This column’s regular readers will know of its faith in ‘Dr Copper’ and the commodity’s status as an economic indicator – if copper prices are firm, the economy is usually doing well and vice-versa. Equally, this column takes an equally keen interest in gold, in the view it is not so much a hedge against inflation but a shield against, or potential harbinger of, a loss of control by, or faith in, policymakers when it comes to the wider economy.

“If the line on the chart rises, then copper prices are doing better than gold and if it falls then the precious metal is outperforming the industrial one.”

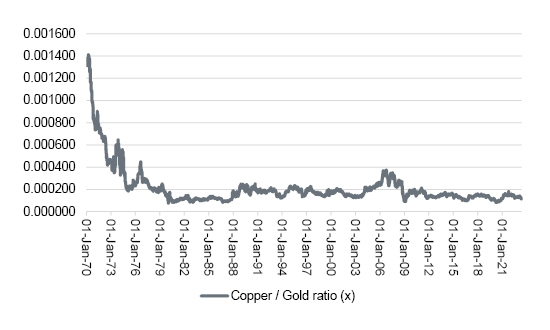

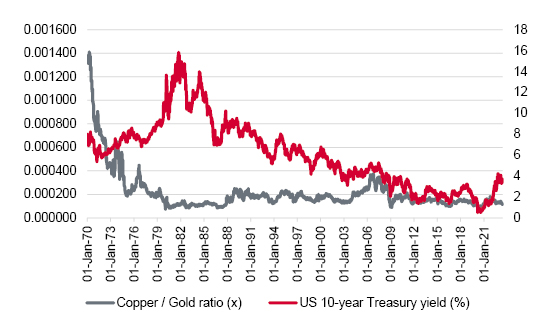

This has prompted a reader’s request to study the copper-to-gold ratio and what it may or may not mean for financial markets more widely. We are happy to oblige and must start by showing how this ratio has developed since the early 1970s when US President Richard M. Nixon withdrew the dollar from the gold standard, scrapped the fixed exchange rate of $35 an ounce and smashed up the Bretton Woods monetary system. Copper is priced in tonnes and gold in ounces, but the conversion is an easy one, as there are 35,270 ounces in a tonne. If the line on the chart rises, then copper prices are doing better than gold and if it falls then the precious metal is outperforming the industrial one.

The copper/gold ratio is trading toward the lower end of its historic range

Source: Refinitiv data

“In sum, the copper/gold ratio plunged in the 1970s as inflation soared and central banks found themselves struggling to rein it in, to the detriment of markets’ faith in them and also politicians’ ability to forge economic growth during a decade of stagflation.”

In sum, the copper/gold ratio plunged in the 1970s as inflation soared and central banks found themselves struggling to rein it in, to the detriment of markets’ faith in them and also politicians’ ability to forge economic growth during a decade of stagflation.

Since 1980s, the ratio has oscillated with copper largely in the ascendant as the deregulatory policies of the Reagan and Thatcher administrations, coupled with the fierce monetary policy of the Volcker-led Fed, crushed inflation and prosperity became the order the day, with minor wobbles in 1987, 1991-92 and 2000-03 along the way.

Then came the Great Financial Crisis and ever since then gold has been persistently stronger, to perhaps suggest to markets that the policy of using ever cheaper debt to solve a debt crisis would not be a lasting solution. And that is where we are today.

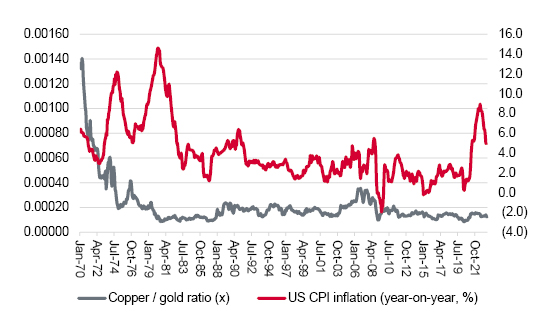

“The past is no guarantee for the future but looking at the copper/gold ratio since 1970, advisers and clients could be forgiven for thinking another inflationary outbreak is on the way, as gold stoutly outperforms its cousin.”

