just Eastern Europe and the Africa/Middle East region since November. This may be down to the perception that the UK is ahead of the game when it comes to vaccination programmes, having previously struggled to contain the virus.

Asia and Japan have been consistent but emerging equity markets have been catching up

Source: Refinitiv data.

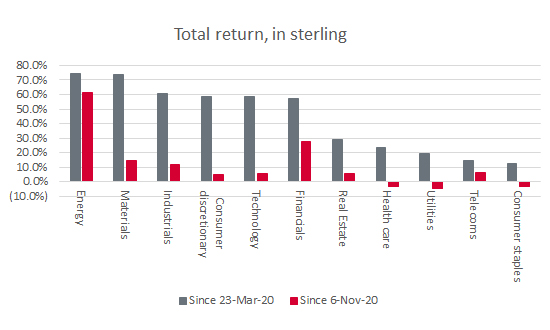

Technology continues to grab the headlines, especially as a raft of new initial public offerings tempts investors’ wallets. But miners, industrials and consumer discretionary stocks have all beaten tech over the past 12 months and oil has been the best performer of the lot, to reaffirm the adage that the darkest hour is before the dawn. (Oil’s resurgence may also inform the rally seen in Eastern European, Middle Eastern and Latin American equities.)

Meanwhile, sectors that looked reliable going into a pandemic – utilities, consumer staples and even healthcare – have lagged, a trend that has become ever-more noticeable since the Pfizer-BioNTech announcement of last autumn.

Technology is no longer king of the hill. Oil now rules, on a sector basis.

Source: Refinitiv data.

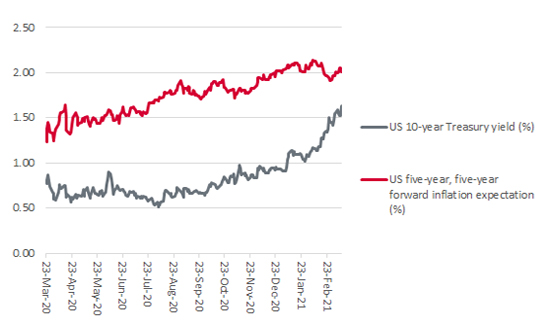

It is possible that all three charts can be explained succinctly by a fourth. Inflation expectations have ground inexorably higher over the past 12 months and dragged benchmark Government bond yields with them.

Rising bond yields mean rising growth and inflation expectations

Source: Refinitiv data

While hopes for, or forecasts of, stronger economic growth are likely to seen as a good thing by most advisers and clients, the data suggest that any return of inflation could bring challenges as well as opportunities. If markets do become fixated with inflation, and begin to take the view that central banks are behind the curve and too slow to act, then short-duration assets such as commodities and equity funds that are ‘value’ oriented (for want of a better turn of phrase) could continue to give long-duration ones, such as certain fixed-income funds or equity funds that have a ‘growth’ tilt, a good run for their money.

Stock-specific data may be of limited interest to time-poor, information-rich advisers and clients. But it is worth noting that these ‘big picture’ trends can be seen on a bottom-up basis in how individual UK equities have performed. There is a clear switch from defensives to turnaround plays, and from ‘growth’ (and promises of long-term secular growth, or ‘jam tomorrow’, almost regardless of the economic backdrop) to ‘value’ (cyclicals that offer growth now, or ‘jam today,’ in the event of a recovery), from pandemic winners to bounce-back candidates. This could form the basis of an interesting discussion with preferred UK equity managers next time there is a meeting, either remotely or even face-to-face.

“Without wishing to belabour the details, it has been quite hard to lose money on UK equities since last year’s panic. Just nine of the FTSE 350’s current membership have lost ground over the last 12 months.”

Without wishing to belabour the details, the list of the FTE 350’s best 20 performers over the last year includes pandemic winners like AO World, gaming and gambling plays 888 and Playtech, as well as comfort food provider Premier Foods. But they are outnumbered by miners and other economically-sensitive names like Virgin Money UK, while the prevalence of bid candidates like William Hill, G4S and KAZ Minerals hints at the value that the downtrodden UK market offered a year ago.

That said, it has been hard to lose money since last year’s panic. Just nine of the FTSE 350’s current membership have lost ground over the last 12 months.

Bid targets, miners and gambling stocks lead the way in the UK over the last year

Source: Refinitiv data.

These trends have become even stronger since Pfizer Monday. Beneficiaries of an economic reopening dominate the leaderboard, notably travel and leisure stocks. The laggards include online delivery plays Ocado and Just Eat Takeaway.com (a red flag for the Deliveroo float?); precious metal miners; pharmaceutical plays; and such dependable names as Reckitt Benckiser, Games Workshop and Avon Rubber – where market participants may have paid too high a valuation, and thus mistaken reliability of earnings for safety of share price. Pay the wrong valuation and nothing is safe.

Pandemic losers have become winners and vice-versa since Pfizer Monday

Source: Refinitiv data.

This is not to be wise after the fact. No one will time a market bottom or top perfectly and trying to do so is a mug’s game. But the trends of the past year show how advisers and clients can calibrate risk and earn rewards over time by going against the crowd, focusing on valuation – with the help of their chosen strategists and asset allocators – and not getting carried away.

“Perhaps the best approach now to tactical or strategic asset allocations is to heed the words of another investment legend, Sir John Templeton. It is perhaps time to once more research those areas of which the crowd is frightened and tread carefully where fear of missing out predominates.”

Perhaps the best approach now to tactical or strategic asset allocations is to heed the words of another investment legend, Sir John Templeton: “Bull markets are born on pessimism, grow on scepticism, mature on optimism and die on euphoria.” It is perhaps time to once more research those areas of which the crowd is frightened and tread carefully where fear of missing out predominates.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.