The US stock market represents almost two-thirds of total world stock market capitalisation, so it seems fair to assume that where America goes the world will follow, at least to some degree. Keeping an eye on the US political scene, US Federal Reserve policy and the American economy may therefore help investors judge what 2024 (and beyond) may hold for their portfolios.

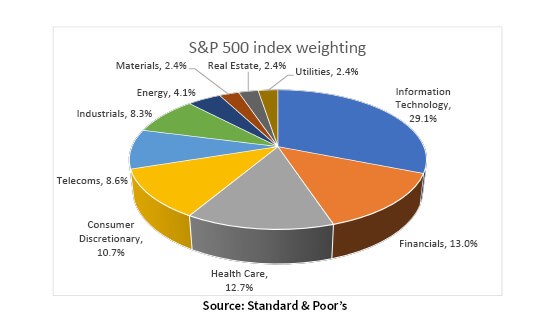

By the same token, four sectors – technology, financials, healthcare and consumer discretionary – make up two thirds of the market value of the headline S&P 500 US equity index. Any adviser or client who wants to cut down on the amount of research they wish to do can at least focus on those, in the knowledge they are looking at some of the most important companies and industries in the world, at least from the perspective of investment.

Just four sectors of eleven represent the bulk of S&P 500’s market cap

Source: Standard & Poor’s

“For better or worse, the US Federal Reserve will remain centre stage in 2024.”

For better or worse, the US Federal Reserve will remain centre stage in 2024. Some advisers and clients will view this as a good thing, given the central bank’s political independence, willingness to explain its thought processes to market participants and how easy it is to follow its eight scheduled meetings a year (and then read the subsequently published minutes). Others will cringe, not least because the Fed has yet to correctly call a recession in its 111-year history, during which period the dollar has lost 97% of its purchasing power, a trend not helped by experiments such as Quantitative Easing and zero interest rate policies (ZIRP) since the Great Financial Crisis.

“Markets’ faith in a cooling in inflation, a soft economic landing and a pivot to interest rate cuts from the Fed underpinned the late-2023 rally in stock (and bond) markets but this has left the US central bank in a position whereby it needs to deliver – or share prices may falter.”

Markets’ faith in a cooling in inflation, a soft economic landing and a pivot to interest rate cuts from the Fed underpinned the late-2023 rally in stock (and bond) markets but this has left the US central bank in a position whereby it needs to deliver – or share prices may falter. At the time of writing, the CME Fedwatch suggests that markets are pricing in six, one-quarter point rate cuts by year end, although last week’s (3 Jan) minutes from the December meeting saw the probability of the first drop coming at the 20 March meeting cut to 66% from 73%. Perhaps the first doubts are creeping in, even if the Fed has done much more to stoke rate-cut expectations than either the Bank of England or the European Central Bank.

The near-one third weighting of the S&P 500 toward technology leaves this column feeling a little uncomfortable, although it does help to explain why the index, at around 20 times earnings for 2024, trades above its long-term average of 18 times, according to research from S&P. Even more intriguing is that the Magnificent Seven of Alphabet (GOOG:NDQ), Amazon (AMZN:NDQ), Apple (AAPL:NDQ), Meta (META:NDQ), Microsoft (MSFT:NDQ), NVIDIA (NVDA;NDQ) and Tesla (TLSA:NDQ)(not all of which are classified as tech stocks) represent 30% of the S&P 500. Such a reliance on so few names is not always a healthy thing, and if anything goes wrong with them then other stocks and sectors will need to take up the slack – financials, healthcare and consumer discretionary in this case. Two of those would presumably falter in the event of a nasty recession, even if lower interest rates could conceivably help the consumer-facing firms and the banks (which could also do with a steeper yield curve).

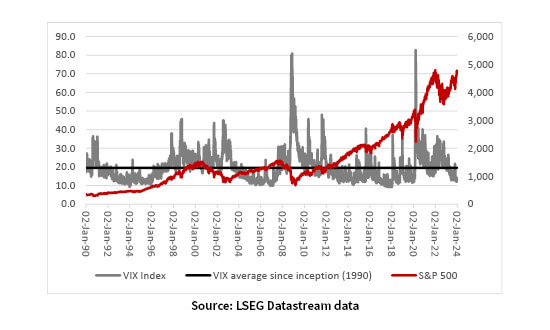

“The VIX – or fear – index is lurking at barely 13, well below its historic average of near 20, to suggest markets are at best complacent, at worst exuberant.”

It bears repetition that markets are currently pricing in lower inflation, a soft landing (or even no landing at all) and rate cuts for 2024. Any developments that diverge from that – in the form of a hard landing or an inflationary, crack-up boom if central banks move too precipitately – might not mean the bull run in US equities ends, but they could surely portend greater share price volatility. The VIX – or fear – index is lurking at barely 13, well below its historic average of near 20, to suggest markets are at best complacent, at worst exuberant.

The VIX index is trading well below its historic average

Source: CBOE data, LSEG Datastream data

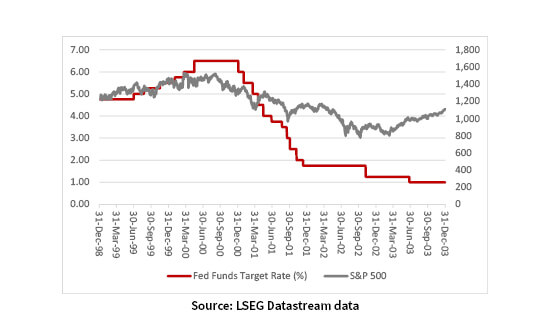

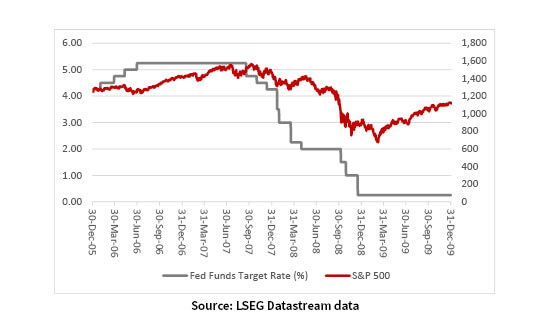

“Advisers and client investors with long memories will remember that Fed intervention did nothing to stop the bear markets of 2000-03 or 2007-09, at least initially.”

This, again, takes us back to interest rates and the Fed. A crack-up boom and rates may not come down as fast and as far as hoped. A sharper-than-expected slowdown may mean the rate cuts arrive but for the ‘wrong’ reason. Advisers and client investors with long memories will remember that Fed intervention did nothing to stop the bear markets of 2000-03 or 2007-08, at least initially. That was because earnings estimates were falling a lot faster than rates, as the US economy hit the buffers.

Fed rate cuts did not stop the US equity bear market of 2000-03…

Source: LSEG Datastream

…or initially stem the downward slide of 2007-08

Source: LSEG Datastream

The dream middle path of cooler inflation, a soft landing and rate cuts may well transpire and in that case then all may be well and good. But if the Fed cuts interest because America’s government debts and the interest burden are too high, or the economy (and earnings) are hitting the buffers, then markets may need to be careful about what they are wishing for.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.