The travel sector has a lot riding on the ‘Summer 2022’ season but it’s shaping up to be more of a damp squib than anything to write home about.

With just weeks to go before the crucial school holiday season gets properly underway EasyJet (EZJ) has taken a red pen to its summer schedule, paring back the number of flights it operates in a bid to avoid the kind of chaos endured by holidaymakers over the May half-term.

There are big questions about what the change in plans will do to profit margins.

Capacity has been significantly impacted with the low-cost carrier now expecting to at operate between 87% and 90% of its pre-Covid levels in place of the 97% it had been shooting for by the end of the summer.

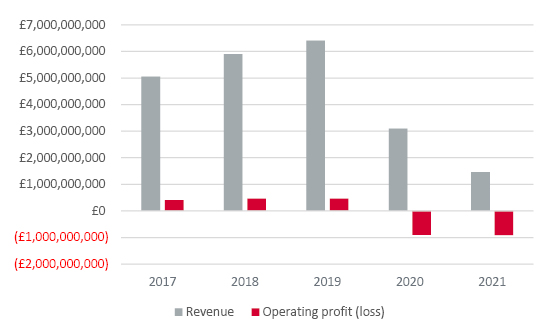

EasyJet revenue and profit

Source: Stockopedia

There are big questions about what the change in plans will do to profit margins. EasyJet’s last lot of numbers proved it’s not just about how many people are flying, it’s about how much it costs to fly them versus the amount they are paying for the pleasure.

But this is damage control and it’s crucial. Bookings heading into the fourth quarter period to 30 September are less than half sold. While that might be broadly in line with the normal ebb and flow there is a danger that many would-be travellers will have been put off by the scenes that have been played out on social media and will be watching the next three months with a laser-like focus to decide if they should risk a foreign sojourn or stick closer to home.

Travelling is tricky at the best of times; at the worst of times, it can be akin to the seventh circle of hell – particularly if you have young children in tow – and I’m one of those firmly standing in the ‘wait and see’ queue.

I watched smugly over the Jubilee Bank Holiday weekend from my Welsh Airbnb by the sea as social media was flooded with horror stories of families on the way to airports receiving last-minute email cancellations, whilst others were stuck abroad paying through the nose for flights to get them back in time for school.

A short trip to Belfast via Manchester airport did little to change my opinion. Once a seasoned traveller I, like many of my fellow travellers, seemed to have forgotten some of the nuances, the little hacks that help speed your way through.

My plastic bag was too big, and I was forced to add a couple of toiletry items to the overflowing bins at the security gate.

I joined the throngs at WH Smith (SMWH) and Boots spending over the odds to replace them before fighting for a seat in one of the few hospitality businesses that had actually managed to open their doors. Though my flights both left on time the journey was fraught. We, the travelling public, might be up for travel but not many of us are really ready, and the airports certainly aren’t either.

Holidays to come are likely to be more expensive at a time when people’s disposable income is under increasingly severe pressure.

Both EasyJet (EZJ) and International Consolidated Airlines (IAG) owned British Airways have bowed to insurmountable pressure not to over promise. Better to cancel flights weeks ahead allowing time to re-jig and re-book than have thousands turned away on the day of departure. Many of this cohort of holidaymakers are still using lockdown savings or even taking the break that had been earmarked for summer 2020.

Holidays to come are likely to be more expensive at a time when people’s disposable income is under increasingly severe pressure. The travel sector will have to fight to win back consumer confidence and investors aren’t altogether convinced that’s going to happen quickly.

The surging price of oil, the cost-of-living crisis and the difficulties getting staff numbers back to pre-pandemic levels have left markets distinctly unimpressed.

That’s not to say there aren’t some businesses operating within the travel sector scenting opportunity. The aforementioned WH Smith is expanding, nipping into holes left behind by the closure of Dixon’s Carphone stores in 2021.

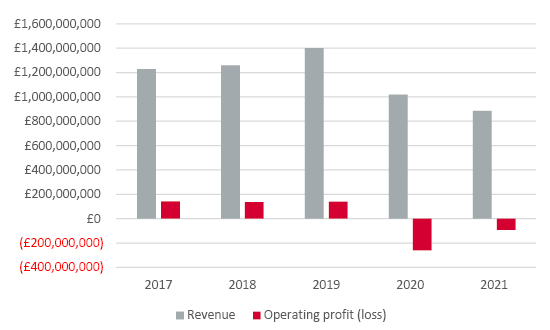

W H Smith revenue and profit

Source: Stockopedia

Its little boxes chock-full of travel essentials and the magical escapism of books are doing a roaring trade, even if its high street offer is still suffering from a dearth of office worker footfall. It’s a simple model but one that’s able to keep costs low and crucially doesn’t need huge staffing numbers to keep doors open.

Then there’s the Great British ‘Staycation’ – the UK Short Term Accommodation Association found the domestic tourism space enjoyed a bumper Jubilee Bank Holiday and expects a boom in bookings over the summer.

Homegrown tourist numbers are also being buoyed by the return of incoming travellers and Premier Inn-owner Whitbread (WTB) is bullish about the outlook for the rest of the year. But it’s warned that costs are set to rise as the business fights to attract and retain the illusive hospitality worker.

And that’s where the wheel keeps stopping. Anyone booking anything will have noticed prices creeping up. Whether it’s flights, hotel rooms or a bottle of water. The bigger the ticket, the more concerned businesses should be, and this week’s annual International Air Transport Association meeting was pretty sombre.

All the conversations so far about the recovery of the travel sector, and air travel in particular, have been primarily focused on this summer. But the real test is still to come.

With incomes squeezed and the initial pent-up demand to jet away having faded, the challenges facing the airlines may only get more acute.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.