NEXT GENERATION PRODUCTS FOR YOUR NEXT GENERATION OF CLIENTS

Our Junior SIPP, Junior ISA and Lifetime ISA can help your clients and their families… and your business.

Next-generation planning

Many of your clients will have children or grandchildren who are ‘millennials’. Born between the early 1980s and 2000s, this generation faces a perfect storm of low wage growth, an insecure labour market and soaring house prices – all of which can make ambitions like home ownership seem like a distant dream. No wonder the ‘Bank of Mum and Dad’ is so keen to lend a hand.

As an adviser, you can recommend products that will let those fortunate baby boomers help out in the most tax-efficient way possible. At the same time, you can take the opportunity to introduce younger family members to the benefits of financial advice, safe in the knowledge that they could become your next generation of clients.

A persistent opportunity

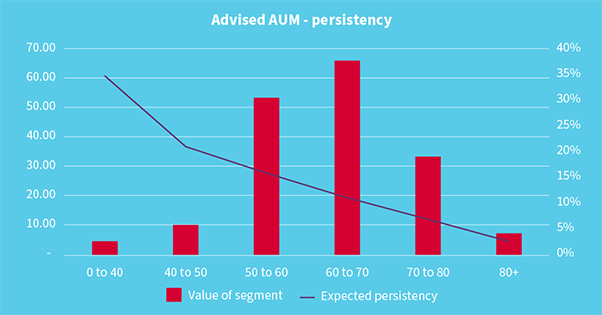

Research conducted by AJ Bell shows that more than 50% of assets under advice have a persistency of between 4 and 19 years – this is based on the life expectancy of the current owner of the assets. Developing early relationships with the beneficiaries of these assets resets the persistency countdown and helps to future-proof your business – as well as delivering the many benefits of financial advice to customers who may not otherwise look for it.

Meet the family

Gaining the trust, and therefore the future business, of your clients’ children and grandchildren may not be as simple as you would first think. Surprisingly, in a recent survey 50% of 22- to 37-year-olds stated that they would not consider using their parent’s financial adviser. Countering this resistance may demand some creative thinking, but the rewards – both for you and this next generation of clients – could be significant.

£5.5 trillion will be passed down as intergenerational transfers in the UK over the next 30 years

Source: The Centre for Economic and Business Research

Adults aged 18-24 are the least likely to receive support from a financial adviser (18% have received support in the last 12 months)

Source: FCA’s Evaluation of the Retail Distribution Review and the Financial Advice Market Review

Financial planning and the next generation

AJ Bell’s Technical Consultant, Joshua Croft, explains how some innovative firms are engaging with a client’s entire family.

Wide range of products

Low-cost Junior SIPP, Junior ISA and Lifetime ISA with custody charges up to 0.20% p.a., dealing from £0 and no establishment or quarterly administration charges where assets are held on our Funds & Shares Service*.

A comprehensive investment range

Access to our 4,200 funds, ETFs and investment trusts, as well as our range of AJ Bell Funds – risk targeted multi-asset funds with an OCF cap starting from as little as 0.31%.

Award-winning platform functionality

You can access a range of easy-to-use portfolio, investment and cash management tools.

Client app and website

Clients can easily access their accounts on the move, via our dedicated client website and mobile/tablet app.

* The standard SIPP administration charges will apply when the account holder reaches age 18.

Competitive prices

Our Junior ISA, LISA, and Junior SIPP options are designed to offer compelling value. Take a look at our comprehensive charges and rates documents.

Recent articles

Opportunities to save and invest for children

Children with incapacity: CTFs and JISAs in limbo

Investing for the next generation

Making the most of tax wrappers for children

Investment options

From ETFs and ETCs, to multi-asset funds and investment trusts, we offer thousands of ways to help your clients invest in their families future.

Our Consumer Duty hub revolves around you

Don’t get caught out by the Consumer Duty. See how we can help you meet the new rules with our new online resource that’s full of useful tools and information.

Request a call

Our dedicated Business Development Team below are available if you have any questions. Alternatively, you can request a call back and a member of the team will be in touch as soon as possible.

- Headshot

Billy Singh

RegionMidlands - Headshot

Greg Morton

RegionSouth WestBerkshire - Headshot

Jon Bowden

RegionNorth West - Headshot

Kenny Boyd

RegionNorthumberland - NorthScotland and Northern Ireland - Headshot

Matthew Jonas

RegionNorth EastNorthumberland - South - Headshot

Michael Teetsun

RegionSouth of the River ThamesSouth East - South - Headshot

Ryan Meredith

RegionNorth West