Given the rate at which Prime Ministers (and Chancellors of the Exchequer) seem to come and go, investors may be inclined to avoid second-guessing the result of the next General Election, even as the Conservatives’ Rishi Sunak drops hints of an autumn ballot, and the opposition Labour Party starts to finalise its manifesto.

The lack of available cash in the Government’s kitty, the Conservatives’ occasionally frayed relationship with ‘business’ and the likelihood that Labour took on board Trussonomics’ lesson that unfunded promises could prompt chaos may all mean that advisers and clients could be in the mood to take Sir Kier Starmer’s big lead in the polls, and any eventual victory, in their stride.

Moreover, the current Conservative Government, whose tenure dates back to 2010 and covers a flurry of five Prime Ministers, could be seen as having taken an increasingly interventionist approach to the economy, given such initiatives as sugar taxes, Help to Buy, energy price caps, windfall taxes on North Sea oil producers, 2021’s National Security and Investment Act and additional levies on housebuilders’ profits.

“Increasingly vocal and forceful regulators, such as the Financial Conduct Authority, Ofcom, Ofgem, Ofwat and the Competition and Markets Authority, also appear to be responding to public pressure for greater action, and perhaps the hardest part for advisers and clients (or their appointed fund managers) going forward will be spotting which industry or sectors will come under scrutiny next, in the wake of such recent examples as betting, funeral services and veterinary services.”

Increasingly vocal and forceful regulators, such as the Financial Conduct Authority, Ofcom, Ofgem, Ofwat and the Competition and Markets Authority, also appear to be responding to public pressure for greater action, and perhaps the hardest part for advisers and clients (or their appointed fund managers) going forward will be spotting which industry or sectors will come under scrutiny next, in the wake of such recent examples as betting, funeral services and veterinary services.

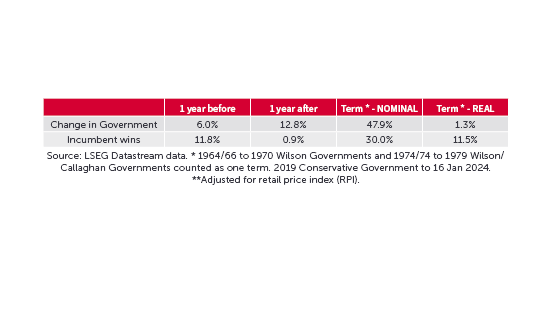

Advisers and clients may nevertheless be tempted to look at the FTSE All-Share’s history since its launch in 1962 to see if the sixteen general elections and thirteen Prime Ministers over that timespan offer any clues as to what may happen this time around, and whether any reviews of strategic UK equity allocations are required.

A study of all sixteen polls and thirteen national leaders suggests the following:

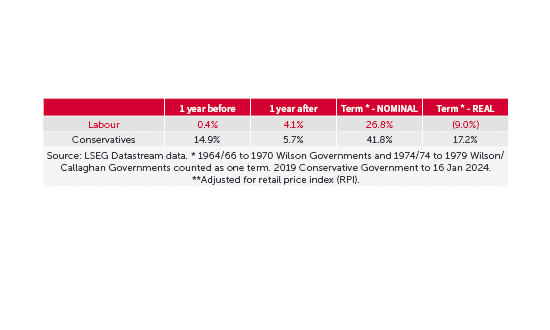

The FTSE All-Share has often reacted positive to a change in Government

Source: LSEG Datastream data. * 1964/66 to 1970 Wilson Governments and 1974/74 to 1979 Wilson/Callaghan Governments counted as one term. 2019 Conservative Government to 16 Jan 2024. **Adjusted for retail price index (RPI)

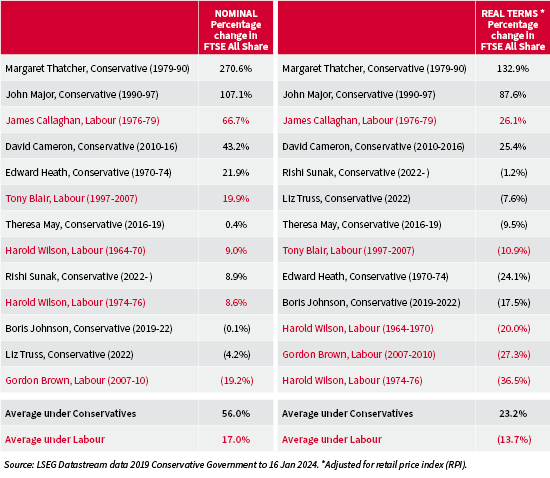

The FTSE All-Share has, on average, done better under Conservative governments

Source: LSEG Datastream data. * 1964/66 to 1970 Wilson Governments and 1974/74 to 1979 Wilson/Callaghan Governments counted as one term. 2019 Conservative Government to 16 Jan 2024. **Adjusted for retail price index (RPI)

“Size of majority is of little concern to the stock market (even if it is hugely important to the PM) and a much greater factor for investors is inflation. Ultimately, the economic backdrop is the real key, rather than the identity of the PM or their political persuasion.”

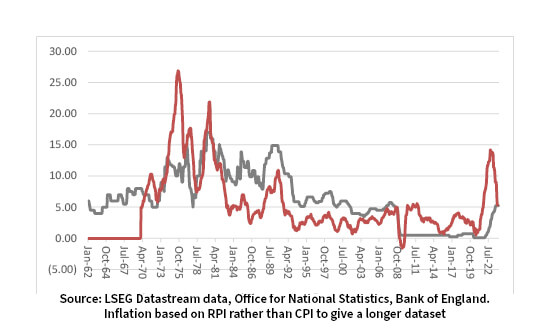

Inflation is a key factor when it comes to assessing UK equity returns by Prime Minister

Source: LSEG Datastream data 2019 Conservative Government to 16 Jan 2024. *Adjusted for retail price index (RPI)

This is not to make a political point, but an economic one. As former US President Bill Clinton’s strategist, James Carville, argued ahead of the then Arkansas Governor’s 1992 election win, ‘It’s the economy, stupid.’ If the voters feel flush, they are more likely to vote for the incumbent Government and less so if not and inflation is a key part of that.

“The galloping inflation of the 1970s, and subsequent labour unrest, did for both the Tories’ Ted Heath in 1974 and Labour’s James Callaghan in 1979. In the latter case, public appetite for a change of tack was particularly strong and ushered into power the nation’s first female Prime Minister.”

The galloping inflation of the 1970s, and subsequent labour unrest, did for both the Tories’ Ted Heath in 1974 and Labour’s James Callaghan in 1979. In the latter case, public appetite for a change of tack was particularly strong and ushered into power the nation’s first female Prime Minister.

The 1970s’ galloping inflation hurt Labour’s reputation for almost two decades

Source: LSEG Datastream data

Gordon Brown had little or no chance, having had the bad luck to preside over the Great Financial Crisis of 2007-09 and Tony Blair’s second term coincided with the bursting of the technology, media and telecoms bubble, the blame for which could not be laid at Downing Street’s door under any circumstances.

What will be interesting this time around is the degree to which inflation and the economy shape public thinking once more. The Brexit vote dealt Theresa May a difficult hand and the pandemic gave Boris Johnson a dud one, but the public will remember inflation and the cost-of-living crisis. Regardless of whether they blame that on the Bank of England’s monetary experimentation, supply chain dislocations caused by the pandemic, the oil price spike that followed Russia’s invasion of Ukraine, or just stick it on the Government may be a crucial factor in how the next General Election plays out and how stock, bond and currency markets subsequently respond.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.