The Greek tragedian Aeschylus may have counselled that “The future you shall know when it has come; before then forget it.” But advisers and clients must think about the future, as financial markets are constantly seeking to price in – or discount – events before they happen, and they have multiple cross-currents to consider in 2021.

“After 2020’s game of two halves, when markets switched from pandemic, panic and worrying about price deflation to thinking about vaccines, recovery and the return of inflation, advisers and clients need to think about whether five key trends from the second half of this year will continue or not in the coming 12 months and beyond.”

After 2020’s game of two halves, when markets switched from pandemic, panic and worrying about price deflation to thinking about vaccines, recovery and the return of inflation, advisers and clients need to think about whether five key trends from the second half of this year will continue or not in the coming 12 months and beyond.

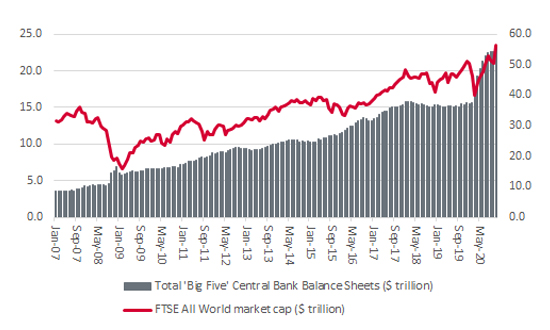

Markets have fallen in ever greater thrall to the monetary authorities since Alan Greenspan and the Fed co-ordinated a bailout of the LTCM hedge fund in 1998 as the Russian debt crisis broke, and each subsequent economic or market dislocation has been greeted with ever-deeper interest rate cuts and then ever-greater amounts of Quantitative Easing (QE). Promises that QE is a temporary or emergency measure, or that the bonds acquired will be sold, are now surely fit only for the dustbin and the only guessing game is how much more stimulus do central banks add, under whatever acronym or guise they choose, and what effect does it have on savings, inflation, economies and asset prices.

“While central banks may feel they are – still – failing in their attempts to stoke consistent growth and inflation, it can be argued that they are doing a lot to fuel asset prices.”

In truth, no-one knows, but while central banks may feel they are – still – failing in their attempts to stoke consistent growth and inflation, it can be argued that they are doing a lot to fuel asset prices. Global equities do seem to be feasting on the cheap liquidity provided by the asset purchase (QE) programmes run by the Bank of England, Bank of Japan, European Central Bank, Swiss National Bank and the US Federal Reserve, at least if the market cap of the FTSE All-World equity index is any guide.

For better or worse, central banks are likely to remain centre stage in 2021, especially as they seem to be forming a consensus that they want to let inflation run hot – although that assumes they can get it going in the first place, after a dozen, post-crisis years of failing to consistently get inflation to their 2% target.

Central bank assets continue to grow at great speed

Source: Bank of England, Bank of Japan, European Central Bank, Swiss National Bank and the US Federal Reserve, Refinitiv data

Faced with the extraordinarily difficult decisions that had to balance the physical, mental and financial health of their respective populations, central banks and governments have acted in the manner they felt was best to provide support during the pandemic and lockdowns.

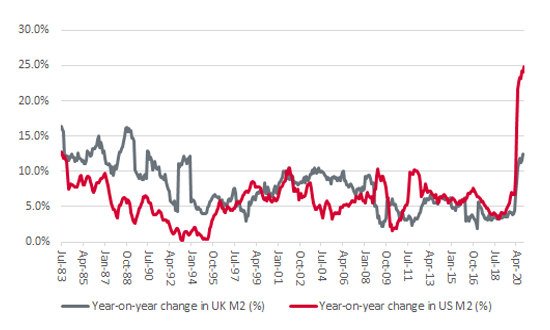

As a result of zero- or negative-interest-rate policies, QE and a host of welfare programmes and initiatives involving state-guaranteed loans, there is a lot of new cash sloshing around. This does not guarantee inflation, by any means – for that, velocity of money is also required. But if banks start lending (of their own free will or at governments’ behest) or food and fuel prices tick up and workers start demanding more pay (and then spending it), there could still be an inflationary surprise in store.

Money supply growth is surging on both sides of the Atlantic

Source: Refinitiv data, FRED – St. Louis Federal Reserve

Rising unemployment is a strong counterargument to the thesis that calls for higher inflation, and a sustained inflation would still be a huge surprise to many should it develop, especially after more than a decade of low growth, low inflation and zero interest rates. The playbook for advisers and clients in this environment has been fairly straightforward: buy long-dated assets, buy bonds, buy equity growth (such as tech), and forget commodities, forget equity value, and forget emerging markets.

If we do get any inflation – and it is by no means guaranteed, as even now five-year forward, inflation expectations in the US are touching just 2% – then the playbook would potentially have to reverse, at least if history is any guide, and providing we did not return to the galloping prices rises of the 1970s.

If we got a dose of inflation, then cyclical and value equities, emerging market equities and commodities – all short-duration assets – could all make a comeback at the expense of those long-duration ones like bonds and ‘growth’ equities. Cash would also become a bit of a hot potato as well, as inflation eroded its purchasing power.

“There are already subtle signs that markets may be positioning themselves for this shift from disinflation/deflation to inflation and therefore from secular growth to cyclical growth (although a prolonged pandemic or double-dip recession could put recovery plays back in the cold).”

