Oil and gas prices are down so far in 2023 and both are trading back to where they were a year ago. If central bankers, politicians, companies and consumers are looking for good news when there seems to be so much bad around, this is it. Higher energy prices stoke inflation, crimp corporate profit margins and act as a tax on consumers. The reverse therefore holds true, so oil and gas price weakness would be a massive bonus for all four groups and potentially financial markets, too. Should the prevailing rate of inflation ease and keep doing so, then central bankers can pause on rate hikes and then pivot to rate cuts – or at least that’s the theory.

“For the moment, analysts seem inclined to believe that oil (and gas) prices are going to fall in 2023 and 2024, because they are forecasting a one-third fall in operating profit from the West’s seven oil majors between 2022 and 2024 (and that is before any change in interest bills or taxes).”

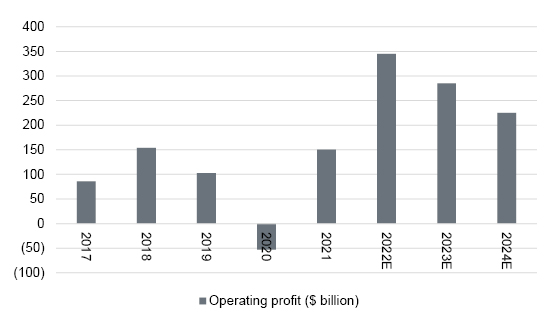

For the moment, analysts seem inclined to believe that oil (and gas) prices are going to fall in 2023 and 2024, because they are forecasting a one-third fall in operating profit from the West’s seven oil majors between 2022 and 2024 (and that is before any change in interest bills or taxes).

The question is whether they are right, and there are five factors which investors may need to follow to see which trajectory energy prices will take in 2023 (and beyond).

Analysts’ earnings forecasts imply lower oil and gas prices for 2023 and 2024

Source: Company accounts, Marketscreener, consensus analysts’ forecasts in aggregate for BP, Shell, Chevron, ConocoPhillips, ExxonMobil, ENI and TotalEnergies

“History shows it doesn’t take much of a drop in oil consumption to hit the price hard, given how delicate the balance between supply and demand tends to be. Crude prices plunged in 1980, 1991, 2001, 2008 and 2020.”

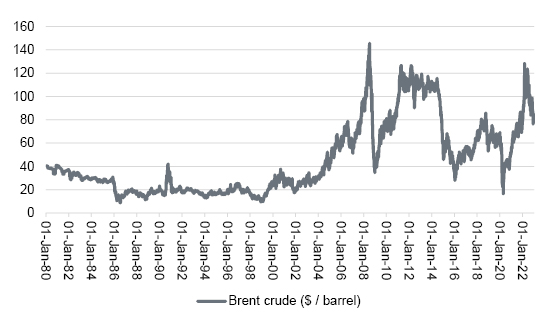

History shows it doesn’t take much of a drop in oil consumption to hit the price hard, given how delicate the balance between supply and demand tends to be. Crude prices plunged in 1980, 1991, 2001, 2008 and 2020 as recession hit home and a slowdown or downturn in 2023 could see a repeat. Oil traders took fright in the second half of 2022 and have been running scared in early 2023, especially as the world’s second biggest economy, China, has struggled to reopen as quickly as some hoped.

Oil and gas prices can be surprisingly sensitive to GDP growth

Source: Refinitiv data

Equally, the pandemic and lockdowns have constrained demand for the thick end of three years, so if the Middle Kingdom can finally shake off COVID then there is a chance that oil demand will increase. OPEC is forecasting an average increase in demand of 700,000 barrels a day from China and this underpins the cartel’s estimate that global demand will rise by some 2.7 million barrels a day in total in 2023.

A peaceful solution and a Russian withdrawal from Ukraine – prompted either by international sanctions or internal pressure – could help oil supply, or at least take the pressure off some key pipelines.

However, sanctions, or price caps, on Russia, Iran and Venezuela, as well as ongoing instability in OPEC member Libya, could all constrain supply, while OPEC also seems keen to manage its output so that oil prices are well underpinned and production cuts remain a key tool in the cartel’s armoury. With demand still forecast to grow, any restraint on oil supply could boost the price.

