As advisors and investors reading a column aimed at advisors and investors this might seem like a totally bonkers hypothesis. Of course, we want companies to make a profit. We want them to deliver robust performance, to demonstrate pricing power in order to defend margins in turn leading to more generous dividends, share buybacks and a higher share price.

Many shareholders are using these investments to fund their retirement and are fighting their way through their own cost-of-living crisis.

Strong companies create jobs, they invest in crucial infrastructure, and they pay huge amounts of tax to the exchequer.

From a purely self-interested perspective companies want to avoid greater regulatory scrutiny in their sector if they can possibly avoid it.

We could leave it there, but the current inflation situation has raised some pretty chunky fundamental questions that investors and businesses would be wise to consider for their future financial wellbeing.

Politicians, particularly politicians staring down the barrel of an impending election, are feeling increasing pressure to do ‘something’ to help inflation-weary voters.

Big energy has already felt the sting of windfall taxes and supermarkets have been under the uncomfortable glare of the UK competition watchdog.

From a purely self-interested perspective companies want to avoid greater regulatory scrutiny in their sector if they can possibly avoid it.

Energy companies have been warned by Ofgem not to pay dividends until they can demonstrate that they have the financial resilience to deal with future price shocks.

Banks are facing difficult conversations with the FCA about why interest rates on savings accounts haven’t followed the same trajectory as mortgage rates, and supermarkets have become politicians’ favourite “bad guys”, coming under fire for increased margins on fuel and continued pressure on shoppers at the tills.

The possibility of price controls on food has elicited a strident negative response from supermarket CEOs and it’s likely no surprise that days after four food retailing giants were grilled by members of the business and trade committee Tesco unveiled yet another package of price cuts on “everyday essentials”.

And it’s that word that seems to be the most important word in all this: businesses involved in supplying the consumer with the essentials needed to live are facing greater pressure than those offering up discretionary ‘treats’.

Holiday companies might get a raised eyebrow over the massive increase in a two-week trip to the Med and JD Sports might enjoy positive headlines about its push to top one billion pounds in profits next year, but that’s because people are perceived to have choice as to whether they take a holiday or splash out on a pair of ridiculously over-priced trainers.

Stories about people struggling to pay for food, fuel, housing and water frankly don’t belong in a modern Western democracy, and allegations that defending margins is making things worse for the most vulnerable in society leave a nasty taste in even the most capitalist of mouths.

What is an acceptable margin? Looking at newspaper headlines following the CMA’s report into petrol pricing by supermarkets you might be forgiven for thinking any profit at all is unacceptable in today’s climate.

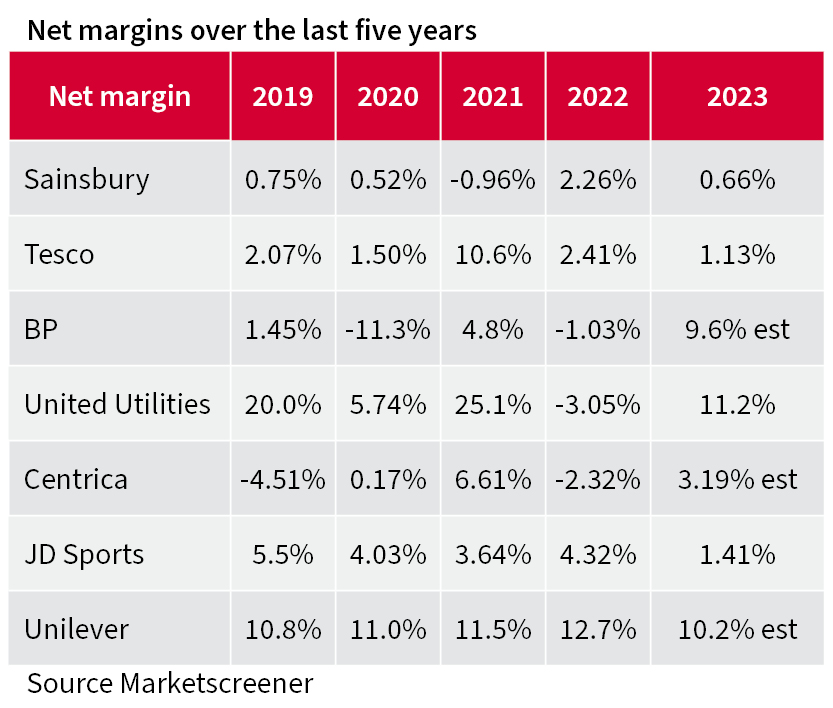

And looking at widely different net margins that some of our biggest listed companies have generated over the years it’s clear there is not a simple story to tell.

Is the practice of even defending margins helping keep the fire burning under the inflation pyre?

But the decision to increase margins on fuel by the new owners of Asda and Morrisons at the peak of the fuel crisis is exactly the kind of action that puts business and shareholders in a bad light, and the consumer doesn’t differentiate between the actions of private-equity or publicly-owned companies.

And that’s another big risk to ponder. Business might have a duty to deliver for shareholders, but they also face a moral obligation to treat their customers fairly.

The S in ESG might not ordinarily get the same amount of attention as its two bookends – Environment and Governance – but consumers have long memories, and they will vote with their feet.

It’s why there’s been so much scrutiny on CEO pay deals and why many shareholders are now prepared to vote against measures they feel are inappropriate when average real wages are failing to keep up with inflation.

There’s also a further consideration. Is the practice of even defending margins helping keep the fire burning under the inflation pyre?

Inflation means higher interest rates and higher interest rates make servicing all that debt being carried by households and businesses alike, more expensive.

It also makes the ability to raise additional funds for expansion or diversification more difficult, and in turn makes UK PLC an ever-ripe target for foreign takeovers.

Yes, investors want the companies that make up their portfolios to make profits, but not at any price.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.