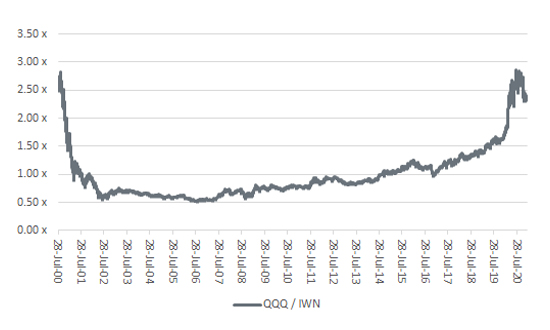

There are already subtle signs that markets may be positioning themselves for this shift from disinflation/deflation to inflation and therefore from secular growth to cyclical growth (or from ‘growth’ to ‘value’ when it comes to investment style and stock selection), although a prolonged pandemic or double-dip recession could put recovery plays back in the cold.

While technology was the equity story of 2020, as many tech firms helped consumers and companies cope with the pandemic, lockdowns and new working and operating environments, cyclical growth – or value – has been outperforming tech and secular growth since July.

This can be measured by gauging the performance of two exchange-traded funds (ETFs) in the US: the QQQ Invesco Trust, which follows the price of the biggest non-financial stocks on the NASDAQ, and the Russell 2000 Value ETF.

If the line on this chart goes up, growth is outperforming. If it goes down, value is outperforming.

And if any adviser or client thinks the post-summer move is big, they need to look at the left-hand side of the chart and check out the violent manner in which tech and growth fell from favour and value returned to it once the tech bubble peaked in 2000.

Cyclical growth equities – or ‘value’ – are starting to outperform secular growth stocks

Source: Refinitiv data

Any continuation or acceleration of this subtle shift from growth to value could have big implications for advisers’ and clients’ portfolios and their asset allocation strategies.

Even if the trend does continue – and it remains an ‘if’ – it would not necessarily mean that tech is going to collapse, as it did in 2000–2003, but it could put a big lid on it. And since tech has done so much to drive US outperformance over the past decade, maybe any return of inflation could see emerging markets, Japan, even the UK have their moment again, as they are more export-driven, more exposed to recovery plays and cyclicals and look cheaper on many metrics than the US market.

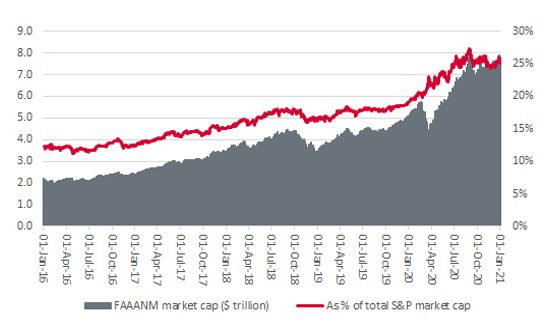

“Facebook, Alphabet, Amazon, Apple, Netflix and Microsoft have added $2.4 trillion in market cap, or 70% of the S&P’s total value gain, over the past 12 months.”

The influence of the FAAANM sextet – Facebook, Alphabet, Amazon, Apple, Netflix and Microsoft – has been huge in helping to drive the S&P 500 higher in 2020. Over the past year, they have added $2.4 trillion in market cap, or 70% of the S&P’s total value gain.

Technology remains vital to the performance of US equity markets

Source: Refinitiv data

If this sextet and tech do run out of steam, weighed down by their own valuations, regulatory pressure or even earnings disappointment, then advisers and clients may face a tricky choice in terms of country, sector and stock selection. Conversely, should inflation stay in its box and disinflation or deflation still rule, then we could easily see the trends of the last 10 years simply keep on running, all other things being equal.

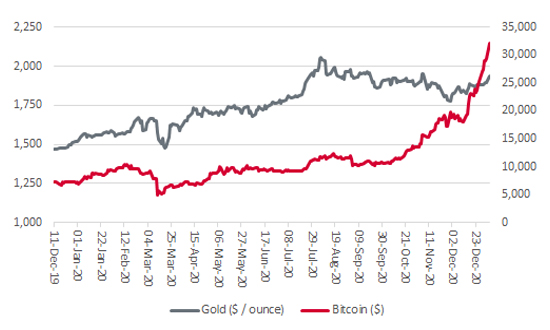

There is a school of thought that buying what is popular is not a recipe for doing well and – to paraphrase Jim Rogers – moving away from the action is the best way to find the new action – and you could say this worked in 2020. Neither bitcoin nor gold garnered much attention at the turn of 2020, yet both had good years – gold briefly forged a fresh all-time high and bitcoin ultimately went bananas.

Gold and especially bitcoin seem to be back in vogue

Source: Refinitiv data

Some advisers and clients will argue that there is more to come from both gold and bitcoin, especially if governments keep piling up debts and central banks do their best to fund that borrowing through the backdoor with QE, zero interest rates and bond yield manipulation, thanks to the scarcity value relative to cash.

Others will argue neither gold nor bitcoin have intrinsic value, as they do not generate cash.

Yet again in 2021, advisers and clients will get their chance to pay their money and take their choice as to whether they see bitcoin and gold as stores of value and useful portfolio diversifiers or more trouble than whatever they may be worth.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.