No adviser or client knows what is coming next, and whether inflation, stagflation or deflation will result from the combination of the interest rate pauses, Quantitative Tightening, pay increases, rising debt and elevated geopolitical tensions.

Basing investment strategies on just one scenario is probably not going to be good idea and portfolio construction may need to address range of outcomes, especially as we have elections to be fought (and electorates to be influenced) on both sides of the Atlantic in the next twelve months.

“Carefully following five major investment themes may help advisers and clients sense which way the wind is blowing so they can try to obtain the best possible risk-adjusted returns for their portfolios, especially once they take the all-important issue of valuation into account.”

Carefully following five major investment themes may help advisers and clients sense which way the wind is blowing so they can try to obtain the best possible risk-adjusted returns for their portfolios, especially once they take the all-important issue of valuation into account.

Debt-to-GDP is one barometer to watch, but according to the Bank of International Settlements it should be studied in conjunction with the percentage of tax income that is used to meet the interest costs. When that latter figure got to around 20% in 2007 (and was still rising), the financial markets buckled and nearly took the global economy with them.

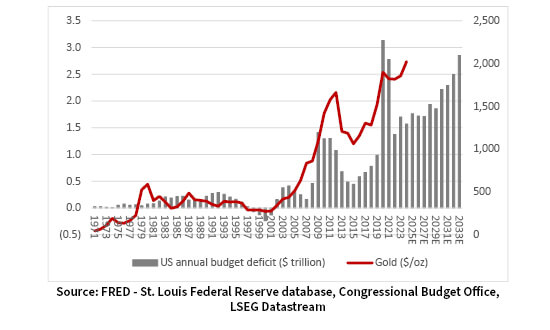

America keeps adding to its deficit at near-record pace

FRED – St. Louis Federal Reserve database, Congressional Budget Office, LSEG Datastream

China and France are the two countries in this invidious position now, but the USA is catching up fast, as the Biden administration spends like fury on the CHIPS and Inflation Reduction Acts.

“America cannot afford to keep interest rates where they are for long and there is a risk that the Fed has to cut rates to keep the burden manageable and take risks with inflation.”

America’s latest annual fiscal deficit was $1.7 trillion, in the year to September 2023, the third-worst number on record, and the annualised interest bill has hit $1 trillion, or 20% of tax income. America cannot afford to keep interest rates where they are for long and there is a risk that the Fed has to cut rates to keep the burden manageable and take risks with inflation. This may be why gold (and Bitcoin, for that matter) are on a roll. Markets are pricing in five rate cuts from the Fed in 2024, but because inflation is cooling and growth benign, not because debt is a problem and interest costs are squeezing economic growth.

The 1970s’ inflationary outburst may have been prompted by loose monetary policy in the UK (and loose fiscal policy in the USA), followed by 1973’s oil price shock, but a vicious circle of higher pay demands, higher prices, higher pay demands, and higher prices then developed.

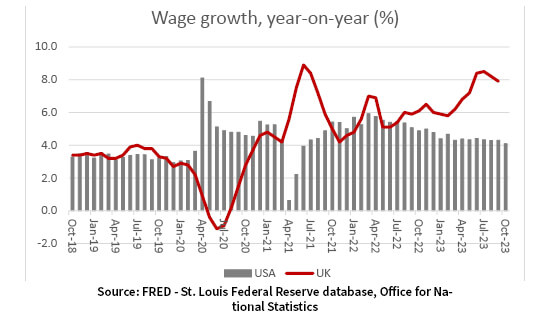

Central bankers keep pleading for pay restraint

FRED – St. Louis Federal Reserve database, Office for National Statistics

“Financial markets may therefore cheer a modest increase in unemployment, and central bankers accept it, as higher joblessness could help to put a lid on wages and inflation and thus provide scope for rate cuts.”

Financial markets may therefore cheer a modest increase in unemployment, and central bankers accept it, as higher joblessness could help to put a lid on wages and inflation and thus provide scope for rate cuts. Equally, a sharp rise in the jobless rate could signal economic trouble, or at least more than is currently factored in by consensus earnings forecasts, so policymakers have a tricky balancing act here.

