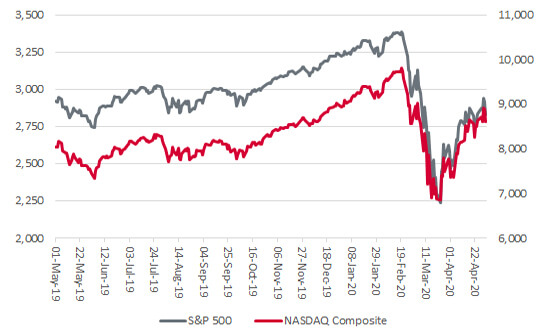

Hard to believe as it may be, America’s S&P 500 index is down by just 3% over the last 12 months, while the NASDAQ Composite is up by 7%. This seems remarkable, given the COVID-19 outbreak and the economic fallout of the lockdown that is being used to fight it. Surely, things cannot be 3% worse than they were a year ago (when US stocks were already trading close to all-time highs) or 7% better for the tech and biotech stocks which populate the NASDAQ?

US stocks have lost little, if any, ground over the past 12 months

Source: Refinitiv data

But stock markets are forward-looking mechanisms which try to discount, or price in, future events, not backward-looking ones. Sharp falls amid the panic of February and March tried to factor in the hit to American economic activity and corporate profits, and the subsequent rally is now trying to price in the future recovery as several nations, including the US, start to emerge from their lockdowns. The question now is have US stocks gone too far, too fast?

The arguments for and against further near-term gains in US equities can be summarised via three topics.

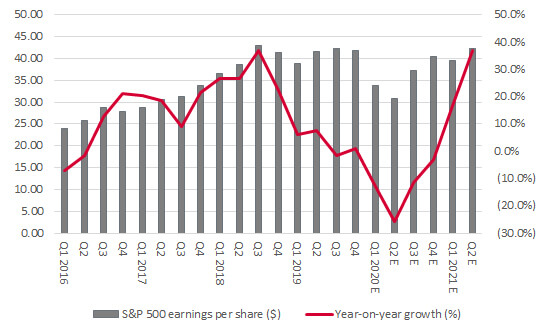

“US earnings are receiving strong support from leading tech stocks, with the Technology sector forecast to generate 23% of 2020 earnings, according to IBES data from Refinitiv.”

US market is pricing in a rapid earnings rebound in 2021

Source: Factset

Case against: Thirty million Americans have lost their jobs in six weeks. Not all of those jobs will come back at all; some may only come back slowly. This could crimp private consumption which drives 70% of US GDP and mean the rebound is much more modest than consensus forecasts suggest – while a strong dollar, lockdowns elsewhere and any resumption of trade tensions with China may be unhelpful for exports at the same time. The consensus forecast of a 12% drop in earnings per share in the S&P 500 could prove optimistic, especially when company profits fell by 31% and 40% during the downturns of 2001 and 2008 respectively. In addition, the US market is becoming ever-more skewed toward tech stocks. In the past 12 months, the S&P 500 has lost $895 billion in market cap. Facebook, Amazon, Apple, Netflix, Google-parent Alphabet and Microsoft have gained $910 billion between them. This sextet now represents 20% of the S&P’s value on its own, up from 15% a year ago, so if any of them disappoint with their earnings, this could have a disproportionate impact."The US Government has already signed off a $2.2 trillion fiscal stimulus programme and the US Federal Reserve, via the resumption of Quantitative Easing, has already pumped more than $2.5 trillion of liquidity into the financial system, more than covering that output gap.”

US equities feasted on Fed cash but rate of QE is slowing down

Source: FRED – St. Louis Federal Reserve database, Refinitiv data

Case against: The Fed has begun to throttle back its QE programme, adding ‘just’ $83 billion to its asset purchases in the last week for which data is available, compared to the $586 billion peak run rate in late March. Even that easing of stimulus has seen US equities’ recovery lose a little pace. If the rally really is relying on abundant central-bank-provided liquidity, then that is a brittle set of foundations, as the Fed cannot print forever and ever.“The S&P 500 has only traded at 26 times earnings using CAPE for any length of time and 10-year compound annual returns from the index were negative after both 1929 and 1999.”

US stocks have rarely traded at such lofty CAPE multiples for long and, when they did, subsequent long-term returns were poor

Source: econ.yale.edu/~shiller/data.htm

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.