The Federal Reserve, like so many other Western central banks, remains on the horns of a dilemma. The US central bank can either let inflation run unchecked and run the risk of damage to the economy as consumers’ pockets and corporations’ margins feel the pinch, or it can raise interest rates to try and dampen inflation but run the risk that growth slows down, or a recession develops.

“Stock markets are clearly perturbed. The Dow Jones Industrials is down 12% from its highs and the S&P 500 by 16%. That suggests some bad news is priced in. But other indices are clearly frightened that worse news is to come.”

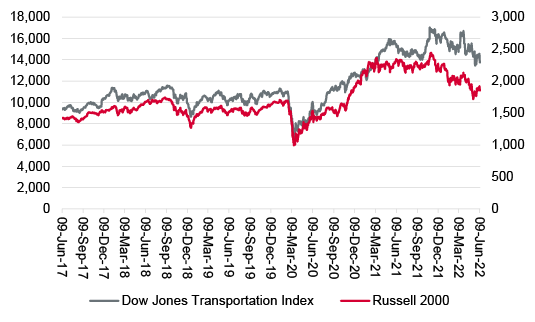

Stock markets are clearly perturbed. The Dow Jones Industrials is down 12% from its highs and the S&P 500 by 16%. That suggests some bad news is priced in. But other indices are clearly frightened that worse news is to come. The Dow Jones Transportation index is down by a fifth from its autumn 2021 zenith, to leave it flirting with a bear market, while the small-cap Russell 2000 has already been gored, as it has fallen by a quarter from its peak.

Economically-sensitive US equity indices are sagging

Source: Refinitiv data

Both of those indicators are trying to rally but the technical analysts will tell you the charts look ugly, while corporate news is taking on a darker tone too, certainly if a mild profit warning from Microsoft (MSFT:NDQ) and a big, bad one from retail giant Target (TGT:NYSE) are to be believed. Perhaps the US economy is weaker than markets believe?

Advisers and clients will not have the time or the inclination to dig into the stock-specific issues, but it may be worth taking a closer look. Microsoft is blaming the strong dollar, and analysts are therefore brushing that one off, but the implications of the Target disaster are much more serious.

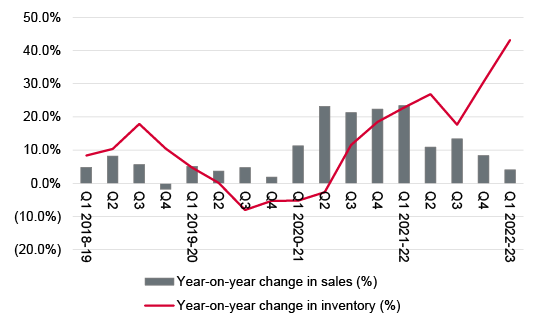

Target’s inventories of goods on its shelves and in its warehouses had outpaced growth in sales for four straight quarters, so something had to give – either revenue growth picked up or Target had to stop buying and start discounting.

Target’s swollen inventories have caught up with the retailer

Source: Company accounts. Financial year to January.

Target has now admitted that it has started cutting prices and swallowing fines and penalties that result from cancelling orders from its suppliers. This combination means management now expects the operating margin to slide to 2% in the second quarter, compared to 5.3% in the first and 9.8% a year ago.

“That is clearly bad news for Target, but it will hardly bring cheer to the firms that manufacture and supply its products or those that ship them. The retailer is reportedly the second-largest importer of containers into the USA, so it is no wonder the Dow Jones Transportation index is looking so sick.”

That is clearly bad news for Target, but it will hardly bring cheer to the firms that manufacture and supply its products or those that ship them. The retailer is reportedly the second-largest importer of containers into the USA, so it is no wonder the Dow Jones Transportation index is looking so sick – data from the giant Port of Long Beach is showing flat volumes for loaded inbound containers for 2022 to date and a year-on-year decline for May.

Target’s share price suggests something is amiss, because it stands at levels last seen in September 2020, when the US Government was handing out stimulus cheques as if they were confetti. Those cheques are now a thing of the past, interest rates are going up and inflation is eating away at consumers’ disposable incomes.

Private consumption generates about 70% of US GDP so a slowdown here, either a temporary one as retailers whittle down their stocks, or a longer one as consumers slow down their spending, could be a major blow to the US economy and the earning power of corporate America.

It is here that the wider danger for American equities may lie.

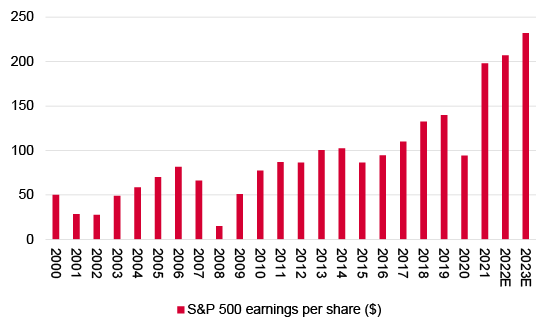

“Based on earnings estimates collated by Standard & Poor’s, US equities trade on 20 times forward earnings for 2022 and 18 times for 2023. Both of those ratings are still a little above historic norms. They also assume earnings growth to new peaks in both 2022 and 2023, which could be a false premise if Target is any guide.”

Based on earnings estimates collated by Standard & Poor’s, US equities trade on 20 times forward earnings for 2022 and 18 times for 2023. Both of those ratings are still a little above historic norms. They also assume earnings growth to new peaks in both 2022 and 2023, which could be a false premise if Target is any guide, especially as work from Standard & Poor’s suggests aggregate consensus estimates for the US stock market are starting to fall.

US earnings estimates still call for new peaks in 2022 and 2023 …

Source: Standard & Poor’s research

“In the past month, consensus forecasts for earnings per share have dribbled down by 5% for each of 2022 and 2023, to $217 and $244 respectively.”

In the past month, consensus forecasts for earnings per share have dribbled down by 5% for each of 2022 and 2023, to $217 and $244 respectively. The combination of above-earnings multiples and falling earnings forecasts could quickly turn toxic, especially as the S&P 500’s operating margins are already at record highs and analysts are implicitly forecasting further improvement, despite inflation and Target’s warning.

… even though margins are already at new highs and inflation is surging

Source: Standard & Poor’s research

This takes us back to Robert Rhea’s three phases of a bear market, as discussed last month (19 May 2022): ‘There are three classic phases of a bear market: the first represents the abandonment of hope upon which stocks were purchased at inflated prices; the second reflects selling due to decreased business and earnings, and the third is caused by distress selling of sound securities, regardless of their value, by those who must find a cash market for at least a portion of their assets.’

Equity indices are trying to rally, and confound forecasts of a bear market and US recession. It is now up to investors to decide whether they are right or whether we are moving from phase one to phase two of Rhea’s downcycle.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.