US Federal Reserve chair Jay Powell’s admission in his testimony to the US Senate Banking Committee in Washington that there is a risk America is heading into a recession represents refreshing honesty, especially for the head of organisation with an unbroken record of failing to accurately predict any of the downturns seen since its foundation 109 years ago.

That shows just how difficult it is to spot a recession – America’s National Bureau of Economic Research only flagged the US downturn that started in late 2007 in late 2008, a delay that rendered any such insight totally useless, especially from an investment point of view.

The question now is how can advisors and clients tell Mr Powell is right, especially as where America goes the world tends to follow?

In this respect GDP growth data is no use. It is published with a lag of a month or two and subsequently revised. Unemployment data is similarly ineffective from an investment point of view, for the same reason. Its only use may be as a contrarian indicator – once cyclical lows are hit then things can only get worse and vice-versa (and right now US and UK unemployment stands at very low levels). Job vacancy data – and changes in the rate of change of vacancies – may have more value.

“Lagging indicators which carry more weight include retail sales and housing, as both tap into how 70% of the US economy is driven by consumption. This year’s weakness in retail sales and the way in which new homes sales have fallen year-on-year ten times in eleven months are therefore potentially ominous.”

Lagging indicators which carry more weight include retail sales and housing, as both tap into how 70% of the US economy is driven by consumption. This year’s weakness in retail sales and the way in which new homes sales have fallen year-on-year ten times in eleven months are therefore potentially ominous.

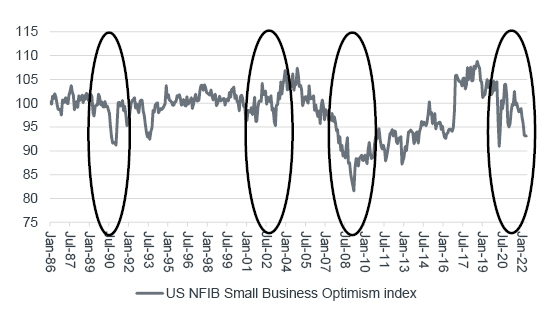

Sentiment surveys may bring more insight. A good one to bear in mind for the US is the NFIB smaller companies business survey. Just under 30 million US firms employ fewer than 500 people and they represent all bar a couple of percent of the total workforce. The NFIB has gone below 95 three times since 1985 and each time signalled a recession (the indicator got down to 96 in the 2001-02 downturn).

“The NFIB has gone below 95 three times since 1985 and each time signalled a recession (the indicator got down to 96 in the 2001-02 downturn).”

Sliding US smaller company confidence bodes ill

Source: NFIB, Refinitiv data

Believers in free, financial markets may prefer to put their faith in forward-looking indicators and frankly there may be few better ones than financial assets. Investors have skin in the game and money on the line. Economists do not.

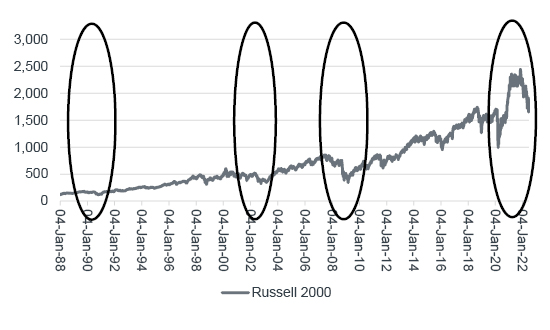

Three useful benchmarks are small caps, transport stocks and copper.

Smaller companies tend to be much more sensitive to their local economy than mega-cap multi-nationals. The Russell peaked before the 1991-92, 2001-02 and 2007-09 recessions.

US Russell 2000 index is in a bear market

Source: Refinitiv data

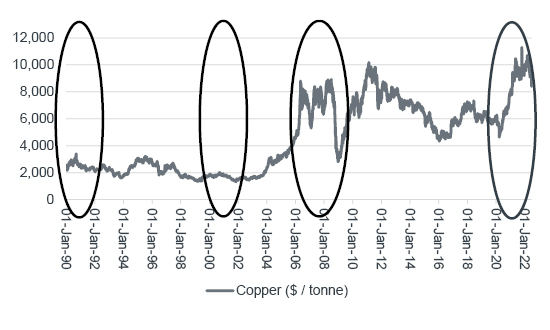

“‘Doctor Copper’ is a good guide to global economic health as the metal’s ductility and conductivity mean it is used in so many industries across the globe. The current triple-top on the chart does look spookily like that of 2006-08.”

‘Doctor Copper’ is a good guide to global economic health as the metal’s ductility and conductivity mean it is used in so many industries across the globe. The current triple-top on the chart does look spookily like that of 2006-08.

Dr Copper is looking a bit poorly

Source: Refinitiv data

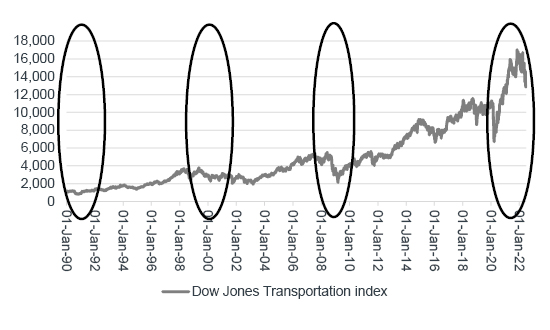

And Richard Russell’s Dow Theory states that the Industrials cannot do well if the Transports are doing badly, because weak transport stocks implies that goods are not being shipped because of an inventory pile-up, weak end demand or both. By contrast, a surge in transport stocks suggests end-demand is good, because shelves and forecourts must be replenished and the newly-manufactured products must be moved around.

Transport stocks need to get back on the rails

Source: Refinitiv data

On the face of it, the outlook is difficult at best, grim at worst, although a downturn would take some of the heat out of inflation, if recent commodity price action is any guide. Portfolio-builders must also bear in mind two other things.

First, the stock market is not the economy (and vice-versa). If a downturn does hit, share prices will have gone down long before analysts begin cutting their forecasts and economists declare a recession. By the time the economists have woken up, there has to be a chance that equities are already looking toward the next upturn.

“If push comes to shove, central banks may well be prepared to take their chances with inflation rather than recession, especially given the West’s indebted state.”

Second, monetary stimulus from central banks and fiscal stimulus from governments could yet change sentiment. Most Western governments are potless but central banks can always turn to QE to help them, and another firehose of cheap liquidity could galvanise risk assets. If push comes to shove, central banks may well be prepared to take their chances with inflation rather than recession, especially given the West’s indebted state. As economist and shrewd stock market player J.M. Keynes wrote in 1923’s A Tract on Monetary Reform: “Inflation is unjust and deflation inexpedient. Of the two, perhaps deflation is worse; because it is worse in an impoverished world to provoke unemployment than to disappoint the rentier.”

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.