Tesla wiped the floor with analysts’ consensus forecasts for its third-quarter results and Netflix missed, to get the reporting season off to a mixed start so far as momentum-fuelled technology stocks are concerned. Netflix’s shares sagged and Tesla’s advanced only modestly to again raise the issue of valuation and just whether there is so much good news baked into these stocks that they may find it hard to make further headway, at least in the near term.

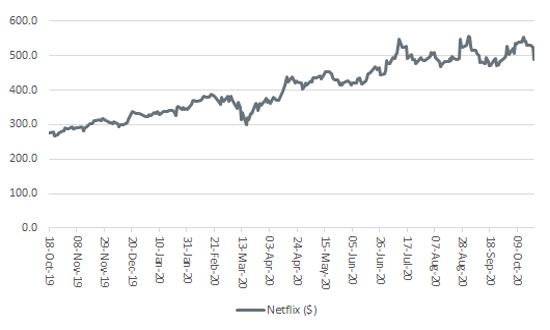

In this context, Netflix’s fourth failure to break through the $550-a-share mark is particularly eye-catching, even if the temptation to run with the narrative that technology stocks are relatively immune to the pandemic – and worthy of premium valuations because of the relative scarcity of consistent earnings growth right now – is quite understandable.

$550 is proving a hard barrier to break for Netflix’s shares

Source: Refinitiv data

“‘Growth’ stocks in the US have shown ‘value’ stocks a clean pair of heels over the past decade and since 2017 in particular. Any reversal of fortunes could have profound implication for fund selection, if not wider strategic asset allocation.”

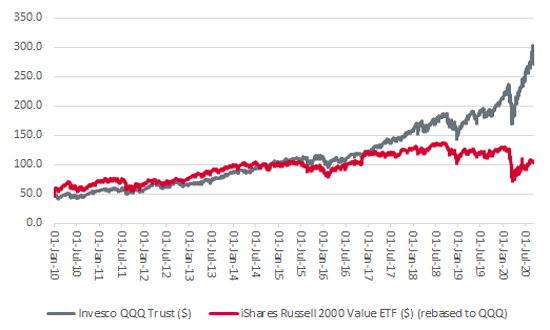

Such stock-specific niceties may be beyond time-pressed advisers and clients but they do beg a bigger issue, namely whether now is the time to (once again) address the outperformance of ‘growth’ stocks relative to perceived ‘value’ names. After all, ‘growth’ stocks in the US have shown ‘value’ stocks a clean pair of heels over the past decade and since 2017 in particular. Any reversal of fortunes could have profound implication for fund selection, if not wider strategic asset allocation.

This trend can be seen by analysing the performance of the Invesco QQQ Trust, an exchange-traded fund (ETF) designed to track and deliver the performance of the heavyweight NASDAQ 100 index (minus its running costs), relative to the iShares Russell 2000 Value ETF, which seeks to do the same for a basket of around 1,400 American small-cap ‘value’ stocks:

‘Growth’ has outperformed ‘value’ to a stunning degree over the past decade

Source: Refinitiv data

“Since January 2010, the iShares Russell 2000 Value ETF is up by 135% in capital terms, for a compound annual return of 8.2% – so it is hard to argue that ‘value’ has ‘failed’ as a strategy. What is clear is that ‘growth’ has simply done so much better.”

Since January 2010, the iShares Russell 2000 Value ETF is up by 135% in capital terms, for a compound annual return of 8.2% – so it is hard to argue that ‘value’ has ‘failed’ as a strategy. What is clear is that ‘growth’ has simply done so much better, offering a 521% return, or a compound annual growth rate of 18.5%, as benchmarked by the Invesco QQQ Trust.

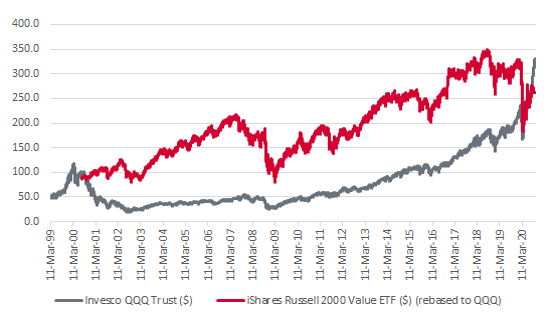

The performance gap between the two stands at a decade high but the last decade’s stellar outperformance from ‘growth’ has only just begun to cancel out the prior decade’s grinding period of marked underperformance relative to ‘value’, taking 2000’s launch of the iShares Russell 2000 Value ETF as a starting point.

