Paying a regular fee for a service is far from a new concept but over the last five years subscription services have mushroomed. Today you can sign up for pretty much everything, from the obvious TV streaming to meal box deliveries, prescription refills, coffee bean fixes and gym classes. The pandemic became boom time with people unable to make spontaneous decisions about their free time, and shares in companies like Peloton, Disney+ and Netflix soared to record highs. But investors have been getting nervous, they’re taking a long, hard look at rising inflation figures and wondering how consumers will react.

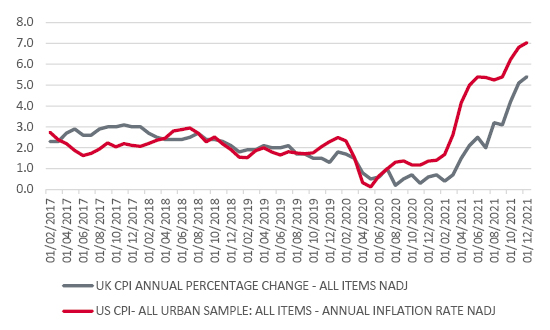

Inflation soars in the US and UK

Source: Refinitiv

“Investors can overlook subscription churn because of a low turnout of new content post pandemic but they’re now wondering if western markets are simply too saturated.”

With inflation now over 7% in the US and expected to head the same way in the UK, many people are having to take a long hard look at their outgoings. Do they really need two or even three different streaming services? Would they rather hit the gym than cycle in their own home and with the choice of restaurant no longer limited to “chez vous” are meal boxes still the best bet? Cost pressures and competition have hit the market in tandem, the latter giving subscription maestro Netflix a bloody nose when it released its last lot of numbers.

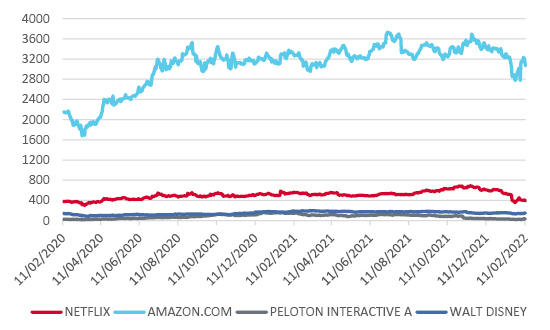

Its downbeat growth forecast resulted in shares losing most of their pandemic gains. Investors can overlook subscription churn because of a low turnout of new content post pandemic but they’re now wondering if western markets are simply too saturated, if everyone who wants Netflix already has it and some of those might be flirting with cancellation.

And lockdown darling Peloton had to slash the price of its flagship bike but even that wasn’t enough to win over consumers who hadn’t splashed out when gyms were shut. Slowing demand and a whole host of supply issues have resulted in a spectacular collapse in market value with the company only worth marginally more than when it first floated. But in Peloton’s case its subscribers could be its saviour. Those who have jumped on their bikes have remained loyal with very little subscriber churn, possibly because those who could afford the bikes in the first place are relatively cushioned from the current cost of living crunch and there is mounting speculation that they and their data might prove a tasty acquisition.

Subscription stocks have seen big fluctuations in share price

Source: Refinitiv

Because people want value for money, give them that and as long as businesses don’t go crazy, they can afford to charge more without significant drop off. Amazon demonstrated exactly this point when it announced it was going to hike the price for its Prime service by $2 a month for its US customers, and you can bet the rest of the world won’t escape either. Its unique model links its retail business with its streaming one – the more you spend, the more you save on delivery fees, the greater the value for money. For many customers, the viewing content is a bonus.

The viewer will most certainly emerge the victor but with these promises locking providers into ever-expanding circles of expenditure, what does it mean for shareholders?

Disney’s boss Bob Chapek has confirmed Disney+ customers might see a price hike next year as the service inches its way to profitability whilst at the same time upping spend on content. The mouse house has confirmed it will shell out $33bn over the next year as it super charges its subscriber base, aiming to double the number of eyes currently on the platform by September 2024, though $10 billion of that will be on sporting rights.

“Content, content, content” was the message from Disney’s CEO, firing the starting gun on what some have dubbed ‘streaming wars’. The viewer will most certainly emerge the victor but with these promises locking providers into ever expanding-circles of expenditure, what does it mean for shareholders?

And that’s where bundling might be the key, and not just in terms of the number of channels being tied up in a shiny bow. Where Amazon has its retail offer and Apple hands over free months of its TV offer with new hardware; Netflix is setting its cap towards gaming, and every man and his dog are being linked with Peloton right now because the subscription space is getting tighter and tighter. Snapping up a rival’s subscribers, even a rival in a different sphere, delivers an easy bounce. And 2022 is already gearing up to be a hotbed of M&A action in this arena, with Amazon’s huge wallet being linked alongside Spotify as potential suitors for UK podcasting group Audioboom. The stage is set but there’s one more actor waiting in the wings. What will regulators make of such plans? Whilst too much competition does leave the consumer in a quandary, not enough could leave them out of pocket.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.