No investment indicator is infallible – if it were, none of us would be working and all of us would be playing the markets (only to find, ultimately, that there would be nothing in which to invest except each other’s investments).

“The curve in the UK stands at its steepest since August 2019, while in the US, the yield premium offered by ten-year US Treasuries relative to two-year paper is at its highest since October 2017.”

However, one which is generally held to stand the test of time is the yield curve, so advisers and clients may be intrigued to learn that the curve in the UK stands at its steepest since August 2019, while in the US, the yield premium offered by ten-year US Treasuries relative to two-year paper is at its highest since October 2017.

In theory, this is the bond markets’ way of saying that an economic upturn, and possibly inflation, are coming. This is a view which has considerable implications for financial markets and asset allocation strategies overall, as well as fund and specific stock selection strategies.

In general terms, there are four types of yield curve, using the difference in yield between two- and ten-year Government bonds as a benchmark.

12-to-18 months ago, all of the talk was of how yield curves were inverting and how that could have been warning of trouble ahead (though no-one would pretend that fixed-income markets saw the pandemic or subsequent recession coming).

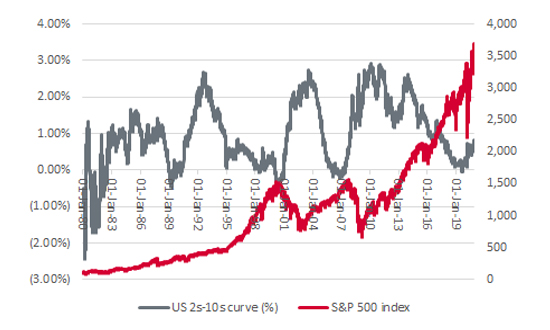

“The yield curve is now steepening in the US, a trend which characterised the early stages of the bull equity markets that began in 1982, 1990, 2002 and 2009.”

The picture is quite different now. Buoyed by further momentum, the race for a COVID-19 vaccine and further fiscal stimulus from Congress, combined with further monetary largesse from the US Federal Reserve, the yield curve is now steepening in the US, a trend which characterised the early stages of the bull equity markets that began in 1982, 1990, 2002 and 2009.

The yield curve stands at its steepest in over three years

Source: Refinitiv data

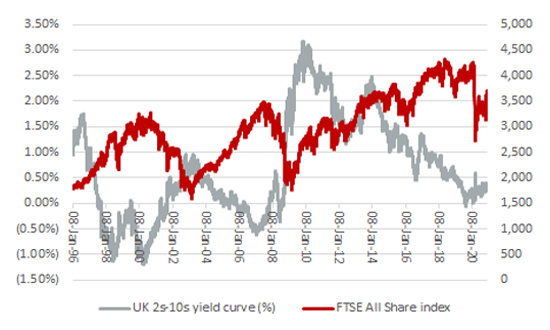

Admittedly, Japan’s experiences since 1990 suggest the yield curve can be a poor predictor of economic activity but the yield curve has had its uses in the UK. Inverted yield curves in 2000 and 2007 helped to call the top for the FTSE All-Share index but a clear steepening marked the beginning of bull runs in 1998, 2003 and in the early stages of the last decade.

The UK yield curve is also steepening

Source: Refinitiv data

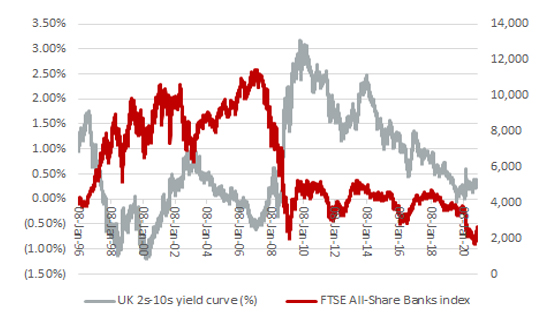

There may be further implications below the level of headline indices. Banking stocks, for example, have been crushed by central banks’ efforts to keep yields low (and, by implication, yield curves flat) as they try to help governments fund their burgeoning debts. A steeper curve could boost banks’ net interest margins, earnings power, share prices and ability to pay dividends. This could be influential in the UK market, for example, where the FTSE 100’s Big Five banks are so integral to earnings and dividend growth forecasts.

Banking stocks could well benefit from a steeper yield curve

Source: Refinitiv data

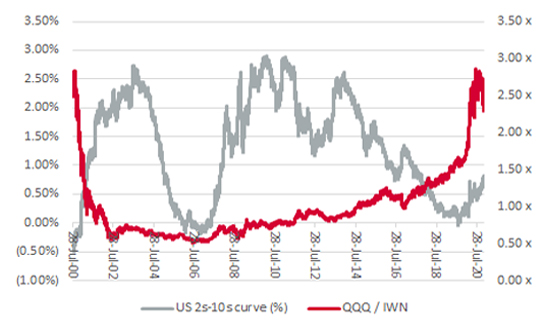

“A steeper yield curve, hinting as it does at a stronger economy and inflation, seems to favour cyclical earnings growth over secular earnings growth – or, to put it more crudely, ‘value’ as a style over ‘growth’ – at least if history is any guide.”

Even more intriguingly, a steeper yield curve, hinting as it does at a stronger economy and inflation, seems to favour cyclical earnings growth over secular earnings growth – or, to put it more crudely, ‘value’ as a style over ‘growth’ – at least if history is any guide.

As this column has noted (30 October 2020), value has tried to forge a recovery relative to growth, using the ratio of the price of the Invesco QQQ Trust, an exchange-traded fund (ETF) designed to track and deliver the performance of the heavyweight NASDAQ 100 index (minus its running costs), relative to the iShares Russell 2000 Value ETF, as a benchmark.

‘Value’ seems to be taking its lead from a steeper curve too

Source: Refinitiv data

Some are wondering if this trade is already exhausted. Looking back at 2000, you could argue that it has hardly begun, such was the violence of the switch from growth to value as the former began to falter under the twin weights of lofty valuations and earnings disappointment.

Russ Mould, AJ Bell Investment Director.This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.