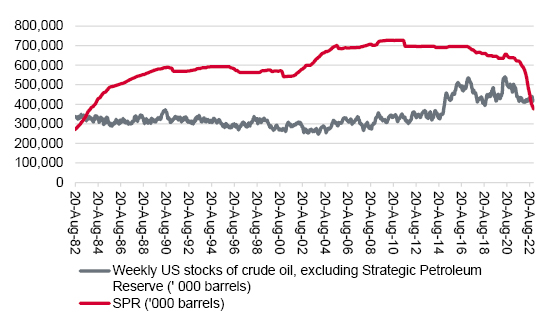

“At some stage America will surely want to replenish its SPR to buttress its national energy security.”

To try and put a lid on oil, the USA has taken its SPR down to 375 million barrels, way below the maximum capacity of 714 million and a figure last seen in December 1983. Sharp drops in regular stockpiles could boost US demand in future, especially as the Biden administration seems dead set against further drilling on environmental grounds, and at some stage America will surely want to replenish its SPR to buttress its national energy security.

The US has run down its oil stockpile

Source: Refinitiv data

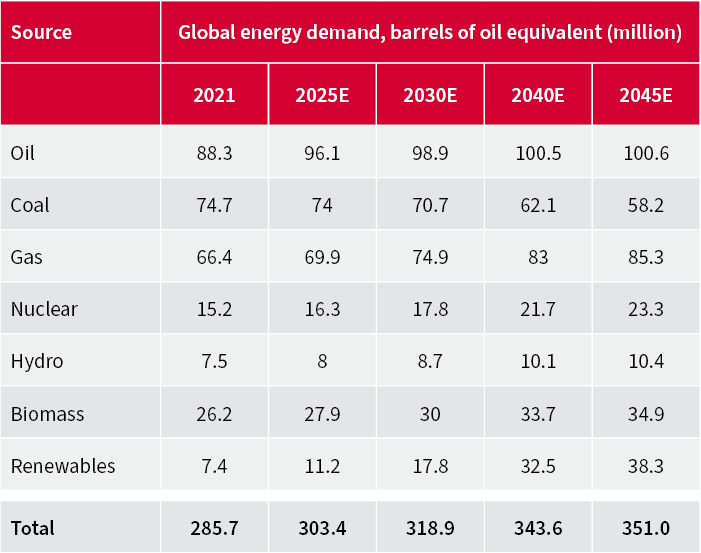

OPEC’s World Oil Outlook document from 2022 forecasts that renewables (mainly wind and solar) will be the fastest growing source of energy supply between now and 2045, with gas playing a much bigger role, nuclear, hydro and biomass chipping in, oil coming in broadly flat and coal going into steep decline. If even OPEC is forecasting this, bears of oil will argue there must be a real danger that oil fields become stranded assets as other sources of energy come to the fore.

Even OPEC expects rapid growth in demand for renewable energy

Source: OPEC World Oil Outlook 2022

“Given the public and political pressure clarion call not to invest in hydrocarbon supply on environmental grounds, oil majors are taking heed, for fear of reputational damage, regulatory attention, windfall taxes or a combination of all three.”

Given the public and political pressure clarion call not to invest in hydrocarbon supply on environmental grounds, oil majors are taking heed, for fear of reputational damage, regulatory attention, windfall taxes or a combination of all three.

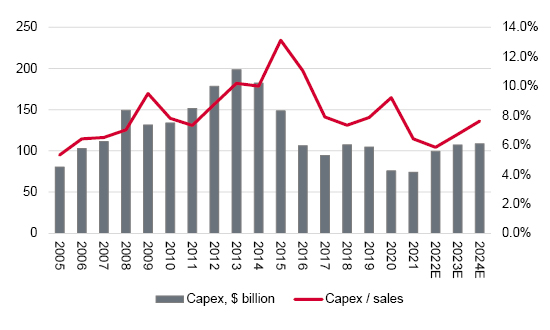

Capex is rising again but the aggregate numbers from the West’s oil majors include investment in renewables and alternative energy sources. They also leave the aggregate capex budget at barely half of the 2013 peak in dollar terms; at just one times depreciation compared to the 2013 high of nearly two times; and the capex/sales ratio at just 7.6% by 2024, again a long way below the 2015 zenith of 13%.

If oil demand does surprise on the upside in any way, these numbers could provide support to crude prices, as it may not be easy to quickly accommodate the increase.

Oil supply growth may be hard to achieve, even if demand surprises

Source: Company accounts, Marketscreener, consensus analysts’ forecasts in aggregate for BP, Shell, Chevron, ConocoPhillips, ExxonMobil, ENI and TotalEnergies

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.