It was former US President Bill Clinton’s Economic Adviser James Carville who said that if he were reincarnated, he would like to come back as the bond market because then “you can intimidate everybody.” Now that US bond yields are surging and prices are falling, stock market investors need to seriously think about whether it is time to be frightened or not.

“It was former US President Bill Clinton’s Economic Adviser James Carville who said that if he were reincarnated, he would like to come back as the bond market because then “you can intimidate everybody.” Now that US bond yields are surging and prices are falling, stock market investors need to seriously think about whether it is time to be frightened or not.”

US ten-year Treasury yields are still way below the prevailing rate of inflation, which suggests that fixed-income investors either do not believe in the US Federal Reserve’s apparent new-found resolution to tighten monetary policy, or fear that a recession will strike first and force the American central bank to quickly backtrack (again). The US yield curve, where the yield is almost lower on ten-year paper than it is on two-year Treasuries, suggests the latter argument may be gaining currency.

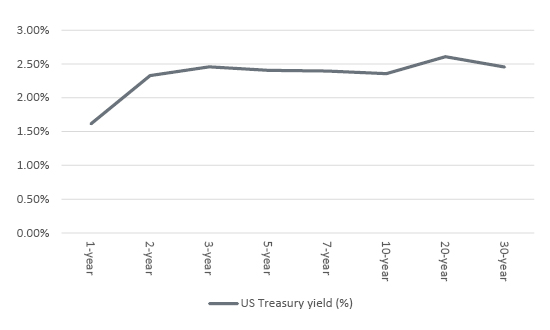

The ten-year US Treasury yield stands at 2.36%, a level last seen in May 2019, but that is still miles below the prevailing rate of inflation of 7.9%.

US ten-year Treasury yields are rising sharply

Source: Refinitiv data.

“The strange shape of the US yield curve implies that holders of US Treasuries are far from convinced that the Fed will follow through on its threats of faster interest rate rises and Quantitative Tightening (QT) from May onwards, should it deem them necessary.”

The strange shape of the US yield curve implies that holders of US Treasuries are far from convinced that the Fed will follow through on its threats of faster interest rate rises and Quantitative Tightening (QT) from May onwards, should it deem them necessary. Again, yields are nowhere near the prevailing rate of inflation and are instead closely hugging the five-year, five-year-forward inflation expectation of 2.3%.

In many ways it is easy to understand why. In early February the bond market had priced in a half-point rate rise only for Fed officials to tamp down that expectation, partly as the Russian invasion of Ukraine intervened, and ultimately deliver a quarter-point increase. Nor did the Federal Open Markets Committee deliver its promised plan for QT. For all of its tough talk, the Fed is still running the second-lowest base rate and the biggest balance sheet in its history. Policy is therefore still ultra-loose, even as inflation gallops higher. The Fed’s calling wolf is therefore failing to convince.

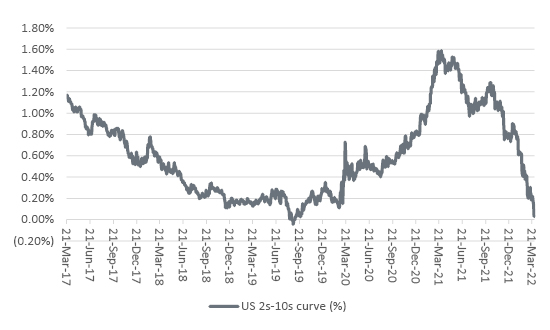

US yield curve looks oddly flat

Source: Refinitiv data.

Perhaps bond markets are thinking about why the Fed is moving so ponderously, especially after chair Jay Powell’s admission its initial analysis – that inflation was transitory – is proving well wide of the mark, at least so far.

Fixed-income investors may still think that inflation will fizzle, as the best cure for high prices proves to be high prices and consumers and corporations simply buy less. It may also be that the surge in demand which followed the easing of lockdowns peters out, especially as tax breaks and fiscal stimulus are being taken away just as monetary policy is being tightened. Indeed, that combination speaks loudly of the risk of a slowdown in economic activity, and the bond market is getting close to giving what is often seen as a classic warning of recession – namely an inverted yield curve.

Usually, long-term interest rates are higher than near-term ones, to price in future rate rises in the view that central banks will act to stop an economy from overheating. However, on some occasions, long-term rates come in below near-term ones, as markets price in interest rate cuts in the view that central banks will have to step in and boost a flagging economy or even stave off a recession.

US 2s-10s curve is at its flattest since autumn 2019

Source: Refinitiv data.

“Someone, somewhere thinks the US economy may be about to lose momentum, and fast, because the 2s-10s curve is at its flattest since autumn 2019.”

This is usually measured by tracking the difference between 2-year and 10-year bonds and is known as the 2s-10s curve. Right now, the yield differential between the two is closing right up and stands at just 0.03%, compared to more than one percentage point just six months ago. Someone, somewhere thinks the US economy may be about to lose momentum, and fast, because the 2s-10s curve is at its flattest since autumn 2019, when US economic data were softening, chaos was about to break out in the US interbank repo market and the Fed stepped in with support before the pandemic broke out.

“Granted the 2s-10s curve is far from an infallible indicator but the Federal Reserve must be treading carefully for a reason and stock market investors should take heed, as inverted yield curves tend to suggest there is trouble ahead for the S&P 500 index.”

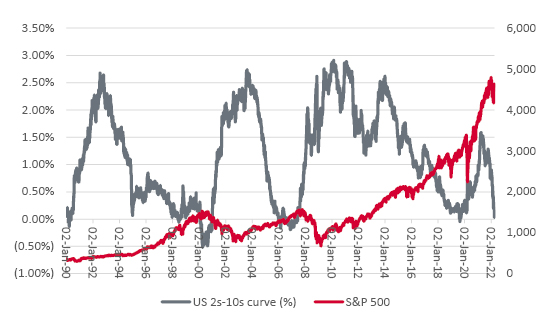

Perhaps bond markets are sending a cautionary signal, but they may be more worried about a recession than inflation. Granted the 2s-10s curve is far from an infallible indicator but the Federal Reserve must be treading carefully for a reason and stock market investors should take heed, as inverted yield curves tend to suggest there is trouble ahead for the S&P 500 index.

Inverted yield curves often herald trouble for US equities

Source: Refinitiv data.

The inverted yield curves which forewarned of economic downturns in 2000, 2007-08 and again in 2020 were followed by bear markets and falls of at least 20% in the US stock market.

Right now, the S&P500, NASDAQ and Dow Jones indices do not seem to care, as they are up since Russia’s attack on Ukraine. But on the face of it, either the stock market or the bond market has got it wrong.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.