Sticky inflation is prompting investors to ask an important question of all businesses. How long can companies keep putting up prices until consumers vote with their feet? And what happens to profit margins when that day comes?

The answer is a complex one, one that’s likely to be top of the agenda in boardrooms all around the world, and one that’s been taking centre stage once again during recent earnings calls.

For bean and ketchup maker Kraft Heinz, the answer has already become evident with sales volumes falling significantly – down 4.8% in the fourth quarter – and its outlook suggests that trend is likely to continue over the next financial year.

Price has driven sales over the last year, which is great for short term gain but not for long term growth

Inflation-weary consumers are making tough choices at the tills, trading down to own-label products for some items rather than paying a premium for brands they often put in their baskets out of habit.

Whether the company always intended to halt increases at this point in the cycle or whether it’s responding to consumer behaviour matters little; what matters is that the consumer goods giant has promised that there are no more price hikes in the pipeline this year.

Price has driven sales over the last year, which is great for short-term gain but not for long-term growth says Executive Vice President and Global Chief Financial Officer Andre Maciel. He said, “…even at the end of the year [volume] will still be negative. That’s something that, as we think about the future, it’s not the negative balance that we want. We want a good balance as we think about top line growth between price and volume.”

Not all companies are on the same page when it comes to price increases, but that could be because they’re starting 2023 from slightly different places.

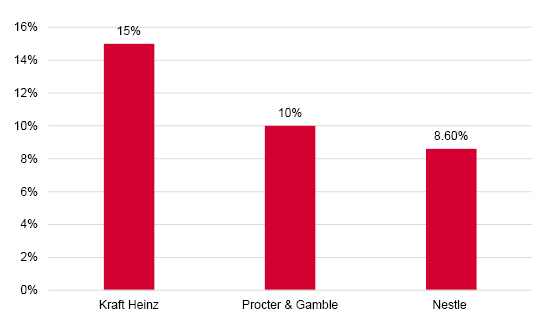

Price increases from packaged food companies 2022

Source: Company accounts

Kraft Heinz has upped the price consumers are paying for its products at a faster pace than some other companies including Nestlé and Procter & Gamble. That could provide the latter two companies with a spot of wiggle room with increasingly savvy shoppers.

It’s not just the consumer they have to keep on-side – retailers are facing their own battle and employing every trick in the book to keep customers spending.

Both companies have said they plan to continue raising prices for now in order to prevent margins being uncomfortably squeezed, but both companies have been clear they’re acutely aware that any additional hikes will need to be targeted and justifiable.

And it’s not just the consumer they have to keep on-side – retailers are facing their own battle and employing every trick in the book to keep customers spending.

In the UK and the US behemoths like Tesco and Walmart are reporting big increases in demand for own-label merchandise, something Walmart’s Chief Financial Officer John David Rainey highlighted to analysts on a recent call, saying: “Our purpose starts by helping people save money and live better. And it's more important than ever in this environment, as consumers manage household budgets more tightly, making frequent trade-offs and biasing spending toward everyday essentials. We're reinforcing our value proposition across our merchandise offering, including featuring high-quality owned brands and leaning into opening price points.”

That trend, their size and public perception seems to be giving them increased power over big brand names. Tesco’s row with both Kraft Heinz and Mars Inc last year saw big gaps on shelves as negotiations on price were resolved, and recent comments from Walmart’s boss that keeping own-brand prices low has historically brought down third-party prices give an insight into what’s going on behind the scenes, and suggest the next twelve months could become increasingly strained.

It’s a complex picture but for companies that get pricing right there are big dividends to be had. Primark owner Associated British Food’s decision not to raise prices last autumn seems to have paid off with shoppers flocking to its stores despite tricky Christmas trading in the UK.

But for those getting it wrong there are conversely huge consequences whatever sector the business is operating in.

Brand power is a mighty weapon but one that can misfire if it’s used in the wrong way

Global fast-food shares fell like dominos after the Australian-listed Domino’s Pizza Enterprises unveiled its latest set of rather grisly results, which sent its own shares plunging 24% and wiped $1.5 billion from its market value.

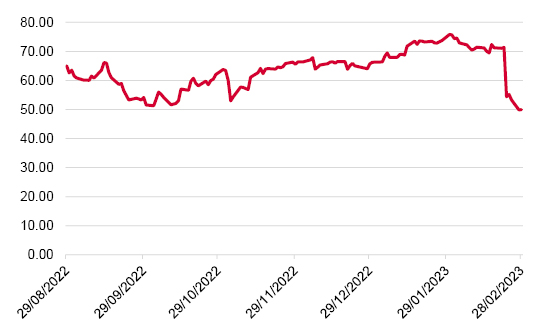

Domino’s Pizza Enterprises 12 month share price performance

Source: Refinitiv

A decision to put up prices put off customers, and the franchisee had to cut dividend payments after the misstep took a 28% bite out of six-month profits.

The company’s chief executive Don Meij admitted: “we just didn’t get it quite right, and it just unwound” referring to a strategy of offering customers “more for more”, which seemed to consist of lifting prices and adding surcharges to try and offset additional costs.

The business is regrouping, and refocusing on its value credentials which it says normally helps it do well during an economic downturn.

It’s a well-worn adage but one that holds true: high prices are the best cure for high prices. Consumers have their own ideas of what to pay. Brand power is a mighty weapon but one that can misfire if it’s used in the wrong way. If consumers feel a business has unduly profited from a situation they will react and remember, and once tarnished it can take a long time for a brand to reshine its image – something investors know only too well.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.