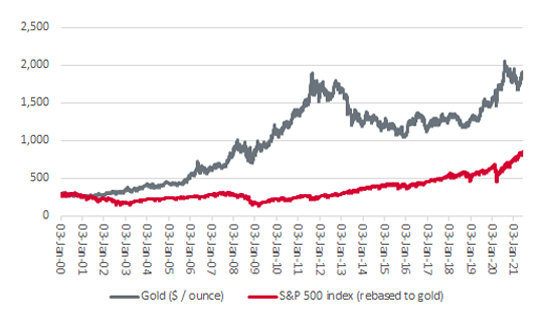

Gold bugs constantly get a kick out of telling those investors who have a heavy weighting toward equities that the precious metal has a better performance record than even the S&P 500 since the turn of the millennium – the commodity is up by 547% at the time of writing, while the American stock index has offered a capital gain of 192% and a total return of 337%, in dollar terms.

Gold has beaten US equities hands down since 2000

Source: Refinitiv data

“Gold’s inability to progress to new highs is reminiscent of its struggles to crack $1,300 between 2013 and 2019 and fits with the view of central banks that the current spike in inflation is merely ‘transitory’.”

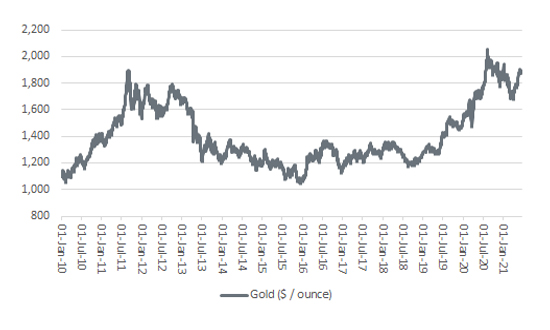

Yet gold buyers may be frustrated by the metal’s inability to break above $1,900 an ounce, especially as inflation is starting to run hot in China, the UK and the US. For many, the return of rises in the cost of living – and the implicit devaluation of the purchasing power of paper money – forms the investment case for gold. The metal’s inability to progress to new highs is reminiscent of its struggles to crack $1,300 between 2013 and 2019 and fits with the view of central banks that the current spike in inflation is merely ‘transitory’, and the result of pent-up demand as economies slowly unlock and supply-chain bottlenecks.

Fans of the precious metal will point to its price chart, which shows the metal’s rapid ascent in the wake of the final, successful assault on $1,300 in May 2019. It shot up by nearly 60% to a peak of $2,053 in just 15 months. Sceptics will counter by pointing to gold’s long slump from 1980 to 2000 as inflation ebbed and argue that the metal will regain its status as a ‘barbarous relic’ if increases in producer and consumer price indices do indeed prove temporary.

Gold surged in 2019 once it broke the $1,300 barrier

Source: Refinitiv data

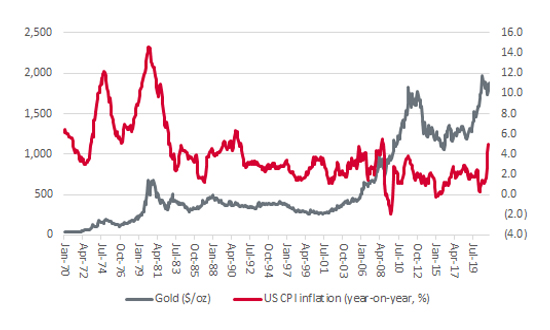

“The past is no guarantee for the future but an analysis of gold’s performance relative to inflation since 1970 helps to explain why fans of the precious metal think that rising prices may bring gold back into the mainstream.”

Every adviser and client knows that the past is no guarantee for the future but an analysis of gold’s performance relative to inflation since 1970 helps to explain why fans of the precious metal think that rising prices may bring gold back into the mainstream when it comes to portfolio allocation strategies.

Gold has a reputation for being a hedge against inflation

Source: Refinitiv data

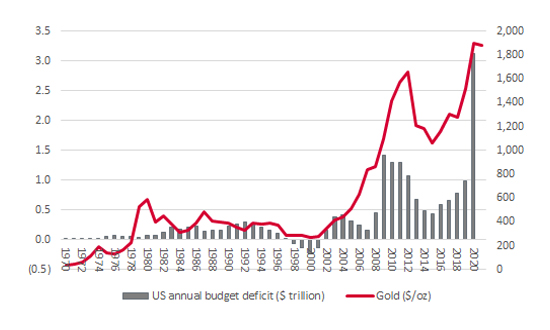

But gathering Government budget deficits, record-low interest rates, quantitative easing and rampant money supply growth are also persuading some advisers and clients to abandon ‘paper’ money and ‘fiat’ currencies in favour of ‘real’ assets.

Some warm to gold as a hedge against deficits and money creation

Source: Refinitiv data, FRED – St. Louis Federal Reserve database

The inflation debate is likely to rage for some time but even the fiercest critic of gold may accept that politicians are still inclined to spend, either to fund what they view as vital, planet-saving projects, support the economy during the pandemic or simply curry favour and buy votes. Austerity is a vote-loser. Granted, the issue of taxation and who should pay more and by how much is gathering pace, but whether it is enough to fund ambitious spending programmes in the US, for example, remains open to questions, even if the Republicans seem unwilling to embrace all of President Biden’s projects. A British Prime Minister whose own personal financial arrangements seem unorthodox at best is unlikely to be a good choice as someone willing to apply rigorous checks and balances toward the use of other peoples’ (taxpayers’) money either.

One reason behind gold’s outperformance of the S&P 500 since 2000 is that the metal was trading at its lowest levels since 1979 back then, after a two-decade bear market, while the US equity market stood near record highs, after a near 20-year bull market.

“As with any investment, the price (or valuation) paid is the ultimate arbiter of investment return. The tricky bit now is that gold is trading near a record peak, in absolute terms, even if the S&P is there already.”

As with any investment, the price (or valuation) paid is the ultimate arbiter of investment return. The trickier bit now is that gold is trading near a record peak, in absolute terms, even if the S&P is there already.

But history suggests Government spending and rising deficits – or profligacy as some gold bugs might term it – are good for gold because investors look for stores of value to preserve their wealth. Gold is hard to find and costly to mine, so supply grows slowly, in contrast to the supply of money.

Warren Buffett is not known to be a fan of gold but the Sage of Omaha touched on this in 1980 nonetheless, when he wrote: “The rub has been that government has been exceptionally able in printing money and creating promises but it is unable to print gold or oil.”

“An unexpected tightening of monetary policy, or a new round of tax rises and hair-shirt fiscal policy, could easily stop gold in its tracks. The question is how able – and willing – central bankers and politicians are to go down those paths.”

An unexpected tightening of monetary policy, or a new round of tax rises and hair-shirt fiscal policy, could easily stop gold in its tracks. The question is how able – and willing – central bankers and politicians are to go down those paths.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.