The period 2000–2010 belonged unequivocally to ‘value’ stocks

Source: Refinitiv data

That miserable 10-year showing followed the bursting of the tech, media and telecoms (TMT) bubble, so advisers and clients with exposure to growth-style funds, be they active or passive, now need to ask themselves whether they should fear a repeat.

Valuation alone is never a catalyst for out- or underperformance, but it is the single biggest determinant of long-term investment returns (and a decade seems like a suitable definition of ‘long-term’). If tech earnings keep growing and surprising on the upside, if interest rates stay low, if inflation stays subdued and the Facebooks and Apples of this world use the combination of product innovation and acquisitions to maintain and even deepen their powerful competitive advantages, then many investors will be tempted to dismiss valuation as an irrelevance.

But the trouble could start if regulators begin to take a hand, earnings disappoint (as Big Tech does not prove to be immune to the pandemic after all or the law of large numbers means it simply becomes harder to generate strong percentage growth figures) or the wider economy starts to accelerate and inflation picks up.

None seem likely now but that it why ‘growth’ has done so well relative to ‘value’.

If a COVID-19 vaccine is quickly and successfully developed and distributed, then stocks which are seen as ‘immune’ from the pandemic may be less in demand and considered to be less worthy of a premium valuation.

Equally, if growth and inflation pick up, then investors may not be so inclined to pay such premium multiples for ‘growth’ companies, if rapid earnings increases can be acquired much more cheaply along downtrodden value, cyclical plays like industrials, financials and the consumer discretionary sector.

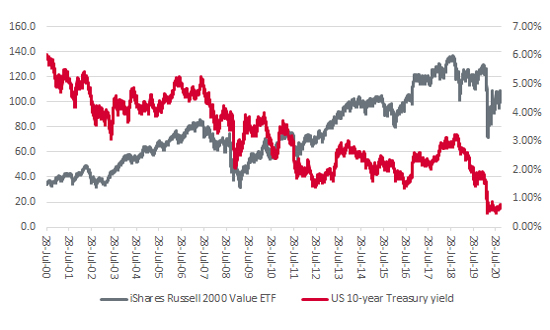

Moreover, an increase in inflation could force government bond yields higher, even if central banks decline to raise interest rates and let inflation run hot, as per the US Federal Reserve’s new ‘average’ inflation target.

‘Value’ stocks may need rising bond yields to turn the tide

Source: Refinitiv data

“Prior periods of rising 10-year US Treasury yields have coincided with attempted rallies in ‘value’ names, so perhaps a return to economic growth and inflation could be the trigger for a sustained period of underperformance from ‘growth’ and ‘tech’ stocks relative to value ones.”

Prior periods of rising 10-year US Treasury yields have coincided with attempted rallies in ‘value’ names, so perhaps a return to economic growth and inflation could be the trigger for a sustained period of underperformance from ‘growth’ and ‘tech’ stocks relative to value ones.

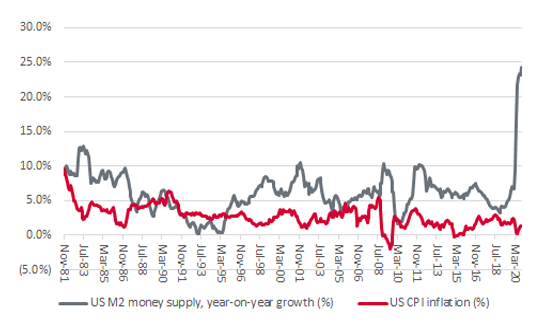

“While the concept of rising inflation may seem fanciful for now, the latest money supply growth figures from the US in particular are eye-popping.”

And while the concept of rising inflation may seem fanciful for now, advisers and clients should not forget that this is what central banks and governments crave to help the globe manage its crushing debts, so they may stop at nothing until they get it. The latest money supply growth figures from the US in particular are eye-popping and should be followed closely as a potential lead indicator.

US money supply growth is absolutely booming

Source: FRED – St. Louis Federal Reserve database

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.