There have been no shortage of polls looking into Brits’ travel intentions at a time the cost-of-living crisis is eating into budgets and forcing some households to make really tricky decisions. The consensus seems to be that bookings will hold up but spend will fall as people hunt out bargains. A summer holiday is seen by many people in the UK as a necessity; a chance to recharge batteries, make memories and crucially provide an affordable and sunny bright spot amidst the hum drum of day-to-day life.

Post lockdown the landscape has changed considerably – you can’t expect to close down a global industry and there not to be casualties.

But with warnings from airlines and travel operators that prices are set to be considerably higher this summer there are big questions about how that might impact travel trends. Which companies might end up the year’s big winners and which might be disappointed with their post summer scorecard?

Post lockdown the landscape has changed considerably – you can’t expect to close down a global industry and there not to be casualties. Capacity in some of the most popular tourist hotspots is likely to be under pressure and where there’s demand there’s inflation.

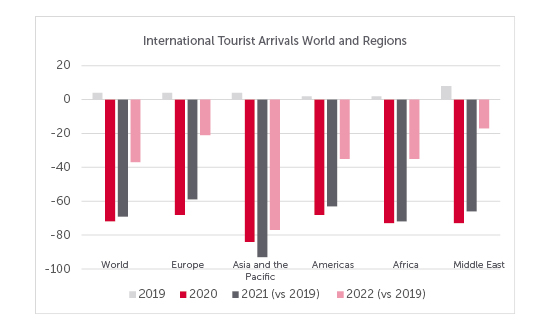

It’s no surprise Europe is one of the areas that’s seen travel rebound strongly though the middle east, with its affordable winter sun, has recovered fastest according to figures from the UN’s World Tourism Organisation.

International tourist arrivals: world and regions

Source: World Tourism Organisation (UNWTO) Data collected January 2023

In the wake of pandemic cancellations and post lockdown uncertainty people flocked to the security of the protected package deal, with TUI, Jet2 and EasyJet big beneficiaries. But will that still be the case this summer or will price push people back into DIY breaks?

Travel is returning to post-pandemic norms and that means it’s not just about a beach and bar especially for holidaymakers wanting to get more bang for their buck.

Airbnb fell out of favour with investors in 2022 but the share price has rebounded strongly since the start of the year after the company lifted revenue guidance. Travel is returning to post-pandemic norms and that means it’s not just about a beach and bar especially for holidaymakers wanting to get more bang for their buck.

Airbnb share performance since IPO

Source: Refinitiv

With confidence growing now that global restrictions are fading into memory, wanderlust is returning. Getting off the beaten track doesn’t just mean awesome holiday photos, it can also mean more space for families fed up with the limitations of sharing a single room.

What’s interesting is how Airbnb has evolved over the years. It’s not just the famous free sofa that kicked off the idea for the company’s founder; hosts are becoming more and more professional, turning their side hustle into a serious business, which is upping services but could also create price creep.

And price creep is one of the reasons that all-inclusive breaks could deliver the biggest opportunity for operators this year. The initial spend is higher, but it does give holidaymakers the peace of mind that every ice cream cone and pool bar cocktail has already been added to the bill.

Getting as many bums on seats on flights to those popular hotspots is the way budget airlines make a good chunk of their money, but with warnings about price rises to all destinations it will be interesting to see how the consumer responds

Consumers are getting savvier with every passing year and search engines and apps are making their job easier. They’re not just looking for the cheapest flights to their destination of choice and thinking that’s ‘job done’ anymore. They’re factoring in accommodation costs, exchange rates, meals and activities as well.

The British tabloids are full of money-saving tips, from the best day to book, to under-the-radar destinations where the price of a cold beer is way below that being charged in popular hotspots.

Getting as many bums on seats on flights to those popular hotspots is the way budget airlines make a good chunk of their money, but with warnings about price rises to all destinations it will be interesting to see how the consumer responds and how their decision making ultimately impacts profits.

There is one other factor to stir into the pot and that’s the potential that some people may ditch the foreign holiday altogether this year either because of price, or because disruptions like strikes make long distance hauls seem much too much trouble.

Britain has a booming holiday sector which Brits turned to in their droves during the pandemic. It avoids airports, long-stay parking costs and you can also take your dog with you, which can save a fortune in boarding costs.

But of course, you can’t guarantee the weather and parents know full well that a beach on a sunny day is about the cheapest entertainment you can find and that being stuck in a caravan or holiday let in the rain is tantamount to torture.

There’s a whole host of companies from Premier Inn owner Whitbread to pub chain Wetherspoons that will be hoping this summer won’t deliver the worst scenario of all – when the lion’s share of holidaymakers flock to sunnier climes and no one has cash left over for a cheeky short break.

There is the prospect of a May filled with bank holidays thanks to an extra long weekend for the King’s coronation but with prices still heading up, and a whole load of people facing increased mortgage costs this year, disposable income is likely to be in pretty short supply.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.