It is a case of so far, so bad for US President Joe Biden’s plan to force the oil price lower by releasing 50 million barrels of oil from America’s Strategic Petroleum Reserve (SPR). Fifty million barrels a day may sound a lot. But in global terms it is half a day’s demand and America’s entire SPR would meet worldwide oil demand for barely a week.

The Biden plan’s failure to make a dent in oil prices seems less surprising in this context. By contrast, the OPEC+ cartel can move oil markets, as its 2020 production cut and then gradual subsequent increases in supply can testify. OPEC and Russia are still producing less than they were before the pandemic, even as the global economy and energy demand recover, and the latest OPEC+ meeting (2 December) will be the next test of the cartel’s influence.

“Fifty million barrels of oil may sound a lot but in global terms it is half a day’s demand and America’s entire Strategic Petroleum Reserve would meet worldwide oil demand for barely a week.”

COP26 made quite clear the political and public will to move away from hydrocarbon as our prime source of fuel. You can therefore hardly blame Saudi Arabia, Russia and other leading producers for looking to monetise their oil assets while they can still do so.

“Demand for energy could therefore outstrip supply, with the result that hydrocarbon prices could remain firm, or even keep rising – at least unless COVID-19 rears its head again and depresses economic activity and oil demand in the process.”

In addition, alternative, renewable sources are not yet ready to take up all of the slack from oil and gas. Demand for energy could therefore outstrip supply, with the result that hydrocarbon prices could remain firm, or even keep rising – at least unless COVID-19 rears its head again and depresses economic activity and oil demand in the process.

That leaves advisers and clients with a quandary about what to do with oil stocks – and whether they should put profit over principle should oil and gas prices stay stronger for longer – and what to think about the global economy. High energy prices are a tax on consumers and a source of margin pressure for many corporations. If oil and gas rocket, there remains the chance that the indebted global economy could wobble under the strain, virus or no virus, just as it did when oil reached $147 a barrel in 2007.

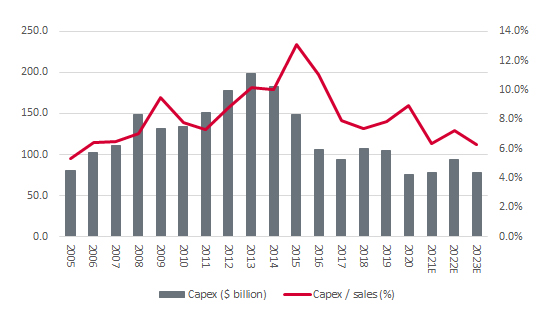

“The combined capital investment budgets of the seven Western oil majors – BP, Chevron, ConocoPhilips, ENI, ExxonMobil, Shell and TotalEnergies – looks set to drop to its lowest mark since 2005, as a percentage of sales.”

Unlikely as it may seem, oil and gas companies are listening to the political and public call for a shift to a greener, less carbon-intensive world. The combined capital investment budgets of the seven Western oil majors – BP, Chevron, ConocoPhilips, ENI, ExxonMobil, Shell and TotalEnergies – looks set to drop to its lowest mark since 2005, as a percentage of sales. In many cases, those budgets include renewable projects, too, so spending on oil production and exploration is by implication lower still.

Global oil majors continue to shy away from new investment in oil and gas fields

Source: Company accounts for BP, Chevron, ConocoPhillips, ENI, ExxonMobil, Shell and TotalEnergies, Marketscreener, consensus analysts’ forecasts

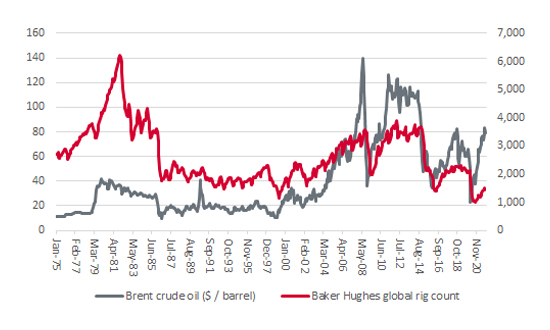

This can also be seen in the global rig count data provided by Baker Hughes (BHI:NYSE). On the previous occasions when oil traded above $80 a barrel, over 3,000 rigs were active. The current figure is barely half that.

Global oil rig activity is subdued relative to prior periods of $80-plus oil

Source: Baker Hughes, Refinitiv data

In the absence of a COVID-inspired setback, that again points to a possible supply/demand squeeze, especially as banks, insurers and many pension funds and managers continue to publicly declare their unwillingness to finance new oil and gas exploration projects.

“This is not to say President Biden has no options at all, as he seeks to manage the energy transition in the world’s largest economy and keep hard-pressed consumers on board as he and the Democratic Party prepare for the mid-term elections in 2022.”

This is not to say President Biden has no options at all, as he seeks to manage the energy transition in the world’s largest economy and keep hard-pressed consumers on board as he and the Democratic Party prepare for the mid-term elections in 2022.

If the President wants to curry favour, as he may well, who is to say he does not offer consumers some sort of subsidy or hand-out, so they can meet their fuel and heating bills? In a world where money printing and negative interest rates are accepted as normal, and austerity is political poison, anything is possible. But it might not be wise to expect oil consumption, or prices, to fall if such a vote-buying scheme is cooked up.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.