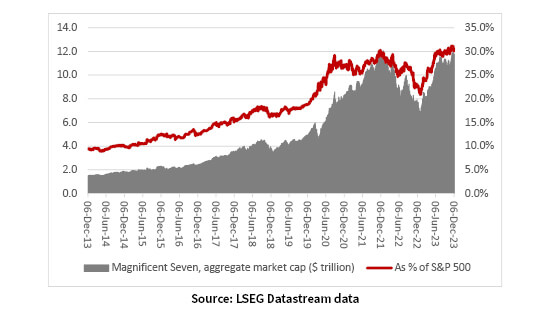

The stock markets’ rally in 2023, and the return to favour of Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA and Tesla, suggests equities are pricing in an economic soft landing and a return to the low-growth, low-inflation and low-interest-rate environment of the 2010s that did so much to help the performance of long-duration assets like bonds and growth sectors, such as technology.

Magnificent Seven’s market cap represents 30% of the S&P 500

LSEG Datastream data

They might be right. But if they are wrong – and those five Fed rate cuts do not appear on schedule in 2024 – then the Magnificent Seven’s aggregate $11.8 trillion market cap could look exposed, for all of their dominant positions in their respective industries. Their share price and profit wobbles of 2022 showed they are not entirely immune to the economic cycle, so an unexpected recession could be one challenge. Sustained inflation could be another if it keeps rates higher than expected and boosts nominal growth from downtrodden cyclicals and value stocks. Again, only a perfect middle path may do.

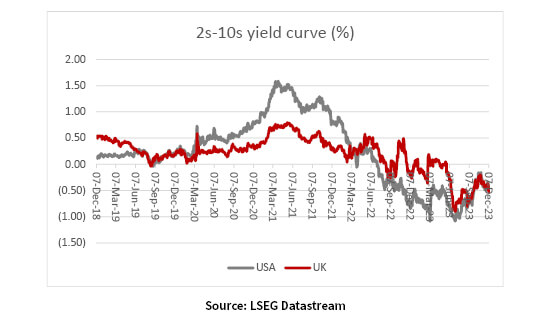

“Bond yields are falling again, but the yield curve remains inverted, whereby ten-year yields on Government bonds are lower than those on the two-year in the UK and USA.”

Bond yields are falling again, but the yield curve remains inverted, whereby ten-year yields on Government bonds are lower than those on the two-year in the UK and USA. This is seen as a warning that a recession is on the way, as it means bond markets are factoring in interest rate cuts (the ten-year would usually have to offer a higher yield to compensate holders for the extra risk scope for things to go wrong over the longer lifespan of the debt).

The yield curve is still inverted on both sides of the Atlantic

LSEG Datastream data

It is not an infallible signal, but examples of soft economic landings are hard to find and stock markets are currently doing their best to ignore the bond market’s quite different message.

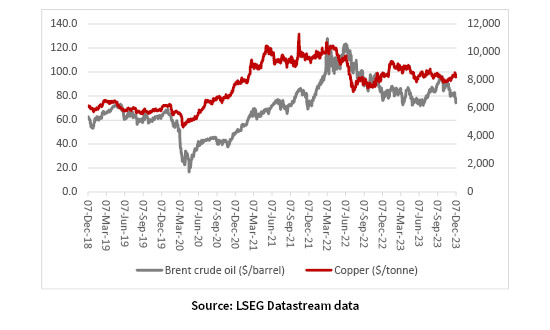

If equities are pricing in a soft landing and fixed-income markets a harder one, commodity traders are even more confused. Oil’s renewed weakness may speak of recession. Copper, a reliable indicator of global economic health due to its many uses, is doing nothing. Gold looks to be fretting about debts and stagflation.

Oil and copper may be flagging economic weakness

LSEG Datastream data

“The messages from stocks, bonds and raw materials are therefore contradictory.”

The messages from stocks, bonds and raw materials are therefore contradictory. But such are the globe’s debts that it seems likely central banks (and politicians) would rather play fast and loose and risk inflation or stagflation than recession and deflation. The experiences of 2007-09 and 2020-21 would suggest as much, anyway.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.