The past is no guarantee for the future but looking at the copper/gold ratio since 1970, advisers and clients could be forgiven for thinking another inflationary outbreak is on the way, as gold stoutly outperforms its cousin.<

The long-term copper/gold ratio could indicate more inflation is on the way …

Source: Refinitiv data

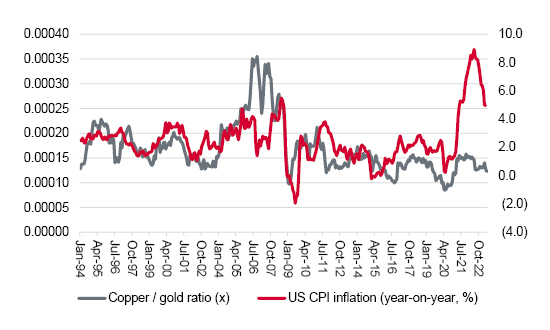

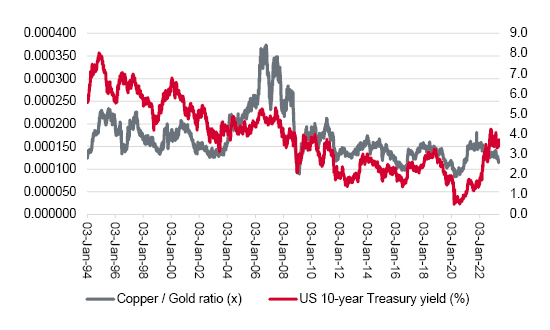

… but a recession could also be coming, if metal traders are on the ball

Source: Refinitiv data

Equally, taking a shorter-term time horizon, the indicator could be implying a deflationary bust, or at least that a recession is on the way. Commodity traders are not sure which but if they are right equity investors may be in for a surprise, as they still seem content to cling to the view that a Goldilocks outcome is the most likely, in the form of a moderation in inflation, a soft landing and carefully controlled pivot to lower interest rates in coming.

“The copper/gold ratio is still 50% above its January 1980 all-time low, so more progress from gold could signal trouble ahead.”

Either way, the copper/gold ratio is still 50% above its January 1980 all-time low, so more progress from gold could signal trouble ahead. Someone is going to be wrong and if the equity markets have it right then copper should start to outperform gold pretty smartly.

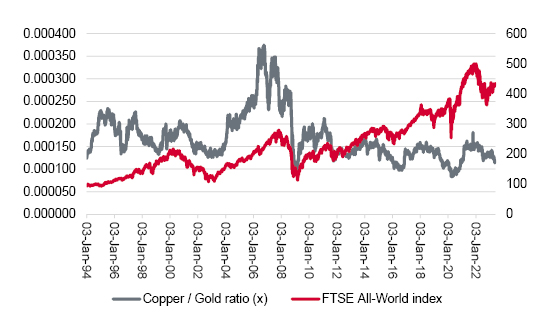

Global equities’ latest rally does not sit easily alongside commodity price action

Source: Refinitiv data

“The stagflationary 1970s look like an outlier on the trend, but that is why its unexpected return could be the worst outcome for all for equity and bond holdings.”

Using the US ten-year Treasury as a proxy, fixed-income markets seem similarly perplexed as to whether the declining copper/gold ratio means inflation, and headline interest rates are going to return to their post-1980s downward trend or a 1970-style upward march. The stagflationary 1970s look like an outlier on the trend, but that is why its unexpected return could be the worst outcome for all for equity and bond holdings.

Government bond markets could welcome gold’s relative strength …

Source: Refinitiv data

… as it may signal demand for haven assets (unless we get a repeat of the 1970s’ stagflation)

Source: Refinitiv data

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.